The Global Financial System before the War↑

Global finance in the first decade of the 20th century was based on the gold standard, a hybrid public-private system. It was public insofar as it underpinned the national currencies of sovereign countries—59 nations were part of the system in July 1914—and set the boundaries within which private businesses, banks, and individuals could access trade, finance, and markets. Yet, the central banks whose coordination and mutual assistance kept the gold standard operational were nominally private entities. Moreover, in the decade before the war, the importance of large financial institutions (especially the large clearing banks of the City of London) grew as their gold reserves and lending behavior exercised a larger influence on global financial market conditions. The public and private elements of the system supported each other in stable times, but they could come into conflict in times of crisis. In the event of a crisis central banks would find themselves torn between two responsibilities. The first was to defend their currency’s parity with gold and thereby the entire edifice of the international gold standard. This required raising interest rates and keeping the total volume of money and credit under control, often with contractionary effects. The other responsibility was to act as a lender of last resort for their banking system by supplying emergency liquidity. This necessitated an expansion of credit and a lowering of interest rates.

As Europe mobilized for war in August 1914, these tasks came into conflict with one another. Given the demands of early wartime mobilization, states that were on the gold standard faced a choice. On the one hand, they could remain within the system at the cost of economic contraction and a prolonged paralysis of the credit system. On the other hand, they could “go off” gold for the duration of the war, but thereby push the costs of regaining parity forward into an uncertain future. Britain and the United States, determined to uphold the exchange rate between the pound sterling and the dollar in the interest of easy borrowing, picked the former option. France, Russia, Germany, and Austria-Hungary chose to abandon the gold standard, either to obtain the flexibility to fight the war more effectively or because they were economically too weak to mobilize militarily while remaining on gold.

London was the linchpin of the global financial system. The architecture of the gold standard and the reach of British imperial power were important prerequisites for this. But it was the scale, power, and international reach of its private financial sector that made London preeminent. The City of London possessed a global empire of its own, with a geography even more diverse than the Commonwealth.[1] The most prestigious institutions were the five great merchant banks: Rothschilds, Barings, Morgans, Kleinworts, and Schröders. They were involved in all the most daring and profitable investment ventures worldwide. But the biggest entities were the joint-stock banks, institutions with large balance sheets such as Westminster (£104m), Lloyds (£107m), and Midland (£109m) that had millions of depositors and connected long-term capital with short-term money markets. London possessed the largest and most liquid markets and was the prime location for the discounting of bills of exchange to finance trade, for the trade in acceptances, which freed up funds when bills were sold or “accepted” in the secondary market, as well as for the extension of long- and short-term loans, the closing of insurance contracts, and the trade in foreign exchange. In 1912 the City of London financed over 60 percent of the world’s trade through its discount markets for bills of exchange.[2] Over £7 million in such bills were drawn per day on London acceptance houses, which had over £300 million in bills of exchange on their books at any given point.[3] Some two thirds of global maritime insurance contracts were handled in Britain.[4] Nor was this financial hegemony a completely virtual presence. It rested on a formidable commercial and industrial base and was boosted by British direct or indirect control over the physical infrastructure of world trade. 70 percent of the global telegraph cable network was composed of lines operated by British companies; UK shipping companies carried 55 percent of the world’s seaborne trade (by comparison, American and French shipping constituted a quarter of the total); and Britain controlled about three quarters of the coking coal annually used by the world’s cargo vessels.[5]

The hierarchical division of labor found in the City of London was the most developed financial system in the world, but the pattern was replicated at a smaller scale in national financial sectors across Europe. Generally, a few specialized and extremely international investment banks would operate at the apex of the financial hierarchy, below which a core group of large joint-stock or universal banks combined capital and money market functions; these market-makers, who brought together suppliers and buyers of credit, would in turn be connected to a larger nation-wide network of regional savings banks and trusts, and would also draw on the services of a diverse array of moneylenders, stockbrokers, discount and acceptance houses, and insurers. The financial ecosystem of Paris centered around the banques d’affaires: the Crédit Lyonnais (at £113m in 1913, the largest financial institution in the world), the Société Générale (£95m), and the Comptoir National d’Escompte de Paris (£75m), which competed with a coterie of older but smaller hautes banques focused on government finance and foreign investment in real assets around the world. In Berlin, Europe’s third financial center, the main actors were Deutsche Bank (£112m), Disconto Gesellschaft (£58m), and Dresdner Bank (£72m), which were heavily involved in trade finance and lending to industry, while sovereign lending was the prerogative of a small clique of private investment houses such as Mendelssohn & Co. and Bleichröder.[6] On the whole, however, Germany had a much less concentrated financial system, and regional and local savings banks comprised the vast majority of finance capital in the Reich. In the United States, the financial system was similarly vast and regionalized. On Wall Street, the power of the major national banks, the Bankers Trust, the National City Bank (£57m), and the Guaranty Trust Co. of New York (£47m), was evident through their role in industrial financing, in which they directly competed with the preeminent investment banks, a group led by the indomitable J.P. Morgan & Co., but which also included Kidder Peabody & Co., Lee Higginson & Co., Kuhn, Loeb & Co., Speyer & Co., and J. & W. Seligman & Co.[7] These banks would prove instrumental in the international financing of the Entente—and the relative lack of external debt finance for the Central Powers.

National Approaches to War Financing↑

Within national war efforts, one can distinguish between the fiscal, debt-related, and monetary aspects of war finance. Taxation was the most direct and traditional way to pay for increased expenditures on war. However, it played a subordinate role for almost every country involved. Taxes paid for at most a quarter of the actual expenses of fighting in Britain and the United States.[8] For most belligerents they were even less significant. In Germany and Italy between 6 and 15 percent of war spending in real terms was financed from taxes.[9] In Austria-Hungary, Russia, and France none of the ongoing costs of the war were paid out of taxes, which were already committed to covering ordinary peacetime budget outlays.[10] Nonetheless, taxation was important to the theory of war finance everywhere. Its served to control inflation and to uphold the creditworthiness of governments in the eyes of their creditors. By removing excess money supply from the civilian economy, taxation would reduce the strong upward pressure on prices caused by increased spending and money issuance. In addition, new taxes created new income streams for the government that would reassure lenders that a cash flow would be available to service the financial assets that they acquired by lending to the sovereign.

