Introduction↑

Unlike the grand debate on the origins of the First World War, financial mobilization, and the inflation that came with it, is not a topic that has caused serious controversies. The general picture is well known. The methods of financial mobilization were basically the same in all belligerent countries. The government borrowed the money from the central bank to meet the rapidly rising expenses of the war to maintain the vast armies, to purchase huge amounts of arms, ammunition and other supplies, and to provide transport and other services. At regular intervals, the short-term debt was funded by issuing long-term war loans. Only a small part of government expenditure was financed by taxes. The rapidly rising government deficit entailed in all countries wartime inflations of various dimensions, visible in rising prices and a deteriorating exchange rate of the currency.[1]

Within this general framework, the history of war finance and inflation has been examined in detail for individual countries. There are several studies of financial mobilization in Germany in the First World War, though the literature is not very extensive.[2] The fiscal and monetary policies of the war years have also been studied in the context of an inflationary process in Germany which comprises both the war and the post-war period, lasting from 1914 to 1923.[3] Research on war finance and inflation in Germany has been advanced not so much by stimulating controversies, but rather by a gradual accumulation of new information from published or unpublished documents, and new interpretations of the available data. This survey will focus on four aspects: the pre-war planning for financial mobilization; the early experience of war finance and inflation under the assumption of a short war; the changing conditions in a war of attrition; and, briefly, the transition from war to peace.[4]

Pre-war Planning for Financial Mobilization↑

The financial mobilization which was implemented in August 1914 had been prepared much earlier than is often assumed.[5] In the German Empire, which was founded in 1871, the early plans for financial mobilization in the eventuality of a war provided for a combination of a cash and credit. After the Franco-Prussian War of 1870-1871 the German government exacted from France reparations of 4 billion Marks. Of this sum, 120 million Marks were set aside as an imperial war chest (Reichskriegsschatz). The money would be used in the initial phase of a military mobilization for the maintenance of soldiers, for arms and ammunition, for transport and other costs. Further costs of a war would be financed by a combination of short-term credit and one or more long-term loans.[6] The imperial war chest, 1,200 sturdy wooden boxes filled to the brim with German gold coins, had been stored since 1874 in the old citadel in the town of Spandau, now part of Berlin.[7]

Since the 1880s, the Prussian finance minister urged the imperial government to revise the plan for financial mobilization. The costs that were to be expected in a future war had much increased, due to the greater number of troops and to the new expensive armament.[8] In April 1891, the Imperial secretary of the treasury, the Prussian finance minister, the president of the Reichsbank and other officials discussed a new plan for fiscal and monetary policies in the contingency of war. It was now assumed that all war expenses were to be financed by credit. The budget rule was that the current activities of the imperial government were on the ordinary budget which had to be balanced. Unusual expenses, essentially public investment, was on an extraordinary budget which was to be financed by credit. The argument was that future generations would benefit from an investment, and thus should contribute to the interests and repayment of the loan that had financed the project. War expenditure was also on the extraordinary budget, on the assumption that a successful war benefited future generations, much like an investment.[9]

The central bank would become the fiscal agent of the government. Germany’s central bank, the Reichsbank, had been founded in 1875. It was in private ownership, but was subordinated to the imperial government. The bank law obliged the central bank to keep one third of its note circulation in gold and a small amount of treasury notes (Reichskassenscheine). The remaining note issue was to be covered by commercial bills. If the note circulation exceeded the legal limit the bank had to pay a special tax.[10]

According to the new program for financial mobilization, the Reichsbank would grant short-term credit to the government. The government’s short-term debt was later to be consolidated by one or more war loans. The small regional note-issuing banks which existed in Germany at the time were not asked to participate in the plan for financial mobilization as they were not under the control of the imperial government. If the central bank became the fiscal agent of the government, the gold standard would have to be suspended. The central bank would be authorized to accept short-term government paper as an equivalent of commercial bills in its secondary reserve. The gold convertibility of the bank notes would be abolished, and the note tax which the central bank had to pay when the note issue exceeded the volume defined by the gold reserve would be eliminated.

To limit the demand for central bank credit, new loan banks (Darlehnskassen) were to be established. The institution of these loan banks had a history. They had been founded by the Prussian government during the credit crises caused by the revolution of 1848 and the civil war of 1866, and the North German Federation had established loan banks in the crisis at the beginning of the Franco-Prussian War of 1870-1871.[11] The loan banks would be owned by the government, but operated by the Reichsbank. Their function was to provide credit to business, state governments and local authorities, covered by securities or goods as collateral. They would issue their own loan bank notes (Darlehnskassenscheine), which were to circulate at par with Reichsbank notes, the money of the regional note-issuing banks and treasury notes. The central bank would be authorized to include the loan bank notes in its primary reserve. In fact the loan banks were a flexible shadow central bank. They extended credit which did not appear in the balance sheet of the Reichsbank, and their note issue was not subject to any reserve requirements. The president of the Reichsbank criticized the planned loan banks; the unfunded paper money which they issued might have inflationary consequences. But his objection was overruled.[12]

The scenario for which the financial mobilization was planned in 1891 was a short war, ending with a German victory. Therefore it was assumed that the departure from the gold standard was only temporary. After the war the currency would return to gold. The loan banks would then be abolished; thus the inflationary danger of which the Reichsbank president had warned could be ignored. The Reichsbank always insisted that the modifications of the bank law should be kept to a minimum, so that the confidence in the German currency was maintained.[13]

As the central bank was to provide the money in the case of a military mobilization, the function of the imperial war chest in Spandau changed. It would not be used for cash payments, but would be transferred to the central bank in exchange for the Mark equivalent, to increase its gold reserve. In connection with the armament programme of 1913 it was decided to increase the imperial war chest in Spandau, now a potential central bank reserve, by another 120 million Marks in gold. In addition, the government was to accumulate a cash reserve of 120 million Marks in silver coins.[14]

After the conference of April 1891, the Imperial treasury (Reichsschatzamt) formulated in June 1891 a set of draft laws which would be enacted in case of a war.[15] In later years, more details were added to the programme for financial mobilization. Detailed plans were elaborated for the location of the loan banks in connection with the regional Reichsbank branches.[16] Millions of central bank notes, loan bank notes and treasury notes were printed in advance to be ready for the days of financial mobilization.[17] To improve the government’s access to the capital market the central bank suggested in 1906 that a new type of short-term state paper should be issued in the case of a war, the Treasury Bill (Reichsschatzwechsel); the new title suggested an affinity to the established commercial bill. The existing short-term treasury certificates (Reichsschatzanweisungen) were less well known and might be not so easy to sell in large quantities.[18]

When international tensions increased at the beginning of the 20th century, an intense public debate on financial mobilization came up in Germany. Experts and journalists discussed in books and articles different methods of financial mobilization. The outcome of the debate was inconclusive. Some experts advocated credit financing of war expenditure, others recommended a reliance on taxes. Government officials or Reichsbank experts did not participate in the debate, and some observers were critical that Germany was not prepared to finance a great war.[19] Some historical studies, too, have accepted the contemporary criticism of inadequate financial preparation.[20]

