Introduction↑

Switzerland’s economic history of the First World War has hardly been studied in recent times. To be sure, there have been new books about some aspects of the war economy. Heinz Ochsenbein describes the regulation of foreign trade as imposed by the belligerents, Eveline Ruoss studies the monetary policy of the Swiss National Bank, Sébastien Guex analyses the interplay between fiscal and monetary policy, and Roman Rossfeld and Tobias Straumann have assembled sixteen business case studies.[1] But a comprehensive and modern history of Switzerland’s economy between 1914 and 1918 has not yet been written. The best account is still to be found in Traugott Geering’s (1859-1932) book written in 1928.[2]

Thanks to Geering’s work, it is possible to describe and explain the essentials. Switzerland like all other small European neutrals – the Netherlands as well as the Scandinavian countries – had a mixed experience, depending on the economic sector and the phase of the war. The biggest winners were some industries that profited from the demand for military goods or from the disappearance of foreign competition on the world market as a result of the war. Many industrial sectors registered high profits as the belligerents and the Swiss military were ready to pay high prices for the goods needed for the war effort. Those firms selling strategic war material even enjoyed a boom until the end of the war. Secondly, most farmers, especially those with large estates, enjoyed rising incomes thanks to high prices resulting from shrinking food imports and their strong political position.

On the other hand, the economy as a whole did not perform well in the second half of the war. Even many of the industrial companies that enjoyed high profits during the war boom of 1915/16 were confronted with import blockades and sales problems in the last two years of the war. And most importantly, the majority of the population suffered from supply shortfall and inflation that lowered their purchasing power as nominal wages were not adjusted rapidly enough. In 1918, social and political tensions resulted in demonstrations, local work stoppages and a general strike at the national level.

Swiss authorities were overwhelmed by the organisational and political complexities of the first industrial war in Europe. They expanded their role by introducing all sorts of regulations, raising new taxes and expanding social services but proved unable to prevent inflation and the uneven distribution of income. Moreover, the severe recession in the early 1920s that followed the restocking boom of 1919/20 caused high unemployment and further social unrest as the strong Swiss franc hampered exports. Again, Switzerland was not exceptional in this respect. As in the Netherlands and the Scandinavian countries, the monetary authorities were convinced that a return to the gold standard at the pre-war parity was both feasible and desirable. Not until 1922 did the Swiss real GDP surpass the level of 1913.

To provide a survey of how the Swiss economy weathered the First World War, this article proceeds in three steps. After the introduction, the second section presents the structure of the economy before the war and summarises the big changes between 1914 and 1925. The third section is devoted to the short-term changes and describes five distinct stages on the basis of trade, traffic, energy consumption and price data. The fourth section analyses the evolution of fiscal and monetary policy and their impact on income, money and prices. The article ends with a short conclusion.

Structure and Change↑

On the eve of the war, Switzerland was one of the wealthiest countries in Europe. New estimates suggest that in 1913 its GDP per capita was even the highest in the world.[3] This economic success was mainly the result of a competitive industrial sector. Several Swiss firms were leading global players in the textile, metal, electrical and machinery, food and chemical and pharmaceutical industries. Trade openness (import and exports as a share of GDP) amounted to 70 percent. The dominance of the industrial sector was reflected in the occupational structure. In 1910, 46 percent worked in the industrial sector, while the agricultural and the service sector employed 26 and 29 percent respectively. A second pillar of Switzerland’s economic success was the financial sector. In the early 20th century, it was established in the second tier of international financial geography and Swiss investment companies (Elektrobank, Motor Columbus) with key international investors played an important role in channelling foreign direct investments to major infrastructure projects around the globe. Thirdly, tourism was an important employer in the Alpine regions. For several decades before 1913, Switzerland’s success in exporting goods and services had resulted in a persistent current account surplus. Accordingly, Switzerland was among the countries with a particularly high share of net foreign assets per capita.