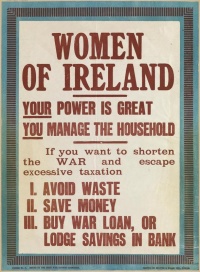

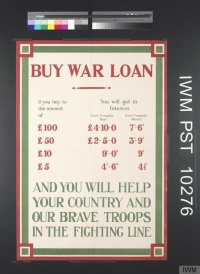

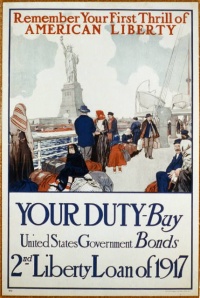

Borrowing was therefore the main method of financing the war. There are two dimensions of borrowing that are important to understanding the dynamics of war finance in the First World War. The first is the temporal dimension that distinguishes short-term and long-term government borrowing. Whereas short-term or “floating” debt was largely contracted with the central banks or with private banks, and therefore represented a claim on the state by the financial sector, long-term debt could be issued to private banks, firms, and citizens. War loans were large credits to the government to which private individuals and entities could subscribe by putting in their own money. In the hope that they would mobilize large sums of money from the public, governments publicized the war loans as patriotic contributions to the war effort—a financial substitute for serving in the field. War loans were the most high-profile form of government borrowing, but they usually contributed to the war effort only temporarily and their issuance was often timed to coincide with battlefield successes or the anticipation of military victories, all to solicit maximum subscriptions from citizens. Long-term debt was more secure because it could be repaid after the war and—if raised through war loans—rested on a fundamental, if contested, social compact between the government and its citizens. Short-term debt was easier to mobilize, but its liquidity also meant that its price was more volatile and that it would circulate as a means of payment. These instruments were also often used as collateral for further borrowing and money creation. Short-term borrowing thus tended to spur large credit expansion and inflation, both of which would eventually become sources of serious economic instability if they were left unaddressed. In addition, short-term debt was generally not spent on constructive investments that increased production; and it was overwhelmingly provided by the financial sector, which meant that popular influence over public finance and government policy, insofar as it existed, was further reduced.

The second dimension of borrowing that mattered was whether credit came from domestic individuals and businesses or from lenders abroad. Foreign borrowing activated a field of power relations that was distinct from the distributional politics of domestic borrowing in that it depended on a country’s position in the global economic hierarchy. Unlike the large volumes of international borrowing before the war—most of which was long-term capital invested in railways, canals, factories, and other real assets—external borrowing in wartime was almost always short-term and meant to cover ongoing expenditures.[11]

Finally, several countries increased the amount of money in circulation, either by “monetizing” the government debt—using the central bank to buy government bonds from a national treasury—or expanding the money supply directly by altering gold reserves, reserve requirements, and note issuance. Money and credit creation was an autonomous process, enabled by a country’s suspension of gold convertibility, as well as a byproduct of government borrowing, since highly-rated government securities could become reserves against which new private and public money could be created.

Most belligerents used a combination of these three methods. The composition of the war financing mix depended on the domestic distribution of political and economic power as well as strategic capabilities and considerations. Most financial mobilization plans were premised on the strategic scenario of a few months of conflict—at most a year. There was a discrepancy between expectations of a short war and the realities of long-term war finance, however. The Franco-Russian alliance, which in terms of fighting power was the military core of the Entente, was particularly hamstrung by a short strategic horizon. As powers with major gold reserves, France and Russia planned to pay for part of the initial mobilization expenses from their accumulated gold reserves, which at $840 million and $750 million were the largest in Europe.[12] The Banque de France saw its gold as a “war chest” (trésor de guerre), and after 1911 prepared in the event of war to advance the government 2.9 billion francs in short-term credits in return for three-month treasury bills.[13] The French and Russians worried about the exhaustion of physical resources and commodity stocks as much as about money. They were right to assume that states rarely stop fighting because of insufficient funds. Yet, such a cash-strapped total war economy could be maintained only through severe state intervention in the form of requisitioning, coercive labor practices such as corvée duty, consumption cuts, and various economic controls on prices, capital, and profits. In France the political and social compact of the Union sacrée provided some democratic legitimation for such sacrifices, but in autocratic Russia the government responded to economic exhaustion and deprivation with increasingly arbitrary rule.

Britain entered the war intending to maintain a more normal civil society and economic freedom; this included relative freedom for business and no conscription unless necessary. The orthodox economic view was therefore that war was like any other expenditure—without the money to pay for it, it could not be done. Britain had traditionally funded its wars one third by tax increases and two thirds by borrowing.[14] British war finance was brought onto a relatively more sustainable long-term footing early in the war. The UK benefited enormously from the pre-war reform of its fiscal system, which had introduced a permanent income tax and an efficient collection apparatus.[15] This was partially because London expected that its public finances and stocks of private wealth would enable it to outlast Germany, and partially because its grand strategic posture depended less on offensive speed and more on the attrition of concentric military offensives and the blockade of Central Europe. Yet as we shall see, Britain also needed this margin of financial strength, since it would be forced to assume growing responsibilities for the conduct of a global war as chief conductor of the Entente until 1917, and thereafter as partner to Washington.