War Finance and Inflation under the Illusion of a short war↑

When the German armies swept into Belgium on 4 August 1914, the imperial diet (Reichstag) passed a series of laws that organized Germany’s financial mobilization. In contemporary understanding, financial mobilization (Finanzielle Mobilmachung) comprised all fiscal and monetary instruments that were necessary to finance the war.[21] The draft laws had been prepared in every detail, and representatives of the government and the parliament had agreed on the procedure the day before, so that the laws could be voted unanimously in rapid succession. Informal steps toward financial mobilization had already begun before 4 August. During the financial panic of late July 1914 the central bank had extended its money supply, and had suspended specie payments on 31 July to protect its gold reserve. The imperial gold reserve of 240 million Marks was transferred to the central bank on 2 August.[22]

The government was authorized to contract credits up to 5 billion Marks to finance the war; the limit could be extended if necessary.[23] The central bank (Reichsbank) was to provide short-term credit for immediate war expenditure; later, the floating debt was to be funded by long-term bonds (Kriegsanleihe). In addition to the existing treasury certificates (Reichsschatzanweisungen) a new type of short-term government paper was introduced, the treasury bills (Reichsschatzwechsel). It was assumed that treasury bills, suggesting a similarity to commercial bills, were easier to place on the market than the less well-known treasury certificates.[24]

As the Reichsbank was to act as financial agent for the government, the gold standard rules that tied the note issue of the central bank to its bullion reserve were suspended. But the formal changes were kept to a minimum; the government and the central bank hoped to convince the public at home and abroad that the stability of the currency was not impaired. The new legislation authorized the central bank to accept treasury bills or treasury certificates as secondary reserve. The convertibility of central bank notes into gold was suspended, and the tax on excessive note circulation was abolished.[25]

The loan banks (Darlehnskassen) were established in connection with the regional subsidiaries of the Reichsbank and managed by the central bank’s staff. Their task was to provide credit to business, and also to states and local authorities, so that the Reichsbank could concentrate on central government finance. The loan banks issued their own money, the loan bank notes (Darlehnskassenscheine). The notes were admissible as primary reserve of the central bank, together with gold and treasury notes.[26]

The government and the military command promised that the war would be short. The strategic plan, prepared since 1905, was to strike a decisive blow against France, attacking through neutral Luxembourg and Belgium, before Russia could mobilize its vast army. In a few months the war would be over.[27] A short war, ending with a victory of the Central Powers, meant that the suspension of the gold standard was only temporary, and that the public debt would be limited. It was also assumed that the government could pay back its debt with reparations from the vanquished countries.

As the financial mobilization had been carefully prepared, it could be immediately implemented. On the day after the new laws more than 100 loan bank offices began to operate.[28] Within days, vast amounts of central bank notes and loan bank notes that had been printed in advance were brought into circulation.[29] The government obtained the funds to pay for the war by discounting treasury bills with the Reichsbank. In addition to its financial role for the government, the central bank expanded its credit to business to fend off the bank panic that had started in late July.[30]

A war loan was issued in September 1914 to consolidate the short-term debt. The interest rate was 5 percent, which was relatively high in comparison with pre-war government bonds. Commercial banks, savings banks and credit cooperatives offered the bonds for subscription. Savings banks allowed their customers to withdraw their savings without notice to purchase war bonds.[31] Also, the loan banks accepted the bonds as collateral for credits.[32] A great propaganda campaign was organized to support the sale of loans. Newspaper reports suggested that individuals who did not subscribe to the war bonds might later regret it; the interest rate was attractive, and as victory was near, this might be the only war bond that would be issued.[33] There were 1.2 million subscriptions, and the government received 4.5 billion Marks, which was considered a great success.[34]

In December 1914, the capital market was reserved for the central government. The states and local authorities were not to issue loans; they were to borrow from the loan banks. The loan banks had been primarily established to finance private business, and the financing of state governments or local authorities was only a secondary motive. But the roles were soon reversed. There was little demand from private business for credits; the companies producing for the war were financed by generous government contracts.[35]

A consequence of the rising government deficit was a strong increase in the money supply. At the end of 1913 the total cash circulation was 6.6 billion Marks. The cash circulation consisted of a medley of coins, central bank notes, notes of the regional note-issuing banks and treasury notes. Only gold coins, until 1907 certain silver coins, and since 1910 central bank notes were legal tender, but all kinds of coins and paper money circulated at par. Reichsbank notes accounted for 39 percent of the total, other bank notes and treasury notes for 5 percent and coins for 56 percent. At the end of 1914 the cash circulation had increased by 32 percent to 8.7 billion Marks. The new loan bank notes augmented the cash circulation, while the total value of coins in circulation declined.[36] The total money supply which consisted of cash and the various sight deposits at the Reichsbank, regional note-issuing banks, commercial banks and the postal giro system, has been estimated at 17.4 billion Marks at the end of 1913. It grew in 1914 by 18 percent to 20.5 billion Marks.[37]

In spite of the increasing money supply the central bank had no problem in maintaining its gold reserve ratio, as the bank could convince the public to change gold coins into bank notes. The gold reserve was 1.2 billion Marks in December 1913 and 2.1 billion Marks in December 1914. The gold ratio, expressing the relation between gold and Reichsbank note circulation, was 45 percent in December in 1913 and 41 percent in December 1914.[38]

In an economy with functioning markets, the inflationary pressure would drive up prices. To limit price increases a law authorizing the state governments to decree price ceilings was passed by the parliament (Reichstag) on 4 August 1914 together with the laws on financial mobilization.[39] Only a limited rise of the price level was permitted, so that the inflationary pressure was not visible to its full extent. Wholesale prices increased in 1914 by 5 percent.[40]

More serious than the domestic consequences was the effect of the inflationary financial mobilization on the balance of payments. Before the First World War, Germany was closely integrated into an expanding world economy.[41] In 1913, merchandise exports amounted to 10 billion Marks and merchandise imports 11 billion Marks. The deficit in the trade balance and capital exports were financed by a surplus in services, including income from foreign assets.[42]

When the war began, the superior British navy immediately blockaded the ports of the Central Powers and tried to interrupt direct overseas trade. Germany needed imports of strategic raw materials, food and other products which contributed to the war effort, and exports were necessary to earn foreign exchange. The German government reacted in various ways to the blockade. It diverted foreign trade to neighbouring neutral countries, and organized a transit trade with more distant countries through neutral ports. At first the blockade was not very efficient, but over the years it tightened and seriously reduced the foreign trade of the Central Powers.[43] Within the limits set by the blockade, financing an import surplus became an important aspect of financial mobilization. The imperial government sought to obtain as many imports as could be smuggled through the blockade to support the war economy. At the same time exports were curtailed not only by the blockade, but also by the shortage of labour and the conversion of industry to war production. The result was a growing trade deficit.

