Introduction↑

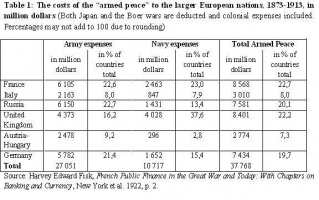

Wars bring with them dramatically higher public expenditure and lower private consumption. During the First World War (WWI) all of the belligerents used a mixture of taxation, inflation, domestic debt and borrowing abroad to finance their growth in public spending, with the emphasis on the latter three. Germany was no exception. The first policy, taxation, is an overt and direct way of redirecting resources from the private to the public sector. The second, printing money and debasing the currency, is an indirect way of doing the same thing. Printing currency devalues existing stocks of wealth in the private sector and shifts resources to the authority that has the power to mint new money, namely, the state. The third method, issuing domestic debt, asks people to voluntarily forego current consumption and instead lend their funds to the state for a given period. Issuing debt, however, merely postpones the final reckoning, since the state must eventually pay off its debt with higher levels of taxation or erode it by debasing the currency. Finally, states can borrow money from foreign citizens and institutions, temporarily adding to their country’s overall stock of wealth. As with domestic debt, though, foreign debt must also be dealt with in the future by raising taxes or devaluing the currency.

Contemporaries and scholars have tended to judge Germany’s wartime financial policies negatively. Many commentators before 1914 believed Germany’s public finances were too decentralized and disorganized to fund a long conflict. Many historians since have argued that the substantial inflation and the shortages of goods during the war, along with the hyperinflation in 1923, resulted from the Reichsbank and the Treasury’s ineffective wartime financial policies.[1] Yet recent scholarship that examines war finance from a comparative perspective paints German mobilization in a more favorable light, illustrating how German policies were more effective than those of the Habsburg, Russian and Ottoman Empires, and comparable in many ways to those of Great Britain and France.[2]

Indeed, Germany’s war finance resembled Great Britain's and France's insofar as all three countries relied much more heavily on debt and inflation than on taxation to fund government spending. From the perspective of the war years, these financial policies were a success in Germany. While the German economy experienced inefficiencies because of concealed inflation, it never suffered a catastrophic breakdown. German war loans enjoyed a higher subscription rate than most other belligerent powers. Germany even supported its allies through loans and gold deliveries. Germany’s defeat in the fall of 1918 had military, not financial, causes. Yet from the perspective of the post-war years, German wartime financial policies look more problematic: the Weimar Republic experienced a wrenching hyperinflation, whereas Great Britain and France did not. To what extent this hyperinflation stemmed from wartime policies has been a recurring point of debate among historians. If Germany’s war finance resembled the Entente’s in broad terms, subtle but important differences in its taxation, its ability to place short-term debt in its money markets, its access to foreign investors, and the peculiar institution of its loan bureaus (Darlehnskassen) created an inflationary potential that was greater in Germany than in its foes to the west. That Germany’s inflationary potential actually became a reality, however, depended primarily on post-war policies.

To understand the techniques and the legacy of German war finance, this article first examines efforts to mobilize for war financially before 1914. It then moves to the war years themselves, paying particular attention to how Germany met the initial financial crises of August 1914, how it paid for the war after the crisis passed, and what role its money market, banking system and public played in supporting the nation’s financial mobilization. It concludes by discussing the consequences of the war both for the post-war hyperinflation and for the larger trajectory of German financial history in the early 20th century.

Mobilizing for War↑

In the two decades before 1914, contemporaries both inside and outside of Germany believed the Wilhelmine Empire was poorly prepared to finance a major war. Germany was a federal state and the central government in Berlin lacked the ability to impose direct taxes, such as an income tax, which were powerful instruments for modern governments to raise revenue. Only 14 percent of Germany’s federal revenue came from direct taxes, mostly inheritance and minor property taxes. The remainder came from indirect revenues generated by tariffs and taxes on consumption. Rising military expenditures before 1914 thus brought higher tariffs and prices for consumer goods, making taxation an explosive political issue. The Social Democrats wanted to halt the rise in tariffs and move Germany to a more centralized and progressive tax system. Meanwhile the states of the Wilhelmine Empire jealously guarded their near-monopoly on direct taxation. For contemporaries, the intense struggle over taxation in Germany created the perception of financial weakness.[3]