Germany pursued an idiosyncratic approach to war finance due to political constraints. The German economy was fast-growing and wealthy, but the Reich lacked a federal fiscal structure capable of levying direct taxes to fund its war expenditures. Berlin remained dependent on the individual German states for most of its revenues other than customs duties and a one-off wealth tax passed in 1913.[16] Since the General Staff was hoping for a short war, however, the Reich Treasury and the Reichsbank prioritized speed over sustainability in the mobilization of funds. The establishment of a localized system of regional loan banks (Darlehenskassen) overcame the fiscal weakness of the Reich by enabling enormous decentralized liquidity creation and monetizing of the government debt. These Darlehenskassen were local institutions created to surmount the liquidity shortage of the initial mobilization process. They were maintained thereafter, taking in short-term deposits of between three and six months and making short-term loans. Unable to fund rising expenditures through long-term debt taken out by the imperial government, the governments of German states and communes borrowed heavily from the Darlehenskassen. By 1917, three quarters of their 7.7 billion-mark balance sheet consisted of loans to state and local governments.[17] These Darlehenskassenscheine started to be used as a medium of exchange, but because they were not legal tender they were not counted in the official money supply; moreover, the Reichsbank and private banks could use these highly volatile short-term securities as a reserve against which to issue yet more money. By the end of the war this enormous uncontrolled surge in liquidity had created the preconditions for later hyperinflation, although increased hoarding kept a lid on runaway prices for the time being.[18]

The Central Powers and the Allies as Financial Alliances↑

The Central Powers↑

The ability of the Central Powers to act as a global financial player was much constrained by the Allied blockade. The loss of export earnings and shipping income caused by the blockade was reinforced by the ejection of German and Austro-Hungarian firms and businesses from the London and Paris markets and the confiscation of private and business assets through British, French, and Russian legislation that prohibited trading with the enemy. Expropriation at the hands of its opponents was much more painful for Germany than the Entente. At least half of the 21-25 billion marks worth of foreign investment that the Reich held around the world in 1914 was in enemy territories, whereas just 10-12 percent of the French and a mere 1.3 percent of the British capital stock was under enemy control.[19] Although it still had access to the neutral economies of the Netherlands, Scandinavia, and Switzerland, Germany was thus from an early stage much more constrained than the Entente, both in its capacity to obtain external financing and in its ability to draw on its foreign wealth.

On Wall Street, US banks were not enthusiastic to lend to Germany, partly because of inherent pro-Entente sympathies, partly because of discouragement from the Wilson Administration. Between 1914 and 1917 the Germans only managed to obtain $35 million in private credits through New York.[20] Nor did the smaller European neutrals offer much elasticity in foreign credit provision. Swiss banks provided $170 million to all foreign borrowers for the duration of the war. The Dutch financial sector extended 440 million guilders ($220 million) in credits, of which about two thirds went to the Central Powers and the remainder largely to Britain.[21] From 1916 onwards the Anglo-French blockade became more comprehensive, entailing not only more pressure on neutral countries to reduce exports to the Central Powers, but also increased controls on financial flows. City bankers assisted the British Ministry of Blockade in identifying suspicious international transactions that might hide German attempts to sell foreign assets or repatriate overseas profits via countries like Spain, Norway, or the Netherlands. Threats to blacklist banks and firms transacting with Germany were effective in closing off Wall Street as a source of funds for the Reich by the end of the year.[22] The main way for Berlin to obtain funds abroad was thereby to sell off its foreign capital stock.

The Reichsbank sold $470 million worth of foreign securities on the New York stock exchange in 1915-1916, and in subsequent years brought in $250 million by selling securities in other neutral countries and about $490 million through the sale of German corporate shares and the export of gold—altogether about five billion marks worth of wealth, or one fifth of the foreign capital stock.[23] In its dealings with neutrals, the German priority was increasingly to obtain adequate supplies of physical commodities and inputs to sustain the war effort rather than funds. In this sense, German external war finance was more directly subordinated to war production. It did not function, as it did for the Entente, as a resource that could be used to leverage the larger alliance’s strategic room for manoeuver.

Despite the strictures imposed on its global position by its enemies, the Reich found itself in the position of a dominant partner among the four Central Powers. Although Austria-Hungary had its own financial sector, which included some large banks such as the Credit-Anstalt and the Anglo-Österreichische Bank, it was handicapped by the small amount of capital available in Vienna. The Dual Monarchy was a creditor only towards the Balkans, where its banks supplied about one fifth of Serbia’s and two fifths of Bulgaria’s long-term foreign loans.[24] Moreover, the dualist administrative structure of the empire meant that its Austrian and Hungarian halves had their own finance ministers and were autonomous in matters of taxation and bond issuance. At the start of the war, three quarters of public debt was held domestically, but over the course of the war Germany became more and more crucial to the creditworthiness and external funding of Vienna and Budapest. German banks enabled the Austro-Hungarian army to stay in the field. By early 1918, Germany owned 71 percent of the external Austro-Hungarian debt.[25] In addition, over the course of the war the Austro-Hungarian Bank sold three quarters of its gold reserve to the Reichsbank to finance imports, a larger loss of bullion than the central bank of any other belligerent.[26]

In the late 19th century, the Ottoman Empire had been in a subordinate position to the European Great Powers, which controlled the empire’s finances through the Ottoman Public Debt Administration. During the war, however, Constantinople managed its financial relations with Germany cleverly by exploiting its position as an essential partner. In return for deploying their armies against the British Empire in the Middle East and Russia in the Caucasus, the Turks received gold shipments and mark loans, rather than exporting gold to Berlin as the Austro-Hungarians did. In a roundabout way, Austria-Hungary was therefore supplying the Ottomans with gold. Ottoman foreign debt rose from 161 million Turkish pounds in 1914 to 454 million Turkish pounds by 1918. Due to price inflation, the real value of the debt was relatively low, and because only one war loan was launched, Ottoman society remained remarkably untouched in fiscal terms.[27]

Bulgaria’s entry into the war on the side of the Central Powers was motivated by strategy mixed with finance. As a relatively undeveloped country in the early 20th century, Bulgaria had to be willing to accept credits from whomever would offer them on good terms. Great Power interest in the Balkans endowed the Bulgarians with the occasional ability to negotiate more favorable terms. However, after its defeat in the Second Balkan War (1913), the country was left with a large debt burden which it owed to French, Russian, and Austro-Hungarian banks and desired to consolidate on a more secure footing. When in the summer of 1914 the German Disconto-Gesellschaft offered a fifty-year credit of 120 million francs in return for a hand in the country’s industrial development and 5 percent interest, the Bulgarians thus gladly accepted. Attempts by the French to woo Bulgaria into joining the Entente by promising to buy its entire harvest were tempting but insufficient, and in September 1915 Sofia joined the Central Powers—a decision immediately rewarded with a monthly revolving credit from Disconto backed by the Reich.[28]