Switzerland’s strength in industrial exports was extraordinary in comparison with other small European nations, i.e. states that had between 2 and 6 million inhabitants, whereas large European countries like France, Germany, Great Britain and Italy counted between 35 and 65 million inhabitants. The Netherlands and the Scandinavian countries (Denmark, Norway and Sweden) mainly specialized in the exporting of processed domestic natural resources, i.e. agricultural goods, fish, iron ore and pig iron as well as wood, pulp and paper. In contrast, on the import side Switzerland was a typical small European country insofar as the two most important imported goods were coal and corn. Table 1 provides a survey of the most important export and import goods of the five small neutrals that would stay outside of the military conflict between 1914 and 1918.

| |

|

|

|

|

|

| Import | |

|

|

|

Iron and Steal |

| Export | |

|

|

|

|

Table 1: Most important import and export goods of small neutral states in 1913[4]

In 1913, Switzerland’s main trading partners were its larger neighbors as well as the UK and the US. Taken together, the future Allies including Italy bought 43 percent of total Swiss exports, the Central Powers 28 percent. This distribution did not change over the course of the war. Yet, as for imports, the war brought about a major shift. In 1913, imports both from Germany and Austria-Hungary and from the UK, France, Italy, and the US amounted to roughly 40 percent. By 1918, the share of the Central powers had shrunk to less than 30 percent, while the Allies (including Italy) provided almost 50 percent of imports.

In 1915, both the Central Powers and the Allies forced the Swiss authorities to allow two bodies to control imports and exports. The belligerents wanted to prevent their goods from ending up in the hands of the enemy. In June the Schweizerische Treuhandstelle für Überwachung des Warenverkehrs (STS), which regulated trade with the Central Powers, was founded and in October 1915 the Société Suisse de surveillance économique (SSS), which controlled exchanges with the Allies, began to operate. As the Allies systematically used economic warfare to weaken their enemies, the SSS became much bigger than the STS. In 1918, the central bureau in Berne employed more than 400 persons and almost a hundred more employees were stationed in London, Paris, Rome and Washington as well as on several Swiss border checkpoints. The companies importing goods from the Allies formed dozens of so-called syndicates which possessed an import monopoly.

Overall, the war had important distributional effects across the different sectors and social classes due to accelerating inflation and the increasing difficulty with importing energy and foodstuffs towards the end of the war. On the winning side was the agricultural sector, especially the large farms. Contemporary statistics by the Swiss Farmers’ Union shows that the income of large farms during the war more than doubled in real terms (relative to the average of 1908-1912).[5] The food shortage lead to price increases and a war-related boom and slowed down the structural change that had started in the late 19th century. As a result, the share of persons employed in the agricultural sector remained stable relative to 1910.

In other sectors, the performance of each branch was different, depending on foreign demand and proximity to the domestic war effort. However, even within the well performing branches profit was unevenly distributed. Accelerating inflation led to deteriorating real wages, as firms failed to adjust nominal wages to inflation fast enough. Only towards the end and immediately after the war, as social and political tensions grew and employers recognized the extent of deprivation, did real wages catch up. In the service sector, different branches showed various outcomes. The tourism sector suffered from enormous losses, while banks and insurances enjoyed stable revenues. In the post-war era, the banking sector entered a boom period, as political instability and high inflation in the neighbouring countries triggered several waves of capital flight towards Switzerland and other small financial centres such as Amsterdam or Brussels. The number of international bonds and shares quoted at the Zurich stock exchange increased rapidly over the course of the 1920s.

Estimates of the aggregate performance of the Swiss economy during the war and immediate post-war period diverge. According to Maddison (2006), both real GDP and GDP per capita declined by 11 percent between 1913 and 1918 and recovered to the pre-war level in 1920. According to Müller and Woitek (2012), the decline from 1913 to 1920 was similar, but the recovery after the war was subdued so that GDP per capita in 1920 was still 7 percent below the level of 1913.[6] Other small neutral countries experienced comparable changes. GDP and GDP per capita were the lowest in 1918, but recovered roughly to the pre-war level in 1920.