The Reichsbank warned already in November 1914 that it was difficult to finance the import surplus from neutral countries. If German importers paid in Marks, the amount would be offered on foreign exchange markets in neutral countries and depress the exchange rate of the German currency. Therefore a part of the imports had to be paid in gold which both the central bank and private importers sent abroad.[44] At the end of 1914 the central bank had already lost 110 million Marks in gold.[45]

War Finance and Inflation in a War of Attrition↑

When the German invasion of France was stopped by French and British forces near the Marne in early September 1914 it was obvious that the illusion of a fast victory had failed. In Germany neither the military command, nor the government had a second plan. The only option was to hold on as long as there were soldiers to fight and a labour force to support the soldiers, in the hope that attrition compelled the opponents to ask for peace.[46]

In late September 1914, Reichsbank president Rudolf Havenstein (1857-1923) explained to the supervisory committee of the bank (Reichsbankkuratorium) the financial situation. In his opinion financial mobilization had proceeded according to plan. The government had obtained the necessary funds to finance the war effort, and the war loan had been a great success; its proceeds were higher than the short-term debt of the government. Havenstein was surprisingly candid; he admitted that the initial military strategy had failed and that a long war was to be expected. He was optimistic, however, that the credit-based financial mobilization which had been successful until then would also be adequate for a long war. He did not specify just how “long” the war might last, but he certainly did not expect the war as we know it: four years of death and destruction on an unprecedented scale.[47]

In fact, the financial mobilization which was essentially based on credit provided sufficient funds to pay for the rapidly increasing war expenditure. Since all expenses for the war were defined as extraordinary expenditure, short-term credit and loans remained the most important instruments of government finance. The smooth operation of the credit mechanism guaranteed that there were no political conflicts with either the parliament or the states. Therefore the imperial government saw no reason for a fundamental change. The expenditure of the central government in the fiscal year from April 1913 to March 1914, ordinary and extraordinary budget together, was 3 billion Marks. In the fiscal year 1914-1915, the first budget that was influenced by the war, expenditure increased to 9 billion Marks. Expenditure then rose rapidly in the second war budget 1915-1916 to 26 billion Marks, in the third war budget 1916-1917 to 28 billion Marks and in the fourth war budget 1917-1918 to 52 billion Marks. According to the official statistics the expenditure in the fiscal year 1918-1919 was reduced to 44 billion Marks. This may be due to the fact that the war ended in November 1918. However the figure has been criticized as unreliable and the increase of the government debt suggests that the expenditure in 1918-1919 may have been higher than declared.[48] According to the official statistics, altogether 159 billion Marks were spent by the imperial government from April 1914 to March 1919.[49]

A second war loan was issued in February 1915. The cumulated government debt became huge by previous standards. In July 1915 the new secretary of the treasury, Karl Helfferich (1872-1924), invited the finance ministers of the states to a conference on war finance. Helfferich still assumed that the war would end with a German victory, probably before the end of the year, or at the latest after the winter of 1915-1916. He asserted that tax increases were not necessary; war expenditure could be financed with the combination of short-term credits and loans. After the war, however, the repayment of the public debt would pose a serious problem. War expenditure had increased beyond all forecasts. The secretary of the treasury estimated that until the end of the war the government would accumulate a huge debt, probably 60-70 billion Marks. It was not to be expected that Germany could obtain reparations that were large enough to pay back the public debt; there had to be a domestic solution. The central government could not pay back the debt with its limited resources. New indirect taxes would be refused by the parliament (Reichstag) if they were not combined with direct taxes on income and property. But the states defended strongly their privilege of direct taxes. The war shifted many responsibilities from the states to the central government, and the states suspected that if the imperial government introduced new taxes on income or property, the centralization of power would become even more pronounced. Two options were discussed. Helfferich suggested that the states should support the central government with higher transfer payments, which were to be financed by increased direct taxes on the state level. The other option was a single tax on war profits which was to be introduced after the war, similar to the defence levy of 1913. No decisions were taken at the conference, and it was agreed that the problem of the public debt must be kept secret.[50]

In public, the government continued to maintain that Germany’s fiscal and monetary policies were sound, and that there was no problem to pay back the war loans. When Helfferich presented in August 1915 a revised budget for 1915-1916 in the Reichstag, he promised that the government did not intend to introduce new taxes during the war. Military expenditure would be financed by credit. The public debt would be paid back after the war with reparations from the vanquished enemies.[51] Helfferich’s speech has sometimes been interpreted as a declaration of government policy, but it was in fact only a propaganda ploy.[52]

War loans continued to be issued, with the ninth and last war loan in September 1918. For every loan the vast propaganda campaign which had already accompanied the first war loan was repeated. As the war dragged on and the debt increased rapidly, the public apparently lost its confidence in reparations. When the fourth war loan was launched in March 1916, the Secretary of the Treasury Helfferich did not mention that the public debt would be paid back with reparations. Instead, he declared that repayment of the loan was guaranteed by the strength of the German economy.[53] The focus of the propaganda for the war loans changed. The Reichsbank emphasized in its propaganda campaign for the sixth war loan in March 1917 that Germany’s national wealth and national income were large enough to guarantee the public debt. Reparations would not be needed for repayment.[54]

Households and corporations were urged to invest all their liquid reserves in war bonds. To enhance the placement, the formally long-term war loans were made a flexible investment. Each war loan consisted not only of long-term bonds of ten years’ maturity, but also of medium-term treasury certificates (Reichsschatzanweisungen) of five years’ maturity. The loan banks continued to accept war bonds as a collateral for credits, as they had already done in September 1914, and the war profit tax that was introduced in 1916 could be paid in war bonds or treasury certificates.[55] Many people bought war bonds without knowing it. Savings banks deposits increased considerably during the war and the savings banks invested a large part of their funds in war loans.[56]

The number of subscriptions for the war loans increased from 1.2 million for the first loan in September 1914 to a maximum of 7.1 million for the sixth loan in March 1917. Compared with the number of households in Germany, which had been 14 million in 1910, the number of subscribers was impressive.[57] People who had never before bought securities invested their savings in war loans. Since the seventh loan in September 1917 the acceptance of the war loans declined. The propaganda seems to have convinced many, but not all investors. For the last war loan in September 1918 there were only 2.7 million subscriptions.[58]

But while the number of subscriptions declined, the money raised by the war loans was still impressive. The eighth loan in March 1918 brought 15 billion Marks. It was only with the ninth loan in September 1918, when defeat was imminent, that the volume decreased to 10.4 billion Marks. The explanation for the success of the war loans may be the lack of alternatives. Nominal incomes increased during the war, but consumption as well as investment for non-military production was curtailed by the planning system. There were few options for households or corporations to invest their savings. The alternatives to war bonds were saving accounts, short-term government paper, or simply cash holdings.

In spite of the wide distribution of war bonds, most of the financial contribution was received from investors who were at the top of the income and wealth pyramid. For statistical purposes the subscriptions for all nine war loans from 1914 to 1918 can be divided into three classes, a lower class of amounts up to 1,000 Marks, a middle class from 1,100 to 100,000 Marks, and an upper class of 100,100 Marks and more. In the lower class 81 percent of all subscriptions contributed 10 percent to the total yield; in the middle class 19 percent of the subscriptions contributed 46 percent; and in the upper class 0.2 percent of the subscriptions contributed 44 percent.[59]

The first four loans until March 1916 raised more money than was necessary to consolidate the volume of treasury bills and treasury certificates. From September 1916, however, the proceeds from the loans were not sufficient to consolidate the short-term debt. About half of the short-term debt was placed on the money market, the other half remained in the portfolio of the central bank. This demonstrated a significant difference between financial mobilization in Britain and in Germany. In the United Kingdom the money market absorbed more treasury bills and thus contributed a greater share to financing the war.[60] As the acceptance of the war loans declined, the government accumulated a considerable short-term debt. A part of the treasury bills and treasury certificates was placed on the money market, but a similar amount of short-term government paper remained in the portfolio of the Reichsbank.[61]