The Entente↑

The Entente achieved much better coordination in its international financial assistance than the Central Powers. In the first year of the war, the Franco-Russian military alliance bore the brunt of the fighting while Britain arranged the logistics and the money.[29] When Italy joined the Entente in May 1915 this added not only strategic weight but also an additional financial burden. As the war entered its second year, London increased its direct military participation and became increasingly reliant on Wall Street as an ultimate backstop. As the alliance expanded, its financial center of gravity moved westward. By 1916-1917 the core of the Entente’s war finance system was the Wall Street-City of London axis. While the Bank of England did everything in its power to preserve the sterling-dollar exchange rate—it would spend over $2 billion in reserves just to maintain parity—the British and French treasuries used American money and capital markets to obtain credit for themselves as well as for Russia, Italy, Serbia, Greece, Portugal, and Belgium.[30] If the United States was increasingly the ultimate provider of funds, Britain was the main orchestrator of their distribution, allocating credit to its allies and matching funds with the strategic and operational requirements of warfare on several fronts. Altogether, without the trans-Atlantic link the Entente would have been unable to develop a war-winning multi-front strategy of attrition.

Between 1914 and 1918, the total amount of foreign credit taken out by the Entente totaled $16 billion. This was an enormous amount of borrowing, as much as the entire British foreign capital stock before the war. The United States was the largest wartime creditor, lending a total of $7 billion, of which $3.7 billion went to Britain, $1.9 billion to France, and $1 billion to Italy. Britain came a close second with a total credit provision of $6.7 billion, largely to Russia ($2.5 billion), Italy ($1.9 billion), and France ($1.6 billion). France lent $2.2 billion, almost of half of which ($955 million) was to Russia, $535 million to Belgium, and the remainder to smaller Allies. Britain and France were therefore both big lenders and borrowers at the same time, although the British balance sheet matched debts and assets much more evenly. As the only government that never had to fund itself through external debt, the United States was the backstop of this global credit pyramid. At the far ends of the credit hierarchy were debtors such as Italy, which owed $3 billion, and Russia, which owed $3.6 billion.[31]

The French slide into dependency, first on London and subsequently on Wall Street, may seem surprising considering its wealth and well-developed financial sector, the third-largest in the world. However, France was constrained by several factors. Already before the war its government debt constituted more than 70 percent of GDP, one of the highest debt burdens among all belligerents.[32] It had introduced an income tax only in June 1914. Moreover, the destruction and loss of industry and agricultural land in the north and east was compounded by military conscription, both reducing the fiscal base. Finally, much of French foreign wealth was long-term capital investment in Central and Eastern Europe that could not be liquidated quickly to raise money.[33] As a result, France borrowed 83.5 percent of its wartime expenditure through a wide variety of debt instruments: national defence bonds, treasury bills (bons du trésor), war loans for public subscription, and foreign borrowing.[34] Starting in October 1914, France tapped into American markets, first for its own needs, but soon also on behalf of its allies. When the war ended, France was a debtor to the US and the UK but a creditor to Russia, Serbia, Belgium, and Greece.

Italy’s overall budget and balance of payments position was in better shape than that of France when it entered the war in May 1915. However, since the two main sources of earnings on the current account—emigrants’ remittances and income from tourism—fell away due to the war, Italy lacked the income to cover its imports of foodstuffs, coal, and crucial inputs for war industry. Italian borrowing, then, was mainly a temporary compensation to finance imports. An initial £60 million loan from the Bank of England was followed by a monthly British credit of £10 million. By late 1915 Rome began to place its treasury bonds in the American market. For 1916 the British Treasury fixed Italy’s allotment at a total of £122 million, of which £65 million could be spent in the United States. In addition, the British government provided the Banca d’Italia with £1m a month to support the lira on foreign exchange markets.[35] Italian dependency on trans-Atlantic finance thus deepened, and by the summer of 1917 virtually its entire food and energy supply was financed through London, Paris, and New York. Most Italian debt remained domestic, however: by the end of the war the public debt stood at 119 percent of GDP, of which a quarter was owed to Britain, the US, and France, and the rest held within the country.[36] The problem was that the lira had depreciated more than 40 percent, which made these foreign debts proportionally much harder to repay than the government’s obligations to its Italian private creditors, which had been hollowed out by inflation.

If one country’s dependence on trans-Atlantic finance stands out, however, it is neither France nor Italy but Russia. The Russian empire’s financial integration had always been a strategic as well as a financial enterprise for the West. For France especially, the prospect of tying down German military resources in the east had made its immense investments in Russia since the mid-1890s a sound long-term plan. Ironically, Russia’s rapid industrialization facilitated a military buildup that in fact heightened the Austro-Hungarian and German anxieties that contributed to the outbreak of war.[37] Besides this self-fulfilling quality, however, foreign investment in Russia was also self-perpetuating: once large amounts of capital had been sunk into the empire, giving up the alliance with the Tsar would come at a massive political, financial, and strategic cost. Despite its perceived military prowess, Russia required enormous additional amounts of credit to mobilize and sustain the war against the Central Powers. Its very backwardness in economic development thus sucked in French and British lenders more deeply as the war continued. Wartime borrowing significantly exceeded pre-war borrowing, and over the course of the conflict Russia’s indebtedness to Britain rose by 5.1 billion rubles, to France by 1.34 billion rubles, and to the United States and Italy by another 2 billion rubles.[38] Over 70 percent of Anglo-French borrowing on Wall Street between 1914 and 1917 was undertaken on Petrograd’s behalf.[39]

When, in the wake of the October Revolution, the Bolsheviks announced that they would take Russia out of the war and would not honor tsarist-era debts, consternation gripped both Western capitals and Western capital. The official repudiation of tsarist debt in January 1918 was the largest debt default in history up to that point, wiping out over $5 billion in debt to foreign creditors. For Britain, which had a very diverse portfolio of foreign investments in every continent, this was a serious setback but not a crippling blow. But for France, which owned 43 percent of the 9.4 billion-ruble total that was repudiated—its Russian assets represented a quarter of all French foreign investment—it was disastrous.[40] France went from being a net creditor to a net debtor as a result. Moreover, three quarters of the French-held Russian debt was in the possession of a group of 1.5 million middle-class private investors. Unlike in other countries, in France the emprunts russes became a highly contested political and electoral issue and a major source of popular anti-Communism among the French public.[41] During the war, all financial roads had led to Petrograd. Now that the Russians were out of the war and temporarily out of the international financial system, rebalancing public finances after the war relied even more than before on exacting an overwhelming victory against the Central Powers.