The Evolution of the Economy↑

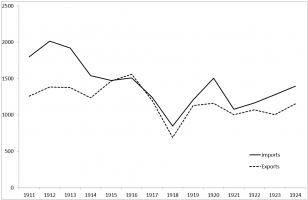

The evolution of the Swiss economy from the outbreak of the war to the end of the post-war depression in the early 1920s can be divided into five phases, in which the following categories were important: exports and imports, energy consumption, transport volumes, and inflation. The first phase covers the months from the outbreak of the war in the summer of 1914 to the spring of 1915. This period was characterised by a bank-run in early August, a partial blockade of foreign trade in the autumn of 1914 and a lack of labor in industry as many male citizens had to serve in the military both in Switzerland and in the neighboring countries. On the eve of the war, foreigners’ share in the industrial sector had amounted to nearly 25 percent.[7] The government was not prepared for a war longer than a few months and had not foreseen that Britain and France would use the instrument of economic blockade. In 1914 imports declined by almost 25 percent in real terms relative to 1913 and exports by 10 percent (see figure 1).[8]

In early 1915, the situation began to improve, marking the beginning of the second phase that lasted until the summer of 1916. Exports increased rapidly, while imports stopped declining. As a result, the trade balance became positive for the first time in the history since the foundation of the Swiss Confederation in 1848. The volume of goods transported by freight train within Switzerland augmented steeply and energy consumption stabilized. At the same time, however, inflation accelerated due to rising import prices and the increasing monetisation of government debt (see section below).

For large parts of the economy, the boom came to an end in the summer of 1916 when the Allies decided to tighten the economic blockade against Germany. Only firms exporting strategic war material continued to have high revenue until the end of the war.[9] Without them, the downturn of the aggregate economy would have been even more pronounced in 1917 and 1918. In this third phase, the Swiss economy began to shrink dramatically, as imports were hampered and foreign demand declined. In 1918 only half as much foodstuffs could be imported relative to 1916 and the import of raw materials declined by 30 percent relative to 1916. The volume transported by freight train and energy consumption shrank. Moreover, inflation further accelerated. From 1916 to 1918, the consumer price index increased from 134 to 204 (1914=100), reducing real wages, as nominal wages were not adapted to rising prices fast enough. The combination of shrinking food supply and rising prices heightened political tensions in the last months of the war. On 11 November 1918, when the armistice of Compiègne went into effect, labor unions and Social Democrats proclaimed a national strike, lasting three days and further poisoning the relations between management and labor.

The fourth phase covered the years from the end of the war to the beginning of the post-war crisis in the early 1920s. It was a time of recovery as war restrictions on trade were continuously abandoned. Both imports and exports increased in real terms. The Swiss population was supplied with sufficient foodstuff and the economy had access to much needed raw materials. Foreign trade did not reach the pre-war levels but a normalization process had been put in motion. Freight transport picked up while energy consumption stabilised. Prices continued to rise but the growth rate was decelerated. Between 1918 and 1920, the consumption price index rose from 202 to 224.

The fifth and final phase was marked by the severe post-war depression that began in the US and UK and then spread to Continental Europe. In 1921, the volume of foreign trade and domestic transport by freight train as well as energy consumption declined markedly. Furthermore, as the monetary authorities aimed at bringing the franc back to the pre-war parity against the US dollar, the demand shock resulted into a steep deflation. Between 1920 and 1922, the consumer price index declined by more than 25 percent. The combination of depression and deflation led employers to reduce the workforce and nominal wages but, as the fall of prices was faster, real wages increased. Recovery started in 1922 but the negative consequences of the crisis did not disappear until late 1923.

Fiscal and Monetary Policy↑

The war effort proved very costly for the public authorities, although Switzerland was not a theater of war. Between 1913 and 1918 total spending of the Confederation, the cantons and the communes increased from roughly 10 to 15 percent of GDP and, due to persistent fiscal deficits, total debt increased from 37 to 45 percent of GDP. The situation further deteriorated during the post-war crisis. In 1922, total spending approached 20 percent of GDP and the debt level reached 73 percent of GDP.[10] Throughout the war, federal spending related to the war was always above 50 percent of total expenditure. The peak was reached in 1917 when so-called mobilisation costs amounted to almost 300 million Swiss francs with total expenditure being 458 million Swiss francs.[11]

The deficits would have been much higher if the national government had not introduced new taxes. In 1913 the only relevant income source of the federal government was the revenue from tariffs. In 1918 the share of extraordinary direct taxes on income and fortunes amounted to 85 percent of total revenues. In the post-war period their importance declined, as new duties increased the revenue from tariffs but they did not disappear altogether. Furthermore, the growth of federal revenues led to a new composition of total public revenues in Switzerland. While in 1913 federal revenues amounted to 20 percent of total public revenues, its share increased to 34 percent in 1920. The war had increased the fiscal position of the federal government thanks to its central role in financing the mobilisation and the war economy.