In addition, several financial crises in the decade before 1914 suggested that Germany was poorly equipped to manage the economic strains a war might bring. For one, the Reichsbank suffered from liquidity problems. Under the rules of the gold standard it had to cover at least one-third of the paper notes in circulation with specie held in its vaults. Yet the Reichsbank’s gold reserves were small in comparison with those of France, giving it less flexibility during financial crises. During the panic of 1907 the German Treasury – unlike Britain’s and France’s treasuries – needed to sell bonds on foreign capital markets, and during the 1911 financial crisis the Berlin money market proved vulnerable to a rapid withdrawal of foreign investment. This was also seen as an indication of German financial weakness. Germany’s national debt, moreover, had grown much more quickly than either Great Britain’s or France’s over the preceding three decades. Finance Minister Adolf Wermuth (1855-1927) feared that Germany’s “financial armament” did not match its “military armament.” The market seemed to agree. German bond prices were significantly lower than those of Great Britain or France, nearer the price of Russian bonds, indicating the perception of greater risk associated with buying German government bills.[4]

To combat the perception of financial weakness, Wermuth and Reichsbank President Rudolf Havenstein (1857-1923) pursued a decade-long program to augment Germany’s gold reserves and reduce Germany’s dependence on foreign creditors. This campaign culminated in the bank laws of 4 August 1914. Austria-Hungary’s declaration of war on 28 July 1914 created turmoil in financial markets across the Europe and presented the belligerents with two immediate challenges: how to prevent a run on the gold reserves of their central banks and how to provide liquidity to their economies given the interruption to foreign trade and investment caused by the declarations of war. Germany solved these difficulties with new bank laws that fundamentally changed its financial system.

First, the Reichsbank suspended the requirement for banks to redeem paper money for gold, which had been the principle rule of the gold standard. Although the Reichsbank upheld its own obligation to cover one-third of all paper notes in circulation with specie or foreign currency, the new law made its gold reserves inaccessible to the public. With this law Germany had, in effect, left the gold standard. A second law authorized the Reichsbank to purchase short-term treasury bills in addition to commercial bills of exchange. This allowed the Reichsbank to act as a lender of last resort and to print new paper money to meet the financial needs of the government. A third law eliminated the tax levied on Reichsbank notes in circulation above the one-third gold coverage limit, a tax that had previously deterred the Reichsbank from expanding the circulation of paper money. With the first three laws, the only legal fetter restraining the Reichsbank from printing unlimited paper currency became the amount of gold it held in its vault, the central bank still being required to maintain a coverage ratio of one gold mark for every three paper marks in circulation.

The Reichsbank circumvented this last hurdle to unlimited paper money by establishing loan bureaus – Darlehnskassen – where people, firms and municipalities could mortgage their illiquid securities for loan bureau notes that were accepted as legal tender by all government agencies. The WWI loan bureaus were modeled on similar institutions established during the Franco-Prussian War of 1870,and enabled German firms and banks to maintain liquidity through the financial upheaval of the first weeks of the war. Crucially, however, the notes issued by these loan bureaus – Darlehnskassenscheine – did not have to be covered by gold held at the Reichsbank. Instead, these paper notes actually counted as gold reserves themselves and could cover the issuing of further paper currency. The August 1914 bank laws preserved the veneer that Germany’s currency was still anchored to gold. And this perception was cultivated by the Reichsbank and most German economists in the hopes of instilling the public with confidence in the German currency. But when all four laws were taken together, they effectively removed Germany from the gold standard and created the potential for serious inflation if misused.[5]

Paying for the War↑

After managing the liquidity crisis of August 1914, officials at the Reichsbank and the Treasury turned their attention to the question of how to pay for the escalating war costs. Raising money through new taxes proved to be a difficult and ultimately unsuccessful strategy. At first German financial authorities like Karl Helfferich (1872-1924), finance minister from 1915 to 1916, decided not to pursue higher taxation in the belief that the war would be a short one. With the growing awareness that a German victory would be a long time coming, and with the onset of the Hindenburg Program in 1916 – Germany’s massive new armament campaign – new leadership at the Treasury tried to increase taxation to cover the costs of war. Siegfried von Roedern (1870-1954), finance minister from 1916 to 1918, introduced a tax on war profits in June 1916, and later a turnover tax and a coal tax. Roedern, however, was unable to implement a direct income tax at the federal level. And the taxes he did implement only raised small sums in comparison to Germany’s overall outlays. In the end, substantial tax reform during the war proved politically impossible because it threatened to disturb the Burgfrieden (public peace). The federal states resisted new direct taxes, and the Social Democrats opposed new indirect taxes on consumer goods. Nevertheless, the share of Germany’s war costs covered by taxation, when including the state governments alongside the federal government, were only slightly lower than that of the other belligerents: 13.9 percent for Germany versus 18.2 percent for Great Britain.[6]