There was one notable outlier within the wider Allied coalition: Japan. As the main Asian ally of the Entente, Japan fought only briefly and managed to increase its economic and financial stature considerably during the conflict. At the outset of the war it had been a net debtor with only small gold reserves, but by 1919 the Japanese net foreign asset position, boosted by a wartime export and shipping boom, showed a 1.39 billion-yen surplus; 1 billion yen worth of foreign investments was accumulated by firms and banks during the war. The private sector and government also held 236 million yen in loans to the Chinese government, making Japan the chief foreign lender to its East Asian neighbor. Owing to the gravity of the logistical and financial crisis of Entente war finance in 1916, the Japanese even started to lend to Britain, France, and Russia; by war’s end they had 575 million yen in outstanding loans to Entente governments.[42]

Several smaller Entente partners received credits from London and Paris (often sourced through New York) to sustain auxiliary campaigns against the Central Powers. Alliances with peripheral European countries had played a role in British imperial containment strategies against continental Great Powers since the Napoleonic Wars. Portugal joined the war in March 1916 in return for a British loan of $14.1 million and sent expeditionary forces to fight the Germans on the Western Front as well as in its African colonies. Greece took both Entente and German loans in 1914-1916 before siding with the Allies in June 1917. For an Anglo-French-American credit of $150 million the Greeks deployed nine divisions in the Balkans.[43] By war’s end, Portugal and Greece owed, respectively, $220 million and $155 million to France, and $78 million and $90 million to Britain. These loans procured the assistance of small armies in the encirclement of Central Europe at relatively little expense, while they further tilted the balance of economic and military power against Germany and its allies. However, the Allies also lost large amounts of money that they lent to small countries that were overrun by the Central Powers during the war, such as Belgium ($1.1 billion) and Serbia ($400 million).[44] The continuation of credit to these countries reflected the cost of maintaining governments-in-exile, armies, and refugees; and, in the case of Belgium, providing the civilian food supply for a population under occupation.

Public and Private Actors in the War Finance System↑

War finance was undertaken by a mix of public and private actors. The war erupted in a world in which the reach and liquidity of private interests in finance, trade, and industry had in many ways outstripped the power of the state to regulate them. For contemporaries such as John Hobson (1858-1940) and Vladimir Lenin (1870-1924) this was proof that capitalism had attained an imperialist stage. The influence enjoyed by the presidents of large financial institutions, holding companies, and industrial conglomerates was certainly enormous. In August 1914, J.P. Morgan & Co. partner Henry Davison (1867-1922) travelled to London to arrange a deal with the Bank of England that made his bank the official sponsor of all credits to the British government floated on American markets. J.P. Morgan & Co. underwrote $1.5 billion in war loans to London over the course of the war. As an investment bank, Morgan was not the largest American bank, but it was the most well-connected.[45] It had already floated credit for London once before, during the Boer War in 1900. The influence of private investment bankers was not unlimited, however. In the fall of 1914, for example, the US government initially barred Morgan from floating French government loans in New York, forcing Paris to look to the City of London for credits instead. However, by the spring of 1915, France too was funding itself on Wall Street. Once Russia also picked Morgan as the intermediary for its borrowings on the American market, the House of Morgan had become the credit-broker to the entire Entente. For its services to the alliance it obtained an 8.3 percent commission, which netted it over $200 million in profits.[46]

Thereafter Washington allowed private financing of Entente war credits in the US, but kept a very close watch on this public-private credit relationship. There was considerable tension between the Federal Reserve and the Wilson administration over how generous America should be with its money and credit. Fed chairman Benjamin Strong (1872-1928) had personal connections with his European counterparts and was a firm supporter of trans-Atlantic coordination.[47] On the other hand, Woodrow Wilson (1856-1924) was keen to discipline what he saw as intra-European imperial recklessness by withholding money, thereby forcing the belligerents to seek a negotiated peace and reaffirming America’s commitment to neutrality and international peace. American pressure reached a peak when, in late November 1916, Wilson ordered the Fed to instruct American banks and investors to halt foreign currency loans and purchases of foreign securities—a clear counsel against further private lending to London, Paris, and Petrograd.[48] Mere days before Morgan planned to float a 1.5 billion-dollar Anglo-French bond to raise money for the military offensives scheduled for 1917, this move brought the Entente’s delicate trans-Atlantic private financing structure to the brink of collapse.[49] Wilson was determined that if the United States entered the war, it would do so on its own terms and as the undisputed economic leader of the alliance. When Washington declared war on Germany in April 1917, private financing of Entente loans in the US was replaced by funding provided directly by the American government.

The reliance of London and Paris on J.P. Morgan & Co. was replicated at a smaller level in the Anglo-Russian and Franco-Russian alliances. Petrograd relied on Baring Brothers for loans from London and on the Banque de Paris et des Pays-Bas (Paribas) to finance its debt on Parisian markets. Here too, however, the involvement of private banks did not mean that profit trumped strategy. At crucial moments the terms of the credits that sustained the war effort would be set by the British, French, and Russian finance ministers based on essentially political considerations; private bankers lost influence in relative terms as the war dragged on.

Effects of Global War Finance↑

Shifts in Income and Wealth Distribution↑

The general trend towards expansionary deficit financing of the war effort strengthened big business, especially industry and the parts of the banking system involved in short-term money market lending to sovereigns. Yet, it curtailed much of the thriving international financial ecosystem that had existed before the war; investment banks in every country except America were hard-hit, as were banks that financed trade and export-oriented industries such as shipping, textiles, and other consumer goods.