The fiscal deficits were covered by bonds and short-term securities. As the short-term securities were to a large extent financed by the Swiss National Bank, the money supply doubled over the course of the war. As a result, the consumer price index between 1914 and 1918 increased by a hundred percent. After the war, the SNB began to reduce its holdings of short-term securities issued by the federal government but prices increased by another 10 percent between 1918 and 1920. In the depression of the early 1920s the monetary authorities, by hesitating to cut interest rates, contributed to the downturn and put pressure on the banking system. The restoration of the gold standard at the pre-war parity was the primary goal.

Switzerland’s fiscal and monetary policy was typical for the group of small neutral countries. The Netherlands and the Scandinavian countries took the same approach during and after the war. Consequently, all five small neutrals had to cope with inflation, social unrest, deflation and banking crises. They differed only with respect to the extent of inflation and of deflation, the severity of the banking crisis and the date when they restored the gold standard. Denmark and Norway had to cope with a more protracted path to the pre-war order, while the Netherlands, Sweden and Switzerland fared relatively well after the war.[12]

Conclusion↑

If we compare Switzerland with the belligerent countries and occupied states like Belgium, there can be no doubt that the former country was in a privileged position. Overall, the economy survived the war without any major losses. Some exporting industries even enjoyed a war boom in 1915/16 and in the middle run the financial sector flourished thanks to the post-war turbulences in neighboring countries. Real wages deteriorated during the war but caught up in the post-war period. When the world economy began to recover after the post-war depression of the early 1920s, the Swiss economy expanded rapidly.

Yet, despite of this relatively good performance, it would be wrong to downplay the economic and social costs of the war. Inflation, shortage of food and raw materials as well as rising public debts traumatized the country. The political clash at the end of the war taught the political elites of the nation that the government and the Swiss National Bank needed to do better in a future war. In this respect, the First World War was an important turning point in the economic history of Switzerland. In particular, it was highly relevant for how Switzerland prepared for the Second World War and how it organized its war economy.

Tobias Straumann, Universität Zürich

Section Editors: Roman Rossfeld; Daniel Marc Segesser

Notes

- ↑ Ochsenbein, Heinz: Die verlorene Wirtschaftsfreiheit 1914-1918. Methoden ausländischer Wirtschaftskontrollen über die Schweiz, Bern 1971; Ruoss, Eveline: Die Geldpolitik der Schweizerischen Nationalbank 1907-1929. Grundlagen, Ziele und Instrumente, Zürich 1992; Guex, Sébastien: La politique monétaire et financière de la Confédération suisse 1900-1920. Lausanne 1993; Rossfeld, Roman / Straumann, Tobias (eds.): Der vergessene Wirtschaftskrieg. Schweizer Unternehmen im Ersten Weltkrieg, Zürich 2008.

- ↑ Geering, Traugott: Handel und Industrie der Schweiz unter dem Einfluss des Weltkriegs, Basel 1928.

- ↑ Müller, Margrit/Woitek, Ulrich: Wohlstand, Wachstum und Konjunktur, in: Halbeisen, Patrick/Müller, Margrit/Veyrassat, Béatrice (eds.): Wirtschaftsgeschichte der Schweiz im 20. Jahrhundert, Basel 2012, pp. 91-222. The new estimates are made internationally comparable by Bolt, Jutta/van Zanden, Jan Luiten: The First Update of the Maddison Project, Re-Estimating Growth Before 1820, Maddison Project Working Paper 4, 2013.

- ↑ Rossfeld, Roman / Straumann, Tobias: Zwischen den Fronten oder an allen Fronten? Eine Einführung, in: Rossfeld, Roman / Straumann, Tobias (eds.): Der vergessene Wirtschaftskrieg. Schweizer Unternehmen im Ersten Weltkrieg, Zurich 2008, pp.11-59.