Tax increases could be avoided for two years in spite of the rapidly rising government expenditure as only civilian expenditure was to be financed by taxes and similar regular government income. The war had at first the paradoxical effect that ordinary expenses decreased, as all military expenditure was transferred to the extraordinary budget. However, interest payments for the government debt were part of the ordinary budget. As the war lasted longer than expected and the public debt increased, the government found it difficult to finance the rapidly rising interest payments. Chancellor Theobald von Bethmann Hollweg (1856-1921) warned in January 1916 that the ordinary budget was deteriorating rapidly. New taxes were inevitable to finance the interest payments. The alternative, borrowing money to pay interest on government debt, would be contrary to established fiscal rules.[62]

In June and July 1916 the Reichstag voted on a series of laws that either created new taxes or increased existing taxes. A war profit tax for corporations and individuals was introduced in June 1916. It was a compromise between the central government and the states. The tax was declared as a single levy on profits earned during the war, similar to the defence levy (Wehrbeitrag) in 1913; it was not to become a precedent for a regular income tax. But as the war continued, the profit levy was renewed in 1917 and 1918, so that there was in fact a new central government tax on profits and property.[63] A sales tax was introduced with a very low tariff in 1916, that was increased in 1918. From then on it became a permanent feature of the German tax system. New taxes or tax increases were imposed on tobacco, coffee, tea, beer, wine, sparkling wine, mineral water, coal and railway transport. Some of the new indirect taxes merely shifted payments between the ordinary and extraordinary budgets. The coal tax and the railway tax reduced the deficit of the ordinary budget, but raised the deficit of the extraordinary budget as they were contained in the prices which the government paid for war supplies.[64] The tax reform of 1916-1918 had only the limited aim to balance the ordinary budget. No attempt was made to raise taxes for the rapidly rising war expenditure.

As a consequence of the inflationary method of financial mobilization, 87 percent of total expenditure was on the extraordinary budget and were financed by short-term credits or war loans. Only 13 percent of total expenditure was on the ordinary budget and was financed by taxes and other regular income of the central government.[65] In December 1918 the total central government debt amounted to 135 billion Marks. The share of long-term loans, including a small number of medium-term treasury certificates, was 80 billion Marks, the share of treasury bills on the money market was 28 billion Marks and the floating debt (in a strict definition, the share of treasury bills or treasury certificates in the portfolio of the central bank), 27 billion Marks.[66]

In addition to the imperial government, states and local authorities had large budget deficits.[67] In 1918 the loan banks extended 85 percent of their total loans to states and local authorities.[68] Total public debt in December 1918, including the central government, the states and local authorities, was 160 billion Marks; of this total, the debt of states and local authorities was 25 billion Marks.[69]

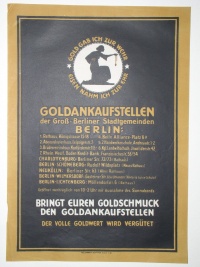

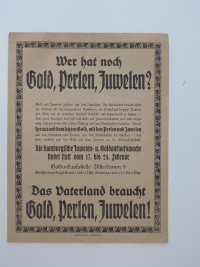

The government and the Reichsbank made great efforts to convince the public at home and abroad that the suspension of the gold standard was only temporary, and that after the war Germany would return to the gold standard.[70] A commitment to fiscal and monetary stability was deemed necessary to place the war loans, and to obtain foreign credits. An important element in the official propaganda was the gold reserve of the Reichsbank. To augment its reserve the central bank attempted to withdraw gold from circulation. This policy was successful; the public changed a large volume of gold coins into bank notes. When the supply of gold coins was almost exhausted, the Reichsbank started in 1916 a campaign to buy gold jewellery, watch chains and other gold objects from patriotic citizens.[71] Some gold was used to finance imports and to support Germany’s allies. But on balance the Reichsbank could increase its gold reserve considerably, in 1914 to 1.5 billion Marks, in 1915 to 2.4 billion Marks and in 1916 and in 1917 to 2.5 billion Marks. In 1918 the reserve was slightly lower with 2.4 billion Marks.[72] The size of the central bank’s gold hoard, which was in 1918 more than twice the pre-war level, may have convinced many investors at home and abroad that Germany was committed to restoring the gold standard after the war.

With the vast afflux of gold, the Reichsbank could maintain for some years a surprisingly solid reserve ratio. In 1915 the gold reserve of the central bank was on average 42 percent, and in 1916 still 35 percent of the note circulation. Since 1917 the central bank had to dilute its primary reserve with loan bank notes and a small number of treasury bills to maintain the legal minimum of one third of the note circulation, as the gold ratio decreased in 1917 on average to 27 percent and in 1918 on average to 17 percent.[73]

At the end of 1918 the cash circulation had increased to 33.1 billion Marks, or 502 percent of the level of 1913; the average growth per year was 38 percent. The composition of the money supply changed significantly during the war. Reichsbank notes accounted now for 67 percent of the total money circulation and loan bank notes, the typical war money, for 31 percent. Gold coins disappeared from the cash circulation.[74]

The total money supply, essentially cash plus sight deposits with the banking system, increased in 1915 by 20 percent. Then the growth accelerated. Apparently many households and corporations held cash balances, rather than buying war bonds or treasury bills. The money supply grew in 1916 by 34 percent, in 1917 by 55 percent and in 1918 by 53 percent. At the end of 1918 the money supply attained 74.8 billion Marks, or 440 percent of the level of 1913.[75] Before the war the Reichsbank had propagated the use of deposits instead of cash to improve the relation between gold and central bank note circulation. But during the war the trend was reversed as the loan banks offered only bank notes, and no deposits. Therefore, the cash circulation increased faster than the total money supply.

Price ceilings, rationing and foreign exchange controls worked reasonably well to control inflation during the war. Wholesale prices increased in 1915 by 35 percent. Thereafter the price controls became more effective. The wholesale price increase in 1916 was 7 percent, in 1917, 18 percent and in 1918, 21 percent. In 1918 the wholesale price index of the mark attained 217 percent of the pre-war level of 1913.[76] The inflationary pressure was more visible in black-market prices, which were considerably higher than the official prices. The controls were not too rigid, and with so much money sitting idly in cash hoards or bank accounts it was not surprising that some people could afford to pay a premium for extra rations.[77]

The public complained about rising prices. Yet the cause of widespread misery was not the inflation, but the real shortage of consumer goods as the national product declined, and a large part of production was consumed by the war. In the war of attrition the transfer of millions of men from civilian employment to the armed forces, the shortage of raw materials, the reduction of investment and other restraints led to a decline of real national product. Net national product was 52 billion Marks in 1913.[78] It has been estimated that real national product decreased in 1914 to 90-92 percent of the pre-war level of 1913, in 1915 to 81-85 percent, in 1916 to 76-81 percent, in 1917 to 74-79 percent and in 1918 to 71-77 percent.[79]

An increasing part of the national product was claimed by the government for the war. Economic mobilization was organized by a combination of profit incentives and planning. The government paid high prices for arms, ammunition and other supplies. But the conversion of the economy to military production relied not only on the market mechanism. Since the beginning of the war a planning system was established. It began with the control of strategic imports and with price limits for the necessities of life. When the war lasted much longer than expected, the planning system was expanded. Since 1916 most sectors of the German economy had been subject to price controls and rationing. Wages were negotiated between industry, labour and government.[80] Goods and services for the war amounted in 1914 to 15 percent of the national product, in 1915 to 35-37 percent, in 1916 also to 35-37 percent, and in 1917 to a maximum of 53-57 percent. Thereafter the impoverishment of the country made it impossible to maintain this high rate of economic mobilization, and the share of war-related production dropped in 1918 to 36-39 percent.[81] As the war consumed Germany’s resources, the standard of living deteriorated.