More important, however, were the enormous costs imposed on populations at large by the imbalances and exigencies of war finance. The war was highly lucrative for a small but powerful set of firms involved in armaments production and related manufacturing and service industries. There was a widespread and justified feeling that capitalists were ‘war profiteers’ who were raking in undue earnings at the expense of the population. Several governments capitalized on these sentiments by introducing a tax on excess profits. In Britain, the United States, and Italy, this tax was levied only on firms; in France and Germany, individuals as well as companies could become liable to pay it.[50] Nonetheless, excess profits taxes could not prevent big shifts in the distribution of income, the dynamics of which were driven not just by real production but by general price level rises. Producers and owners of real assets gained at the expense of savers and rentiers living off fixed incomes. In general, the price of goods on the (black) market rose far more quickly than incomes.

Global inflation↑

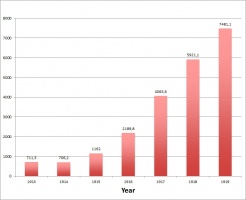

The First World War created a global rise in prices. Taking the price level of the last pre-war year, 1913, as a benchmark level of 100, the increases were significant everywhere. In all economies that were at officially war, prices had risen at least twofold by 1918: from 196 in Japan and 203 in the USA to 235 in Great Britain, 217 in Germany (soon to cascade into dangerous hyperinflation), 340 in France, and 409 in Italy. Shortages of raw materials, excess liquidity spillovers, and foreign import binges also affected the neutrals, most of which saw the 1913 price levels more than triple.[51] Since European central banks also controlled currency and securities circulating in their colonial economies, deficit financing in the metropole caused inflation in the periphery. Because colonial subjects lacked rights and democratic institutions, this inflation fueled social unrest and anti-colonial uprisings. In Central Europe, town-country exchange was breaking down by the end of the war, causing famine in urban centers; Asian peasants from the Indian Ocean to the Pacific confronted a rice crisis that would persist for three years after the end of the war.[52] The way that these high price levels were brought down was through a sustained, purposeful deflation of the global money supply, initiated by the Federal Reserve’s hiking of interest rates in March 1920 and (due to America’s leading role in the return to the gold standard) thereafter forcibly followed by most central banks around the world. The economic result was a sharp worldwide recession in 1920-1921. This monetary consolidation was accompanied by a wave of violent political repression and counterrevolution—a “world-wide Thermidor” that ended the revolutionary aftermath of the Great War.[53]

Hegemonic Transition↑

All the European belligerents experienced the Great War as a war of financial attrition. In just four years the three major European pre-war creditors, Britain, France, and Germany, lost or burned through more than $12 billion of foreign assets, over a third of the total external investment that they had built up over the course of the 19th century.[54] At the commanding heights of the global financial system, the war marked the beginning of the end of the hegemony of the City of London and the ascendancy of Wall Street to a position of global dominance. This shift was far from complete by 1919. Britain retained the largest overall foreign capital stock of any country. Yet the quick emergence of America’s strong net creditor position was a powerful sign that the Victorian and Edwardian heyday of British financial supremacy was approaching its end. During the conflict it became clear that the American state was better able to cooperate with its private financial sector and possessed a more activist and powerful central bank in Benjamin Strong’s Federal Reserve.

A second shift caused by the war’s financial effects on the world economy was the prominence of well-developed financial centers in European neutrals—chiefly Amsterdam, Zurich, and Stockholm. These hubs were a major beneficiary of the financial exhaustion of the larger nations surrounding them. They established themselves as attractive conduits of capital for reconstruction, and for most of the 1920s would punch above their weight as British, French, and German banks struggled to regain their pre-war footing.[55]

Finally, the financial weakening of large European empires and shifts in creditor-debtor relationships within the core of the global economy led to increased pressure on economies in Latin America, Africa, Middle East, and East Asia. Before the war, the boom in globalization had meant that plentiful capital had been available for investment, often in high-yielding ventures such as railways and infrastructure that spurred economic growth. With reconstruction at home a paramount objective, intercontinental financial flows were reduced in scale, although this by no means meant that banking and lending ceased to matter. Latin America is an instructive example. Before 1914 it had been a major destination for British, German, and American investment.[56] The exhaustion of the European powers meant that by 1918 the United States had emerged as the preponderant foreign creditor and foreign investor in the region.[57] Latin American nations faced slower growth and became more financially dependent on the United States. This increased the already existing inequality in economic relations in the Western Hemisphere during the 1920s and 1930s. In the interwar period, Washington’s informal imperialism in Latin America would manifest itself through the technical control offered by US “money doctors” as well as in a series of military interventions—the so-called Banana Wars. Even if the Great War weakened the long-run prospects of formal European imperialism, Euro-American economic influence continued to restrict the autonomy of nations elsewhere in the world.

War Debts↑

American entry into the war transformed the inter-Allied credits from a hybrid public-private network into a set of intra-governmental relations of indebtedness with the United States at its core as the ultimate global creditor. This financial pre-eminence caused significant discord, however. European sovereigns had borrowed in the United States on the assumption that they were defending civilization from the threat of the Central Powers’ aggression and autocracy. They did not expect the Americans to treat their foreign lending as a business investment aimed at maximizing profit. When the loans came due, European countries faced the costs of domestic reconstruction and foreign debt repayment in tandem.

Britain was in some sense helped by the fact that its claims on France, Russia, Italy, and other countries almost equaled its obligations to the United States.[58] France faced a much bigger debt problem since the mismatch between its assets and liabilities was almost $1.4 billion, and even larger once its lost Russian assets were considered. French governments in the 1920s were often exasperated at the unwillingness of Republican administrations in Washington to cancel or at least freeze war debts. The war debts issue thus became a major weakness in the material foundations of the liberal international order during the 1920s. The Allies’ failure to resolve it satisfactorily before the Great Depression commenced was a pre-figuration of further coordination failures in the response to the economic slump itself. This portended the deterioration of global economic relations amidst mutual suspicion and distrust in the 1930s—a precondition for the political instability that in due course made a second world war possible.

Nicholas Mulder, Columbia University

Section Editor: Michael Geyer

Notes

- ↑ Darwin, John: The Empire Project. The Rise and Fall of the British World-System, 1830-1970, Cambridge 2009, pp. 112-143.