Instead, Helfferich, Havenstein, and Roedern’s grand strategy was to fund the extraordinary budget – i.e. combat expenses – by issuing war loans to the German public. As in the Franco-Prussian War, they hoped a victorious Germany would levy an indemnity on its vanquished opponents at the end of the conflict, and use this to pay off its debt. To raise immediate cash the central government floated short-term bills on a continuous basis, which were bought either by the Reichsbank itself or by Germany’s private financial institutions. Each fall and spring the government then issued a long-term war loan to the general public – nine in total – and used the proceeds to pay down its floating short-term debt. Until the fall of 1918 nearly all circles of the population subscribed to these war loans, reflecting Germany’s successful loan publicity and the confidence the population placed in their nation’s financial authorities. Germany’s debt grew tremendously during the war, but so did that of its enemies and allies. Its annual deficit hovered around 90 percent of total government expenditures in the second half of the war. Yet these deficits were only moderately higher than either France (80 to 85 percent) or Great Britain (70 to 75 percent). By the end of the war overall public debt of these three nations as a percentage of GDP had reached comparable levels.[7]

| Year | U.K. | France | Germany |

| 1914 | 61.3 | 54.8 | 73.5 |

| 1915 | 79.8 | 79.4 | 94.4 |

| 1916 | 75.0 | 86.6 | 92.7 |

| 1917 | 76.1 | 86.1 | 90.8 |

| 1918 | 69.2 | 80.0 | 93.8 |

Table 1: Government Budget Deficits as a Percentage of Expenditures

Source: Eichengreen, Barry: Golden Fetters. The Gold Standard and the Great Depression 1919-1939, New York 1995, p. 75; Ferguson, Pity of War 1999, p. 75

Throughout the war, moreover, Germany served as the banker for its allies. Over the course of the war it extended three and a half billion marks of credit to the Habsburg Empire, much of which Vienna used to finance its massive trade deficit. In return, Germany demanded gold from the Austro-Hungarian Bank. By contrast, Germany lent nearly 800 million marks in gold to the Ottoman Empire, where specie remained the main channel of payments. Gold shipments from Germany were crucial for the Ottoman army to purchase supplies in the periphery of the empire, where Ottoman currency enjoyed little confidence. Financial relations between the Central Powers certainly strained Germany’s own resources at home. Yet that Germany was able to support its allies, if at times in a heavy-handed manner, underscores that its own financial system was never in danger of collapsing during the war.[8]

Banking, the Money Market and the Monetization of German War Debt↑

Germany’s main financial problem, however, was the explosion of public spending caused by the Hindenburg Program. Despite the popularity of its war bonds, by the end of 1916 the German government was spending significantly more than it was taking in either through its long-term loans or through taxation. After 1916, the federal government’s short-term floating debt grew relentlessly and by the end of the war it accounted for over 30 percent of the federal government’s total debt. This situation created the potential for serious inflation. Any short-term debt not purchased by German banks or placed in the Berlin money market had to be bought by the Reichsbank, which printed new paper money to do so.[9]

This is where important differences began to appear between Germany’s war finance and those of its western foes. Both Great Britain and France had deep money markets, Britain in particular, which were willing and able to buy short or medium-term government bills in large quantities. By contrast, the German money market was much younger and still developing. At the beginning of the war German banks purchased relatively few short-term government bills, yet this was of little consequence because the proceeds of the semi-annual long-term war loans were large enough to soak up Germany’s short-term, floating debt. After 1916 German banks began to purchase more of the government’s floating debt, in large part because this debt began crowding out private commercial bills. But the new appetite of German banks for public short term debt was still not enough to offset the massive increase in expenditures associated with the Hindenburg Program.[10]