The nominal value of the national product was inflated by the price increases which the government permitted, in spite of a system of rationing and price controls. When the real national product in 1918 is adjusted by the index of wholesale prices, nominal net national product in 1918 may have been between 81 and 88 billion Marks.[82]

The foreign exchange market was controlled. To finance the growing trade deficit, the government, the Reichsbank and private business tried to obtain credits in neutral countries, and to sell securities in Marks or foreign currency. Private gold exports were prohibited in November 1915, and gold transfers were monopolized by the central bank.[83] For two years Germany was surprisingly successful in attracting capital imports. When the Reichsbank negotiated loans in neutral countries, pre-war bonds of the central government and the states were accepted as security.[84] Apparently the monetary propaganda, with the central bank’s gold reserve as the main argument, impressed foreign investors.

When the war lasted longer, the foreign exchange situation deteriorated.[85] In August 1916 the central bank informed the government that the financing of imports became more difficult than before. Import prices went up due to the depreciation of the mark; the sale of securities in neutral countries declined; and foreign exchange earnings from exports dwindled. Imports would have to be strictly limited.[86] A month later the central bank repeated its warning. The lack of foreign exchange necessitated a serious reduction of imports. Exports should be increased to earn more foreign exchange; but this would conflict with the demand of the military.[87]

To improve the balance of payments, the government planned in August 1916 to seize private portfolio assets in foreign currencies; the owners would be compensated in Marks.[88] The central bank organized an inquiry into foreign assets held by German corporations or individuals. It was estimated that before the war, in July 1914, the volume of foreign portfolio investment had been 20 billion Marks. Until September 1916 an estimated 4 billion Marks of securities and shares had been sold, leaving a volume of 16 billion Marks. A large part of the assets was locked in enemy countries, or was invested in Austria-Hungary and Germany’s other allies where it was not of much help.[89] From October 1916 to the end of the war only 2 billion Marks of securities were sold.[90]

In a meeting of government officials and central bank officials in June 1917 Germany’s foreign trade situation was described as extremely serious, heading towards disaster. The Reichsbank saw no solution for the crisis. It offered Marks in neutral countries, though this accelerated the depreciation of the currency, and it sold a considerable amount of its cherished gold reserve to finance imports.[91] In addition to the blockade, financial constraints contributed to the decline of Germany’s imports.

Germany supported its allies Austria-Hungary, Bulgaria and the Ottoman Empire with war credits, though not to the same extent as first Britain and then the USA did for their allies.[92] The German government expected that the credits should be used to buy necessary supplies in Germany. But Austria-Hungary, Bulgaria and the Ottoman Empire also used the German credits for purchases in neutral countries, or sold Marks on neutral foreign exchange markets, thus depressing the exchange rate of the German currency.[93] The Ottoman government obtained gold transfers from Germany for purchases in remote areas of the Ottoman Empire where paper money was not accepted.[94]

On balance the German economy drew more heavily on foreign resources during the war than at any previous time. German imports from August 1914 to December 1918 amounted to 32 billion Marks; exports were only 17 billion Marks.[95] In addition to its own trade deficit of 15 billion Marks Germany financed import surpluses of its allies of 5 billion Marks. The total deficit of 20 billion Marks was financed by gold transfers, sales of securities on neutral markets and credits in Marks or foreign currencies.[96] The official dollar exchange in rate Berlin was 143 percent of the pre-war gold standard parity.[97]

The occupied areas in Belgium, France, Russia and later Romania were forced to contribute to the German war effort. The military and civilian occupation authorities exacted food and other deliveries in kind for the armies, as well as monetary contributions.[98] As the war dragged on, raw materials, machinery, railway stock and other capital goods were seized and transferred to Germany.[99] The military authorities estimated the contributions exacted in the occupied territories at 3.5 billion Marks.[100] Belgium alone paid until March 1918 contributions of 1.5 billion Marks, and in addition industrial equipment worth 2.5 billion Marks was dismantled in Belgium and transported to Germany.[101]

Conclusion: From War to Peace↑

A vivid public debate on financial demobilization began in 1917, but it had no echo in government circles.[102] While financial mobilization had been carefully planned in Germany over many years, there was no comprehensive plan for financial demobilization after the war. The Reichsbank, however, since early 1918, made suggestions for the fiscal and monetary policies of the post-war years.[103]

In July 1918, when that last desperate German offensive on the Western front had failed, the Reichsbank recommended that after the war sound government finances and monetary stability should be restored. As a precondition for the stabilization of the currency, deficit spending should stop, and the short-term government debt should be reduced. A balanced budget required a reduction of expenditure and an increase of tax revenue.[104]

The inflation had to some extent reduced the real value of the debt, but the burden was still serious. The relation between public debt and domestic product, today a popular indicator for the relative burden of the public debt, can be estimated only approximately as we do not have reliable data for either the public debt or the domestic product. If we accept the figure of 160 billion Marks for the total public debt in December 1918, including the central government, the states and local authorities, the public debt in 1918 may have been between 182 and 198 percent of net national product.[105]

Fiscal and monetary stabilization was connected with the return to the world market. In spring 1918 the grandiose plan for “Mitteleuropa”, a vast economic zone in central Europe under German control, was abandoned. Instead, government officials and prominent businessmen discussed ways and means to parry the Allied aims to isolate Germany after the war. It was agreed that the supply of raw materials and the access to export markets were necessary for Germany’s economic future. The multilateral world economy that had existed before the war was essential and should be resumed after the war.[106]

In March 1918, the president of the Reichsbank submitted a memorandum on the perspective to reintegrate Germany into the world economy after the war. He assumed that the general military and economic exhaustion of the belligerent countries would make it necessary to conclude peace in the autumn of 1918. However, he was apparently still influenced by the optimism of the military command and assumed that Germany could negotiate in a strong position. Large reparations to pay for the German public debt were not to be expected. But Germany should try to obtain moderate reparations in the form of raw materials or foreign exchange to compensate a trade deficit which would persist for some years after the war.[107] In July 1918, Havenstein recommended again that after the war the German economy should be reintegrated into the world economy as soon as possible.[108]

The republican government which was established in Berlin on 9 November 1918 faced a difficult task. Military expenditure decreased sharply, but this did not imply a return to the pre-war situation. There were new responsibilities, with new expenses: pensions for disabled soldiers, widows and orphans; subsidies for business to support the transition from war to civilian production; the service of the huge government debt; new social policy programmes; and reparation payments. It has been estimated in retrospect that if the total expenditure of the central government, states and local authorities were to be financed from current revenue, a tax ratio of 35 percent of national income would have been necessary. This was more than the pre-war tax ratio in imperial Germany of approximately 15 percent, but the burden would have been much lighter than during the war.[109]

The Reichsbank recommended fiscal and monetary stabilization, as it had already done in the last months of the war. President Havenstein warned repeatedly that the increase of the floating debt was alarming, and that it was the cause of an accelerating inflation. He urged that public expenditure should be reduced, and tax revenue increased.[110]

But the instable republican governments rejected fiscal and monetary stabilization and pursued instead from November 1918 to 1923 an inflationary policy. The main reason was the political situation. In the revolutionary situation of the time, faced by radical opposition from the right and from the left, the government refrained from expenditure cuts and massive tax increases. Inflation was a form of taxation that even weak governments could apply.[111] In addition there were economic arguments for inflation: it reduced the government debt, fostered production and employment, and it might convince the Allies that Germany could not pay large reparations. The central bank cooperated with the government, in spite of its repeated warnings. Until May 1922 the central bank was subordinated to the government. But even after May 1922, when the central bank was legally independent, its president Havenstein felt obliged to support the government. The central bank discounted a rapidly rising volume of treasury bills and treasury certificates, and expanded the money supply. Without formal constraints, inflation escalated into the hyperinflation of 1922-1923.[112]

The German inflation of 1918-23 had its origins in the First World War.[113] Yet the fiscal and monetary policies of the early post-war years were quite different from the financial mobilization during the war. Thus one might say that there were two inflations, not one: the suppressed inflation of 1914-18, and the post-war inflation of 1918-1923.