- ↑ Kynaston, David: The City of London, Volume 2. Golden Years, 1890-1914, London 1995, p. 8.

- ↑ Brand, Robert: Lombard Street and War, in: Round Table 2/6 (1912), p. 249.

- ↑ Ball, Michael / Sunderland, David: An Economic History of London, 1800-1914, London 2001, p. 356.

- ↑ Lambert, Nicholas: Planning Armageddon. British Economic Warfare and the First World War, Cambridge, MA 2012, p. 239.

- ↑ Cassis, Youssef: Capitals of Capital. A History of International Financial Centres, 1780-2005, Cambridge 2006, pp. 102-106, 109-112.

- ↑ Ibid., pp. 115-119.

- ↑ Daunton, Martin: Just Taxes. The Politics of Taxation in Britain, 1914-1979, Cambridge 2007, p. 40. Gilbert, Charles: American financing of World War I, Westport 1970, pp. 221-223.

- ↑ Knauss, Robert: Die deutsche, englische und französische Kriegsfinanzierung, Berlin 1923, p. 175. Forsyth, Douglas J.: The crisis of Liberal Italy. Monetary and financial policy, 1914-1922, Cambridge 1993, p. 76. Strachan, Hew: Financing the First World War, Oxford 2004, p. 95.

- ↑ Strachan, Financing the First World War 2004, p. 115.

- ↑ Ibid., p. 220.

- ↑ Moulton, Harold / Pasvolsky, Leo: War Debts and World Prosperity, New York 1932, p. 31.

- ↑ Jèze, Gaston / Truchy, Henri: The war expenditure of France, New Haven 1927, p. 190. Mouré, Kenneth: The Bank of France and the Gold Standard, in: Flandreau, Marc / Holtfrerich, Carl-Ludwig / James, Harold: International Financial History in the Twentieth Century. System and Anarchy, Cambridge 2002, pp. 95-124; p. 97.

- ↑ Strachan, Financing the First World War 2004, p. 3.

- ↑ Daunton, Just Taxes 2007, pp. 37, 48.

- ↑ Strachan, Financing the First World War 2004, pp. 95-99. Roesler, Konrad: Die Finanzpolitik des deutschen Reiches im Ersten Weltkrieg, Berlin 1967, pp. 71, 104-105, 134. Gross, Stephen: Confidence and Gold. German War Finance, 1914-1918, in: Central European History 42/2 (2009), pp. 223-252.

- ↑ Knauss, Kriegsfinanzierung 1923, p. 56. Roesler, Finanzpolitik 1967, pp. 212-214.

- ↑ Roesler, Finanzpolitik 1967, pp. 91-95, 200. Balderston, Theo: War finance and inflation in Britain and Germany, 1914-1918, in: Economic History Review 42/2 (1989), pp. 222-244; pp. 238-240.

- ↑ David, Hans: Das Deutsche Auslandskapital und seine Wiederherstellung nach dem Kriege, in: Weltwirtschaftliches Archiv 14 (1919), pp. 275-300.

- ↑ Zeidler, Manfred: Die deutsche Kriegsfinanzierung 1914 bis 1918 und ihre Folgen, in: Michalka, Wolfgang (ed.): Der Erste Weltkrieg. Wirkung, Wahrnemung, Analyse, Munich 1994, pp. 415-433; p. 424.

- ↑ Euwe, Jeroen: Amsterdam als Finanzzentrum für Deutschland, 1914-1931, in: Klemann, Hein A.M. / Wielenga, Friso (eds.): Deutschland und die Niederlande. Wirtschaftsbeziehungen im 19. und 20. Jahrhundert, Münster 2009, pp. 153-172; p. 159.

- ↑ Strachan, Financing the First World War 2004, p. 164.

- ↑ Ibid., pp. 163, 166.

- ↑ Köver, György: The Austro-Hungarian Banking System, in: Cameron, Rondo / Bovykin, I.M. (eds.): International Banking 1870-1914, New York 1991, pp. 319-344; pp. 333-334.

- ↑ Popovics, Alexander: Das Geldwesen im Kriege, Vienna 1925, pp. 133-134.

- ↑ Between December 1914 and October 1918, the Austro-Hungarian Bank’s gold reserves fell from 1,055 million crowns to 268 million crowns. Popovics, Geldwesen 1925, pp. 120-125.

- ↑ Larcher, Maurice: La guerre turque dans la guerre mondiale, Paris 1926, p. 541.

- ↑ Strachan, Financing the First World War 2004, pp. 176-177. Tooze, Adam / Ivanov, Martin: Disciplining the black sheep of the Balkans: financial supervision and sovereignty in Bulgaria, 1902-38, in: The Economic History Review 64/1 (2011), pp. 30-51; p. 36.

- ↑ For the essential importance to the Entente of the Franco-Russian alliance in the first year of the war in 1914-1915 see Soutou, Georges-Henri: La grande illusion. Quand la France perdait la paix, Paris 2015.

- ↑ Strachan, Financing the First World War 2004, p. 19.

- ↑ Moulton / Pasvolsky, War Debts 1932, p. 426. Cassis, Capitals of Capital 2005, pp. 147-148, gives slightly higher estimates of inter-Allied debts ($19.4 billion) at constant prices based on Artaud: Les dettes de guerre de la France, 1919–1929, in: Lévy-Leboyer, M., (ed.): La position internationale de la France. Aspects économique et financiers, XIXe–XXe siècles, Paris 1977, pp. 313-18.

- ↑ Hautcoeur, Pierre-Cyrille: Was the Great War a watershed? The economics of World War I in France, in: Broadberry, Stephen / Harrison, Mark (eds.): The Economics of World War I, Cambridge 2005, pp. 169-205; p. 186.

- ↑ Moulton / Pasvolsky, War Debts 1932, p. 27.

- ↑ Jèze / Truchy, War expenditure 1927, p. 193.

- ↑ Forsyth, Crisis of Liberal Italy 1993, pp. 164-165.

- ↑ Galassi, Francesco / Harrison, Mark: Italy at war, 1915-1918, in: Broadberry, Stephen / Harrison, Mark (eds.): The Economics of World War I, pp. 276-309; p. 281. Forsyth, Crisis of Liberal Italy 1993, p. 321.