By contrast, the deep money markets of Great Britain and France paid dividends because they enabled their governments to place large quantities of short-term debt, and thereby help limit the growth in the money supply. After March 1915 approximately 32 percent of German war debt was floating on a regular basis; in Britain the figure was just 18 percent. As the Reichsbank purchased ever more short-term bills to pay for the Hindenburg Program, it printed more paper money to do so. German debt, in other words, became monetized and the volume of new currency exploded. German currency in circulation rose 599 percent over the course of the war, more than its rivals to the West, although less than its rival to the East. Great Britain and France saw an increase of money in circulation of 91 and 386 percent respectively; Russian paper currency in circulation increased by an astounding 1,102 percent. The German government managed to keep a lid on price inflation and the overall cost of living, but only by imposing price controls on consumer goods. These controls distorted the market price of goods, contributing to shortages, allocation problems and the rise of black markets across Germany.[11]

| Year | Funded Debt | Floating Debt | Monetized Floating Debt |

| 1914/15 | 9,713 | 1,800 | 1,596.6 |

| 1915/16 | 18,181 | 4,600 | 3,340.2 |

| 1916/17 | 25,281 | 4,100 | 2,802.8 |

| 1917/18 | 21,667 | 14,400 | 4,810.4 |

| Cumulative | 74,842 | 24,900 | 12,550 |

Table 2: Increase in Germany's Funded, Floating and Monetized Debt

Source: Ritschl, Albrecht: Germany’s Economy at War. 1914-1918, in: Broadberry, Stephen/Harrison, Mark (eds.): The Economics of World War I, New York 2005, p. 62

The huge volume of new paper currency, moreover, still had to be legally covered by gold reserves held at the Reichsbank. To accommodate the growth of paper money in circulation, Helfferich and Havenstein pursued an aggressive publicity campaign to convince the German public to hand their gold over to the Reichsbank to augment its reserves and to place their trust in Germany’s paper currency. By the end of 1916 virtually no specie remained in circulation. Even this accumulation of gold, however, was not enough to cover the vast expansion of paper money. After 1916 the Reichsbank relied increasingly on its loan bureau notes to circumvent the gold ratio while maintaining the impression that Germany’s paper currency was still backed by specie. The loan bureau notes issued by federal authorities were nothing more than paper notes backed by the authority of the state. Yet under the August 1914 bank laws they functioned like gold when held by the Reichsbank and counted toward the one-third coverage limit. When the war ended in November 1918, the legal reserves amounted to 2,328 million marks of gold specie, and 4,005 million marks of loan bureau notes. Together these covered 18,610 million marks of Reichsbank notes in circulation: a ratio of 34 percent, just above the legal one-third limit. If, however, loan bureau notes are counted not as specie, but as paper notes, these figures change significantly. By the end of the war, the total of publicly issued paper in circulation (paper currency plus loan bureau bills) amounted to 28,834 million marks. The ratio of all publicly issued notes covered by specie alone, closer to the spirit of the gold ratio framework, had fallen to just 8 percent, far below the one-third legal limit. That the public accepted this transition to a fiat currency system was due in large part to the publicity of Germany’s central bank, its economists, private banks, and its financial community, which by and large endorsed the policies implemented by Helfferich, Havenstein and Roedern.[12]

| Month-Year | Specie in Reichsbank | Notes in Circulation |

| Sept-1914 | 1,787 | 4,491 |

| Sept-1915 | 2,457 | 6,158 |

| Sept-1916 | 2,503 | 7,370 |

| Sept-1917 | 2,506 | 10,205 |

| Sept-1918 | 2,563 | 15,334 |

Table 3: Reichsbank Gold Holdings and Paper Notes in Circulation

Source: Roesler, Konrad: Die Finanzpolitik des Deutschen Reiches im Ersten Weltkrieg, Berlin 1967, Appendix Table 13