Gerd Hardach, Independent Scholar

Section Editor: Michael Geyer

Notes

- ↑ Hardach, Gerd: The First World War 1914-1918, London 1977, pp. 139-173; Soutou, Georges-Henri: Comment a été financée la guerre, in: de la Gorce, Paul-Marie (ed.): La première guerre mondiale, 2 volumes, Paris 1991, volume 1, pp. 281-297; Ferguson, Niall: How (not) to pay for the war. Traditional finance and a “total” war, in: Chickering, Roger/Förster, Stig (eds.): Great war, total war. Combat and mobilization on the Western front, Cambridge 2000, pp. 409-434; Balderston, Theo: Industrial mobilization and war economies, in: Horne, John (ed.): A companion to World War I, Chichester 2012, pp. 223-224.

- ↑ Roesler, Konrad: Die Finanzpolitik des Deutschen Reiches im Ersten Weltkrieg, Berlin 1967; Balderston, Theo: War finance and inflation in Britain and Germany, 1914-1918, in: Economic History Review, 42 (1989), pp. 222-244; Zeidler, Manfred: Die deutsche Kriegsfinanzierung 1914 bis 1918 und ihre Folgen, in: Michalka, Wolfgang (ed.): Der Erste Weltkrieg. Wirkungen, Wahrnehmung, Analyse, München 1994, pp. 415-433. Gross, Stephen: Confidence and gold: German war finance 1914-1918, in: Central European History, 42 (2009), pp. 223-252; Gross, Stephen: War finance (Germany), in: 1914-1918-online. Issued by Freie Universität Berlin, 2014; Hardach, Gerd: Financial mobilization in Germany 1914-1918. European Association for Business History (2004), eabh Papers, number 14-08.

- ↑ Holtfrerich, Carl-Ludwig: The German inflation 1914-1923. Causes and effects in international perspective, Berlin et al. 1986; Feldman, Gerald: The great disorder. Politics, economics and society in the German inflation, 1914-1924, Oxford 1993.

- ↑ I wish to thank Carl-Ludwig Holtfrerich for his comments and assistance.

- ↑ Hardach, Financial mobilization 2004, pp. 3-7.

- ↑ Pantlen, H.: Die finanzielle Mobilmachung des Deutschen Reiches 1870-1914. Manuskript, 1929. Geheimes Staatsarchiv Preußischer Kulturbesitz (GStA) I. HA Rep. 151 HB 970; Reichsarchiv, Kriegsrüstung und Kriegswirtschaft, Bd. 1, Berlin 1930; Reichsarchiv, Kriegsrüstung und Kriegswirtschaft. Anlagen zum ersten Band, Berlin 1930.

- ↑ Reichskanzleramt an die Rendantur des Reichs-Kriegsschatzes, 5 May 1874. Bundesarchiv Berlin (BArch) R 2101/1.

- ↑ Pantlen, Finanzielle Mobilmachung 1929, p. 12.

- ↑ Witt, Peter-Christian: Die Finanzpolitik des Deutschen Reiches von 1903 bis 1913, Lübeck et al. 1970.

- ↑ Bankgesetz, 14 March 1875. Reichsgesetzblatt (RGBl.) 1875, pp. 177-198.

- ↑ Feuchtwanger, Leo: Die Darlehnskassen des Deutschen Reiches mit Berücksichtigung der entsprechenden Kreditorganisation des Auslands, Stuttgart et al. 1918; Zilch, Reinhold: Die Reichsbank und die finanzielle Kriegsvorbereitung 1907 bis 1914, Berlin 1987, pp. 122-123.

- ↑ Konferenz über die Beschaffung des Geldbedarfs im Kriegsfall, 14 April 1891. BArch R 2/275.

- ↑ Reichsbank-Direktorium an den Reichskanzler, 17 April 1912. BArch R 2/41282.

- ↑ Zilch, Reichsbank und finanzielle Kriegsvorbereitung 1987, pp. 120-122.

- ↑ Reichsschatzamt an den Preussischen Finanzminister, 5 June 1891. BArch R 2/274.

- ↑ Die Lage der Reichsbank im Kriegsfalle und die Einführung des Zwangskurses. Undatiertes Memorandum, BArch R 2/41285.

- ↑ Besprechung über die Vorbereitung finanzieller Massnahmen für den Fall einer Mobilmachung, 1 April 1901. BArch R 2/41275; Reichsdruckerei an das Reichsschatzamt, 20 January 1906. BArch R 2/41278.

- ↑ Reichsbank-Direktorium an das Reichsschatzamt, 23 July 1906. BArch R 2/41279; Reichsbank-Direktorium an das Reichsschatzamt, 4 October 1906. BArch R 2/41279.

- ↑ Holtfrerich, German inflation 1986, pp. 108-110.

- ↑ Zeidler, Die deutsche Kriegsfinanzierung 1994, pp. 417-421; Gross, Confidence and gold 2009, pp. 227-228; Gross, War finance 2014, pp. 2-4.

- ↑ Der Stellvertreter des Reichskanzlers, Denkschrift über wirtschaftliche Massnahmen aus Anlass des Krieges, 23 November 1914. Verhandlungen des Reichstags, 13. Legislaturperiode, 2. Session, Band 135. Anlage 26, p. 4.

- ↑ Reichskanzler an den Bundesrat und Reichstag, 2 August 1914. BArch R 2 /41134.

- ↑ Gesetz, betreffend die Feststellung eines Nachtrags zum Reichshaushalt für das Rechnungsjahr 1914, 4 August 1914. RGBl. 1914, pp. 345-346.

- ↑ Gesetz, betreffend die Änderung des Bankgesetzes, 4 August 1914. RGBl. 1914, p. 327; Gesetz, betreffend die Reichschuldenordnung, 4 August 1914. RGBl. 1914, pp. 325-326.

- ↑ Gesetz, betreffend die Reichskassenscheine und die Banknoten, 4 August 1914. RGBl. 1914, p. 347.

- ↑ Darlehenskassengesetz, 4 August 1914. RGBl. 1914, pp. 340-345.

- ↑ Janz, Oliver: Der Große Krieg, Frankfurt 2013, pp. 31-32, 71-72; Leonhard, Jörn: Die Büchse der Pandora. Geschichte des Ersten Weltkriegs, Munich 2014, pp. 52-53; Münkler, Herfried: Der Große Krieg. Die Welt 1914-1918, Berlin 2013, pp. 71-90.