- ↑ See table in Baumann, Werner: Bauernstand und Bürgerblock. Ernst Laur und der Schweizerische Bauernverband 1897-1918, Zurich 1993, p. 303. For a concise survey see Moser, Peter: Mehr als eine Übergangszeit. Die Neuordnung der Ernährungsfrage während des Ersten Weltkriegs, in: Rossfeld, Roman/Buomberger, Thomas/Kury, Patrick (eds.): 14/18: Die Schweiz und der Grosse Krieg, Baden 2014, pp. 172-199.

- ↑ See Maddison, Angus: The world economy, Paris 2006; Bolt/van Zanden, The First Update of the Maddison Project 2013.

- ↑ Ritzmann-Blickenstorfer, Heiner / Siegenthaler, Hansjörg: Historische Statistik der Schweiz, Zurich 1996, tables F.2a, F.5, F.6.

- ↑ Geering, Handel und Industrie der Schweiz 1928, pp. 22, 43 and 57.

- ↑ Rossfeld, Roman: “Abgedrehte Kupferwaren”. Kriegsmaterialexporte der schweizerischen Uhren-, Metall- und Maschinenindustrie im Ersten Weltkrieg, in: Jahrbuch für Wirtschaftsgeschichte, 2 (2015) [forthcoming].

- ↑ Guex, Sébastien: Öffentliche Finanzen und Finanzpolitik. In: Halbeisen/Müller/Veyrassat (eds.), Wirtschaftsgeschichte der Schweiz im 20. Jahrhundert 2012, pp. 1077-1129.

- ↑ Schär, Arnold: Aufwand- und Deckungsgrundsätze im schweizerischen Bundeshaushalt insbesondere in der Kriegs- und Nachkriegszeit, Basel 1930.

- ↑ Straumann, Tobias: Fixed Ideas of Money. Small States and Exchange Rate Regimes in Twentieth-Century Europe, Cambridge and New York 2010, pp. 61-93.

Selected Bibliography

- Baumann, Werner: Bauernstand und Bürgerblock. Ernst Laur und der Schweizerische Bauernverband, 1897-1918, Zurich 1993: Orell Füssli.

- Fahrni, Dieter: Die Nachkriegskrise von 1920-1923 in der Schweiz und ihre Bekämpfung, Basel 1977: Universität Basel.

- Geering, Traugott: Handel und Industrie der Schweiz unter dem Einfluss des Weltkriegs, Basel 1928: Benno Schwabe & Co.

- Guex, Sébastien: La politique monétaire et financière de la Confédération suisse, 1900-1920, Lausanne 1993: Payot.

- Halbeisen, Patrick / Müller, Margrit / Veyrassat, Béatrice (eds.): Wirtschaftsgeschichte der Schweiz im 20. Jahrhundert, Basel 2012: Schwabe.

- Kreis, Georg: Insel der unsicheren Geborgenheit. Die Schweiz in den Kriegsjahren 1914-1918, Zurich 2014: Verlag Neue Zürcher Zeitung.

- Moser, Peter: Mehr als eine Übergangszeit. Die Neuordnung der Ernährungsfrage während des Ersten Weltkrieges, in: Rossfeld, Roman / Buomberger, Thomas / Kury, Patrick (eds.): 14/18. Die Schweiz und der Grosse Krieg, Baden 2014: hier + jetzt, pp. 172–199.

- Ochsenbein, Heinz: Die verlorene Wirtschaftsfreiheit 1914-1918, Bern 1971: Stämpfli.

- Rossfeld, Roman: Zwischen den Fronten oder an allen Fronten? Eine Einführung, in: Straumann, Tobias / Rossfeld, Roman (eds.): Der vergessene Wirtschaftskrieg. Schweizer Unternehmen im Ersten Weltkrieg, Zurich 2008: Chronos, pp. 11-59.

- Rossfeld, Roman: 'Abgedrehte Kupferwaren'. Kriegsmaterialexporte der schweizerischen Uhren-, Metall- und Maschinenindustrie im Ersten Weltkrieg, in: Jahrbuch für Wirtschaftsgeschichte / Economic History Yearbook 56/2, 2015, pp. 515–552.

- Ruoss, Eveline: Die Geldpolitik der Schweizerischen Nationalbank 1907-1929. Grundlagen, Ziele und Instrumente, Zurich 1992: Universität Zürich.

- Straumann, Tobias: Fixed ideas of money. Small states and exchange rate regimes in twentieth-century Europe, New York 2010: Cambridge University Press.