The western allies enjoyed a final advantage over Germany insofar as they were able to raise funds in neutral markets. All belligerents ran substantial trade deficits during the war, importing much more than they exported. Financing these trade deficits became a constant challenge. Great Britain, France and Germany all sold off privately owned foreign assets to help pay for their imports. When these ran out the Entente powers enjoyed the benefits of being able to take out loans in New York to finance their trade deficits, whereas Germany did not. Before its entry into the war, money markets in the US lent over 2 billion dollars to the Entente, compared to only between 27 and 35 million dollars to the Central Powers. Likewise, in Switzerland, the Entente, and France in particular, dominated the market for foreign war bonds. More than anything else, raising funds abroad enabled the Entente to access foreign resources and purchase war material from beyond their own borders to an extent not possible for Germany. Through much of the war Germany’s trade deficit was just 50 percent of its imports, whereas the trade deficit for France, Italy and Russia hovered between 60 and 80 percent.[13]

The Consequences of German War Finance↑

From a bird’s eye comparative perspective, Germany’s financial policies during the war do not look so different from those of the Entente. Yet on closer examination important differences emerge that created a greater potential for inflation than in either Great Britain or France. Germany relied slightly less on taxation and slightly more on debt than did Great Britain. The Berlin money market absorbed less of its government’s short-term floating debt than did the money markets in London and Paris. Germany found it harder to raise funds abroad; its debt and the inflationary consequences of that debt remained firmly anchored in the domestic economy. And finally, its loan banks fostered a false sense that the German currency was still firmly anchored to gold, even though that ceased to be the case well before the end of the war.

Yet, as numerous historians have pointed out, inflation after the war could have been managed had the international climate been less acrimonious, the burden of reparations less severe, or the German leaders not pursued a policy of non-fulfillment. The mark, after all, stabilized against the dollar in late 1920 and early 1921, and inflation briefly reached an annual level of just 2 percent before the London reparations ultimatum of May 1921. Barry Eichengreen and Gerald Feldman suggest, respectively, that in crucial ways reparations were “ultimately responsible for the inflation,” or that they served as a powerful “disincentive to stabilize.” By contrast, Niall Ferguson argues that reparations were not primarily to blame. Germany could have paid them without destroying its economy: its debt burden in 1921 as a percentage of GDP was actually slightly lower than Great Britain’s. Instead, to appease the domestic critics of the Treaty of Versailles, German leaders on both ends of the political spectrum pursued a deliberate policy of fiscal deficits to induce the Entente powers to dismantle the reparations system. Yet Ferguson, like Eichengreen and Feldman, still finds the roots of the hyperinflation in Germany’s post-war policies, not in its wartime finance.[14]

Ultimately, the larger implication of German war finance was less the hyperinflation, and more the fact that it accelerated the transition from a specie to a fiat currency. By the end of the war virtually all gold and silver coinage had been drawn out of circulation and collected in the vaults of the Reichsbank. As a result, during the four long years of war Germany’s population became accustomed to paper money to an extent not thought possible before August 1914. Although Weimar tried to return to the gold standard in the 1920s, its gold-backed currency was short-lived. With the Great Depression Germany again left the gold standard, this time for good.

Stephen Gross, University of California, Berkeley

Section Editor: Christoph Cornelißen

Notes

- ↑ Bresciani-Turroni, Costantino: The Economics of Inflation. A Study of Currency Depreciation in Post-War Germany, London 1953; Mendelssohn-Bartholdy, Albrecht: The War and German Society. The Testament of a Liberal, New York 1937/1971; Kindleberger, Charles: A Financial History of Western Europe, New York 1993, pp. 292f.

- ↑ Ferguson, Niall: The Pity of War. Explaining World War I, New York 1999; Balderston, Theo: War Finance and Inflation in Britain and Germany. 1914-1918, in: The Economic History Review 42 (1989), pp. 222-244; Broadberry, Stephen/Harrison, Mark (eds.): The Economics of World War I, New York 2005.

- ↑ Ferguson, Pity of War 1999, pp. 115, 122f.

- ↑ Ferguson, Pity of War 1999, pp. 132-135.

- ↑ Gross, Stephen: Confidence and Gold. German War Finance 1914-1918, in: Central European History 42 (2009), pp. 227ff.

- ↑ Balderston, War Finance 1989, pp. 222-244; Feldman, Gerald: The Great Disorder. Politics, Economics, and Society in the German Inflation, 1914-1924, New York 1993, pp. 41ff.

- ↑ Eichengreen, Barry: Golden Fetters. The Gold Standard and the Great Depression 1919-1939, New York 1995, p. 75; Ferguson, Pity of War 1999, pp. 324f.