- ↑ Die Darlehnskassen des Reichs im Jahr 1914. Bearbeitet im Bureau der Hauptverwaltung der Darlehnskassen, Berlin 1915, p. 4.

- ↑ Statistisches Reichsamt, Zahlen zur Geldentwertung in Deutschland, Berlin 1925, p. 45.

- ↑ Verwaltungsbericht der Reichsbank für das Jahr 1914, Berlin 1915, pp. 4-5.

- ↑ Regierungspräsidium Düsseldorf, Besprechung über mit dem Kriegszustand zusammenhängende Fragen, 14. September 1914. GStA I. HA Rep. 151 HB 983.

- ↑ Feuchtwanger, Die Darlehnskassen des Reichs 1915, p. 3-4.

- ↑ Reichsbank, Statistische Abteilung, Kriegsanleihen. BArch R 2501/539.

- ↑ Verwaltungsbericht der Reichsbank für das Jahr 1918, Berlin 1919, p. 11.

- ↑ Reichsschatzamt an den Preussischen Finanzminister, 21 December 1914. GStA I. HA Rep. 151 HB 984.

- ↑ Statistisches Reichsamt, Zahlen zur Geldentwertung 1925, p. 45.

- ↑ Holtfrerich, German inflation 1986, pp. 50-51.

- ↑ Statistisches Reichsamt, Zahlen zur Geldentwertung 1925, pp. 48-49.

- ↑ Gesetz, betreffend Höchstpreise, 4 August 1914. RGBl. 1914, pp. 339-340.

- ↑ Statistisches Reichsamt, Zahlen zur Geldentwertung 1925, p. 16.

- ↑ Burhop, Carsten: Wirtschaftsgeschichte des Kaiserreichs 1871-1918, Göttingen 2011, pp. 101-117.

- ↑ Hoffmann, Walther G./Grumbach, Franz/Hesse, Helmut: Das Wachstum der deutschen Wirtschaft seit der Mitte des 19. Jahrhunderts, Berlin 1965, p. 817.

- ↑ Hardach, First World War 1977, pp. 11-34; Lambert, Nicholas A.: Planning Armageddon. British economic warfare and the First World War, Cambridge, Massachusetts et al. 2012.

- ↑ Reichsbank an den Staatssekretär des Reichsschatzamtes, 10 November 1914. GStA Rep. 151 HB 984.

- ↑ Reichsbank an den Staatssekretär des Innern, 6 January 1914. GStA Rep. 151 HB 984

- ↑ Strachan, Hew: The war experienced: Command, strategy and tactics, 1914-1918, in: John Horne (ed.), A companion to World War I, Chichester 2012, pp. 35-48.

- ↑ Rede von Reichsbankpräsident Havenstein in der Sitzung des Reichsbankkuratoriums, 25 September 1914. BArch R 43/2398.

- ↑ Balderston, War finance 1989, pp. 224-225.

- ↑ Reichsfinanzminister Schiffer, Die Finanzen des Deutschen Reichs in den Rechnungsjahren 1914 bis 1918, memorandum, 12 March 1918. Verhandlungen der verfassungsgebenden Deutschen Nationalversammlung, Bd. 135. Anlage 158, pp. 99-114; Roesler, Finanzpolitik 1967, pp. 195-200.

- ↑ Aufzeichnung über die vom Staatssekretär des Reichsschatzamtes veranlasste Besprechung von Finanzfragen des Reichs mit den einzelstaatlichen Finanzministern, 14 July 1915. BArch R 2/41231.

- ↑ Helfferich, Karl: Rede zum Nachtrag zum Haushalt für 1915/16, 14 August 1915. Verhandlungen des Reichstags. 13. Legislaturperiode, 2. Session. Bd. 306. Stenographische Berichte, pp. 225-226.

- ↑ Gross, Confidence and gold 2009, pp. 246-247; Gross, War finance 2014, p. 5.

- ↑ Reichstagssitzung, 16 March 1916. Verhandlungen des Reichstags, Bd. 306, p. 775.

- ↑ Reichsbank, Material zum Werbevortrag für die sechste Kriegsanleihe. BArch R 2501/397.

- ↑ Kriegssteuergesetz, 21 June 1916. RGBl. 1916, pp. 561-572.

- ↑ Reichsschatzamt an die Bundesregierungen, 22 February 1916. GStA I. HA Rep. 151 HB 989.

- ↑ Statistisches Bundesamt, Bevölkerung und Wirtschaft 1872-1972, Stuttgart 1972, p. 98.

- ↑ Verwaltungsbericht der Reichsbank 1918, p. 207.

- ↑ Verwaltungsbericht der Reichsbank 1918, p. 207.

- ↑ Balderston, War finance 1989, pp. 224-231, 241-242.

- ↑ Verwaltungsbericht der Reichsbank 1918, pp. 3-4.

- ↑ Reichskanzler, memorandum, 31 January 1916. BArch R 2/41232.

- ↑ Kriegssteuergesetz, 21 June 1916. RGBl. 1916, pp. 561-572; Roesler, Finanzpolitik 1967, pp. 189-191.

- ↑ Roesler, Finanzpolitik 1967, pp. 189-194.

- ↑ Roesler, Finanzpolitik 1967, pp. 196-199.

- ↑ Stand der fundierten Kriegsschuld, 31 December 1918. BArch R 2/1895; Roesler, Finanzpolitik 1967, pp. 88, 204-205; Reichsfinanzminister Schiffer, Die Finanzen des Deutschen Reichs in den Rechnungsjahren 1914 bis 1918, memorandum, 12 March 1919. Verhandlungen der verfassungsgebenden Deutschen Nationalversammlung, Bd. 135. Anlage 158, pp. 99-114.

- ↑ Roesler, Finanzpolitik 1967, p. 201.

- ↑ Feuchtwanger, Leo: Die Darlehnskassen des Reichs im Jahre 1918. Bearbeitet im Buero der Hauptverwaltung der Darlehnskassen, Berlin 1919, p. 3.

- ↑ Stand der fundierten Kriegsschuld, 31 December 1918. BArch R 2/1895; Roesler, Finanzpolitik 1967, pp. 204-205; Schiffer, Die Finanzen des Deutschen Reichs 1918, pp. 99-114.

- ↑ Gross, Confidence and gold 2009, p. 252.

- ↑ Verwaltungsbericht der Reichsbank für das Jahr 1916, Berlin 1917, pp. 7-13.

- ↑ Statistisches Reichsamt, Zahlen zur Geldentwertung 1925, pp. 48-51.

- ↑ Ibid.

- ↑ Statistisches Reichsamt, Zahlen zur Geldentwertung 1925, pp. 45-46.

- ↑ Holtfrerich, German inflation 1986, pp. 50-51.

- ↑ Statistisches Reichsamt, Zahlen zur Geldentwertung 1925, pp. 6, 16.

- ↑ Hardach, First World War 1977, pp. 112-120.

- ↑ Hoffmann/Grumbach/Hesse, Das Wachstum der deutschen Wirtschaft 1965, pp. 825-826.

- ↑ Ritschl, Albrecht: The pity of peace. Germany’s economy at war, 1914-1918 and beyond, in: Broadberry, Stephen/Harrison, Mark (eds.), The economics of World War I, Cambridge 2005, p. 44.