- ↑ Tooze, Adam / Fertik, Ted: The World Economy and the Great War, in: Geschichte und Gesellschaft 40 (2014), pp. 214-238; p. 218. Clark, Cristopher M.: The Sleepwalkers. How Europe Went to War in 1914, London 2012, pp. 326-334.

- ↑ Siegel, Jennifer: For Peace and Money. French and British Finance in the Service of Tsars and Commissars, Oxford 2014, p. 7.

- ↑ Michelson, A.M. / Apostol, P.N. / Bernatzky, M.W.: Russian Public Finance during the War, New Haven 1928, pp. 312-315.

- ↑ White, Stephen: The Origins of Détente. The Genoa Conference and Soviet-Western Relations, 1921-1922, Cambridge 1985, pp. 26-27.

- ↑ Williams, Andrew J.: Trading with the Bolsheviks. The politics of East-West Trade, 1920-1939, Manchester 1992, p. 99.

- ↑ Tooze, Adam: The Deluge. The Great War and the Remaking of Global Order, 1916-1931, London 2014, pp. 96-97, Table 3. Schiltz, M.: The Money Doctors from Japan. Finance, Imperialism, and the Building of the Yen Bloc, 1895-1937, Cambridge, MA 2012, pp. 135-154.

- ↑ Cassimatis, Louis P.: American Influence in Greece, 1917-1929, Kent, OH 1988, p. 6.

- ↑ Moulton / Pasvolsky, War Debts 1932, p. 426.

- ↑ ‘At the dawn of the twentieth century, John Pierpont Morgan was unquestionably the world’s top banker’. Cassis, Capitals of Capital 2005, p. 115.

- ↑ Harvey, A.D.: Collision of Empires. Britain in Three World Wars, 1793-1945, London 1992, p. 291.

- ↑ Soutou, Georges-Henri: L’or et le sang. Les buts de guerre écononomiques de la Première Guerre Mondiale, Paris 1989, pp. 343-353.

- ↑ Tooze, Deluge 2014, pp. 51-55.

- ↑ Soutou, L’or et le sang 1989, pp. 373-377.

- ↑ Strachan, Financing the First World War 2004, pp. 72-73, 81, 84-85, 94, 100-101.

- ↑ Tooze, Deluge 2014, p. 213, Table 4.

- ↑ Ibid., p. 212.

- ↑ Ibid., pp. 353-373. Maier, Charles: Recasting Bourgeois Europe. Stabilization in France, Germany, and Italy in the Decade after World War I, Princeton 1975, pp. 136, 138.

- ↑ Feinstein, Charles H. / Temin, Peter / Toniolo, Gianni: The World Economy Between the World Wars, New York 2008, p. 81.

- ↑ Cassis, Capitals of Capital 2005, pp. 176-180. Feinstein / Temin / Toniolo, World Economy 2008, p. 80, Table 5.

- ↑ Feis, Herbert: Europe, the World’s Banker, 1870-1914. An Account of European Foreign Investment and the Connection of World Finance with Diplomacy Before the War, New Haven 1930, p. 74.

- ↑ Rinke, Stefan: Latin America and the First World War, Cambridge 2017, p. 70.

- ↑ Harvey, Collision of Empires 1992, p. 291.

Selected Bibliography

- Balderston, Theo: War finance and inflation in Britain and Germany, 1914-1918, in: The Economic History Review 42/2, 1989, pp. 222–244.

- Broadberry, Stephen N. / Harrison, Mark (eds.): The economics of World War I, Cambridge; New York 2005: Cambridge University Press.

- Cappella Zielinski, Rosella: How states pay for wars, Ithaca; New York 2016: Cornell University Press.

- Cassis, Youssef: Capitals of capital. A history of international financial centres, 1780-2005, Cambridge 2010: Cambridge University Press.

- Descamps, Florence / Quennouëlle-Corre, Laure (eds.): La mobilisation financière pendant la Grande Guerre. Le front financier, un troisième front, Paris 2016: Institut de la gestion publique et du développement économique.

- Feinstein, Charles H. / Temin, Peter / Toniolo, Gianni: The European economy between the wars, Oxford 1997: Oxford University Press.

- Feis, Herbert: Europe, the world's banker, 1870-1914. An account of European foreign investment and the connection of world finance with diplomacy before the war, New Haven 1930: Yale University Press.

- Ferguson, Niall: The pity of war, New York 1999: Basic Books.

- Flandreau, Marc / Holtfrerich, Carl-Ludwig / James, Harold: International financial history in the twentieth century. System and anarchy, Cambridge 2003: Cambridge University Press.

- Forsyth, Douglas J.: The crisis of liberal Italy. Monetary and financial policy, 1914-1922, Cambridge; New York 1993: Cambridge University Press.

- Gilbert, Charles: American financing of World War I, Westport 1970: Greenwood.

- Horn, Martin: Britain, France, and the financing of the First World War, Montreal; Ithaca 2002: McGill-Queen's University Press.

- Jèze, Gaston / Truchy, Henri: The war finance of France. The war expenditure of France, New Haven 1927: Yale University Press.

- Knauss, Robert: Die deutsche, englische und französische Kriegsfinanzierung, Berlin 1923: Gruyter.

- Moulton, Harold G. / Pasvolsky, Leo: War debts and world prosperity, New York 1932: Century Co.

- Roesler, Konrad: Die Finanzpolitik des Deutschen Reiches im Ersten Weltkrieg, Berlin 1967: Duncker & Humbolt.

- Soutou, Georges-Henri: L'or et le sang. Les buts de guerre économiques de la première guerre mondiale, Nouvelles études historiques, Paris 1989: Fayard.

- Soutou, Georges-Henri: Comment a été financée la guerre, in: La Gorce, Paul Marie de (ed.): La Première guerre mondiale, Paris 1991: Flammarion, pp. 281-297.

- Strachan, Hew: Financing the First World War, Oxford; New York 2004: Oxford University Press.

- Tooze, J. Adam: The deluge. The Great War and the remaking of the global order, 1916-1931, London; New York 2014: Allen Lane.