- ↑ Strachan, Hew: The First World War, vol. I To Arms, Oxford 2001, pp. 946-952.

- ↑ Balderston, War Finance 1989, p. 227; Hardach, Gerd: The First World War. 1914-1918, Berkeley 1977, p. 160.

- ↑ Gross, Confidence and Gold 2009, p. 232.

- ↑ Hardach, First World War 1977, p. 172; Holtfrerich, Carl-Ludwig: The German Inflation, 1914-1923. Causes and Effects in International Perspective, translated by Theo Balderston, New York 1986, pp. 79-94; Ferguson, Pity of War 1999, pp. 320, 330; Ritschl has come up with a lower estimate for Germany’s percentage of floating debt, estimating it at 15 percent of total debt by 1918. See: Ritschl, Albrecht: Germany’s Economy at War. 1914-1918, in: Broadberry, Stephen/Harrison, Mark (eds.): The Economics of World War I, New York 2005, pp. 59-64.

- ↑ Roesler, Konrad: Die Finanzpolitik des Deutschen Reiches im Ersten Weltkrieg [The German Reich’s Finance Policy in World War I], Berlin 1967, pp. 208, 216; Gross, Confidence and Gold 2009, pp. 242-251.

- ↑ Strachan, First World War 2001, pp. 943-944; Born, Karl Erich: Geld und Banken im 19. und 20. Jahrhundert [Money and Banks in the 19th and 20th Centuries], Stuttgart 1977; Kellenberger, Eduard: Theorie und Praxis des schweizerischen Geld-, Bank- und Börsenwesens seit Ausbruch des Weltkrieges (1914-1939) [Theory and Practice of Swiss Money, Bank and Stock Systems since the Outbreak of WWI (1914-1939)], vol. 2 Kapital Export und Zahlungsbilanz [Capital Export and Balance of Payments], Bern 1939, pp. 45f; Eichengreen, Golden Fetters 1995, p. 82.

- ↑ Eichengreen, Golden Fetters 1995, p. 141; Feldman, Great Disorder 1993, pp. 255-272; Ferguson, Pity of War 1999, pp. 407-423; Ritschl also concludes that the monetization of debt during the war was not a major cause of inflation. See: Ritschl, Germany’s Economy 2005, p. 63.

Selected Bibliography

- Balderston, Theo: War finance and inflation in Britain and Germany, 1914-1918, in: The Economic History Review 42/2, 1989, pp. 222–244.

- Born, Karl Erich: Geld und Banken im 19. und 20. Jahrhundert, Stuttgart 1977: Kröner.

- Bresciani-Turroni, Costantino: The economics of inflation; a study of currency depreciation in post-war Germany, 1914-1923, London 1953: G. Allen & Unwin Ltd.

- Broadberry, Stephen N. / Harrison, Mark (eds.): The economics of World War I, Cambridge; New York 2005: Cambridge University Press.

- Eichengreen, Barry J.: Golden fetters. The gold standard and the Great Depression, 1919-1939, New York 1995: Oxford University Press.

- Feldman, Gerald D.: The great disorder. Politics, economics, and society in the German inflation, 1914-1924, New York 1993: Oxford University Press.

- Ferguson, Niall: The pity of war, New York 1999: Basic Books.

- Gross, Stephen: Confidence and gold. German war finance 1914-1918, in: Central European History 42/02, 2009, pp. 223-252.

- Hardach, Gerd: The First World War, 1914-1918, Harmondsworth 1987: Penguin Books.

- Holtfrerich, Carl-Ludwig: The German inflation, 1914-1923. Causes and effects in international perspective, New York 1986.

- Kindleberger, Charles P.: A financial history of Western Europe, New York 1993.

- Mendelssohn-Bartholdy, Albrecht: The war and German society; the testament of a liberal, New York 1971: H. Fertig.

- Ritschl, Albrecht: Germany’s economy at war, 1914–1918, in: Broadberry, Stephen / Harrison, Mark (eds.): The economics of World War I, New York 2005, pp. 41-76.

- Roesler, Konrad: Die Finanzpolitik des Deutschen Reiches im Ersten Weltkrieg, Berlin 1967: Duncker & Humbolt.

- Strachan, Hew: The First World War, New York 2003: Viking.