- ↑ Feldman, Gerald: Army, industry and labor in Germany, Princeton 1966; Hardach, First World War 1977, pp. 55-75.

- ↑ Ritschl, The pity of peace 2005, p. 44.

- ↑ Hoffmann/Grumbach/Hesse, Wachstum der deutschen Wirtschaft 1965, pp. 825-826; Ritschl, The pity of peace 2005, p. 44; Statistisches Reichsamt, Zahlen zur Geldentwertung 1925, p. 5.

- ↑ Verwaltungsbericht der Reichsbank für das Jahr 1915, Berlin 1916, p. 7.

- ↑ Reichsbank-Direktorium an den Staatssekretär des Reichsschatzamtes, 15 June 1916. BArch R 2/41671.

- ↑ Hardach, Financial mobilization 2004, pp. 18-20.

- ↑ Reichsbank-Direktorium an den Staatssekretär des Schatzamtes, 11 August 1916. BArch R 2/41671.

- ↑ Reichsbank-Direktorium an den Staatssekretär des Schatzamtes, 15 September 1916. BArch R 2/41672.

- ↑ Bekanntmachung über die Anmeldung von Wertpapieren, 23 August 1916. RGBl. 1916, p. 952.

- ↑ Reichsbank, Gesamtergebnis der Wertpapierbestandsaufnahme nach dem Stande, 30 September 1916. BArchB R 2501/6664.

- ↑ Deutscher Besitz an ausländischen Wertpapieren. Nach dem Friedensvertrag aufgestellt. BArch R 2501/6664.

- ↑ Aufzeichnung über eine Besprechung im Reichsamt des Innern, 19 June 1917. BArch R 2/41673.

- ↑ Fisk, Harvey E.: The inter-ally debts. An analysis of war and post-war public finance 1914-1923, New York 1924.

- ↑ Der Unterstaatssekretär in der Reichskanzlei an den Staatssekretär des Reichsschatzamtes, 1 September 1917. BArch R 2/41674.

- ↑ Pantlen, Finanzierung der Mobilmachung 1929, pp. 78-79.

- ↑ Hardach, First World War 1977, pp. 32-33.

- ↑ Reichsbank-Direktorium, Die deutsche Zahlungsbilanz und der Auslandskredit, memorandum, 2 January 1919. BArch R 2/41674.

- ↑ Statistisches Reichsamt, Zahlen zur Geldentwertung 1925, pp. 6, 16.

- ↑ Zilch, Reinhold: Okkupation und Währung im Ersten Weltkrieg. Die deutsche Besatzungspolitik in Belgien und Russisch-Polen 1914-1918, Goldbach 1994.

- ↑ Hautcoeur, Pierre-Cyrille: Was the Great War a watershed? The economics of World War I in France, in: Broadberry, Stephen/Harrison, Mark (eds.): The economics of World War I, Cambridge 2005, pp. 169-205; Liulevicius, Vejas Gabriel: German occupied Eastern Europe, in: Horne, John (ed.): A companion to World War I, Chichester 2012, pp. 447-463; de Schaepdrijver, Sophie: Belgium, in: Horne, John (ed.), A companion to World War I, Chichester 2012, pp. 386-402.

- ↑ Preussisches Kriegsministerium, memorandum, 16 October 1918. BArch R 704/25.

- ↑ Reichsbankdirektorium an den Reichskanzler, 8 March 1918. BArch R 704/29.

- ↑ Holtfrerich, German inflation 1986, pp. 119-137.

- ↑ Hardach, Financial mobilization 2004, pp. 21-24.

- ↑ Reichsbank-Direktorium an den Reichskanzler, 29 July 1918. BArch R 2/1849.

- ↑ Stand der fundierten Kriegsschuld, 31 December 1918. BArch R 2/1895; Hoffmann/Grumbach/Hesse, Wachstum der deutschen, Wirtschaft 1965, pp. 825-826; Ritschl, The pity of peace 2005, p. 44; Roesler, Finanzpolitik 1967, p. 88; Statistisches Reichsamt, Zahlen zur Geldentwertung 1925, p. 5.

- ↑ Soutou, Georges-Henri: L’or et le sang. Les buts de guerre économiques de la Première Guerre mondiale, Paris 1989, pp. 726-745.

- ↑ Reichsbank-Direktorium an den Reichskanzler, 8 March 1918. BArch R 704/29.

- ↑ Reichsbank-Direktorium an den Reichskanzler, 29 July 1918. BArch R 2/1849.

- ↑ Haller, Heinz: Die Rolle der Staatsfinanzen für den Inflationsprozess, in: Deutsche Bundesbank (ed.): Währung und Wirtschaft in Deutschland 1876-1975, Frankfurt 1976, p. 139.

- ↑ Reichsbank-Direktorium, memorandum, 1 July 1919. BArch R 2/3889; Reichsbank-Direktorium an den Reichsfinanzminister, 18 July 1919. BArch R 2/1894; Reichsbank-Direktorium, memorandum, 29 July 1919. BArch R 2/1894.

- ↑ Keynes, John Maynard: A tract on monetary reform (1923). Collected writings, volume 4, London 1971, p. 37.

- ↑ Holtfrerich, German inflation 1986, pp. 119-180.

- ↑ Feldman, The great disorder 1993, p. 25.

Selected Bibliography

- Balderston, Theo: Industrial mobilization and war economies, in: Horne, John (ed.): A companion to World War I, Chichester; Malden 2010: Wiley-Blackwell, pp. 223-224.

- Balderston, Theo: War finance and inflation in Britain and Germany, 1914-1918, in: The Economic History Review 42/2, 1989, pp. 222–244.

- Feldman, Gerald D.: The great disorder. Politics, economics, and society in the German inflation, 1914-1924, New York 1993: Oxford University Press.

- Ferguson, Niall: How (not) to pay for the war. Traditional finance and a 'total' war, in: Chickering, Roger / Förster, Stig (eds.): Great War, total war. Combat and mobilization on the Western Front, 1914-1918, Washington, D.C.; Cambridge; New York 2000: German Historical Institute; Cambridge University Press, pp. 409-434.

- Gross, Stephen: Confidence and gold. German war finance 1914-1918, in: Central European History 42/02, 2009, pp. 223-252.

- Hardach, Gerd: Die finanzielle Mobilmachung in Deutschland 1914-1918, in: Jahrbuch für Wirtschaftsgeschichte / Economic History Yearbook 56/2, 2015, pp. 359-388.

- Hardach, Gerd: The First World War, 1914-1918, Harmondsworth 1987: Penguin Books.

- Holtfrerich, Carl-Ludwig: The German inflation, 1914-1923. Causes and effects in international perspective, New York 1986.

- Ritschl, Albrecht: The pity of peace. Germany’s economy at war, 1914-1918 and beyond, in: Broadberry, Stephen N. / Harrison, Mark (eds.): The economics of World War I, Cambridge; New York 2005: Cambridge University Press, pp. 41-76.

- Roesler, Konrad: Die Finanzpolitik des Deutschen Reiches im Ersten Weltkrieg, Berlin 1967: Duncker & Humbolt.

- Soutou, Georges-Henri: Comment a été financée la guerre, in: La Gorce, Paul Marie de (ed.): La Première guerre mondiale, Paris 1991: Flammarion, pp. 281-297.