Introduction↑

Many of the challenges of New Zealand’s post-war economy arose out of wartime developments. The war unsettled economic patterns and relationships and triggered a short-lived boom and then a depression in the early 1920s. The fate of New Zealand’s returned soldiers has often been framed around the economic depression of the 1930s, and was captured fictionally in John Mulgan’s (1911-1945) widely read novel Man Alone (1939). But issues of compensating soldiers and their families for what they had undergone in wartime were much more prominent in the period 1919-1924.

In the mid to late 1920s, economic conditions were more settled, returned soldier issues were less salient, and the returned soldiers’ association (RSA) itself was nearly moribund. The massive worldwide depression of the early 1930s was seen at the time as a product, if delayed, of wartime disruption. Certainly it brought returned soldier issues back into public consideration, but in the context of widespread economic and social distress, focus was not just confined to soldiers and their families. The depression was its own "force field" and it is of limited value to cast general developments in those years as "post-war."

The Post-war Boom↑

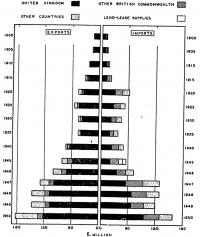

“The moving picture houses are crowded, and the race meetings have never been better attended”, reported one newspaper in November 1920.[1] The first two post-war years saw boom times. Export prices remained at the high levels characteristic of the war years; the bulk of New Zealand’s exports continued to be commandeered by the British government – in the case of meat and wool into 1920 and in the case of butter and cheese up until March 1921.[2]

Imports had risen from £24 million in 1918/19 to over £30 million in 1918/19; and soared to £61.1 million in 1920 (a level in real terms that was not to be exceeded until 1937). The rise was in quantity as well as price – importers had been duplicating their orders when shipping was unreliable, now “a hitherto eager market was hopelessly sated. Merchants facing a heavy loss had difficulty in finding credit to lift their consignments. At the waterside, bonded stores were full of unclaimed goods....”[3] The banks charged more for London funds to discourage the demand – in mid-1920 the rate was 50 Shillings per £100 (i.e. 2.5 percent), "a figure which it had not reached for something like 30 years"; some weeks later it was increased to 60 Shillings (3 percent) at which level it stayed until August 1921.[4]

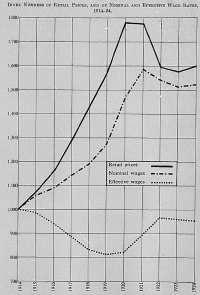

But prices rose too and were a bugbear for wage earners and housewives. "It would be futile", said Prime Minister W. F. Massey (1856-1925) in his 1920 budget (he was minister of finance as well as prime minister that year) "to attempt to review the whole of the causes of the increased cost of living, which constitute a world-wide problem."[5] Food prices stabilized in 1919 but rose sharply in 1920. With the exception of Wellington, where some reduction in government war-related jobs may have occurred, rents also rose from 1919 – an 11 percent increase between 1919 and 1921. This was worse than during the war.[6] Tenants were on the move and landlords were allowed to raise the rent on vacated properties, and the government also loosened rent control regulations in 1920.[7] Some bought instead of renting: in the four main centres, mortgaged properties rose from 24.35 percent of the total in 1916 to 36.02 percent in 1921; whilst rented properties fell from 58.3 percent to 46.4 percent.[8]

Industrial disputes were common in the immediate post-war years, in part a reflection of prices outpacing wages. Effective wages fell sharply from the end of the war up to 1921 and this measure of "effective" did not take into account rent increases – the fall would have been even greater if that had been taken into account.[9] Moreover, many during the war had worked extremely long hours and not taken leave, on the understanding that it was for the national good. When peacetime did not bring redress, pent-up anger erupted. There were thirty-two industrial disputes in 1919 and seventy in 1920.

In September 1919, coalminers observed a "go slow" when mine owners refused to accept their terms; normal work was not resumed until March 1920, after Massey had intervened.[10] In 1920, nearly 10,000 workers were involved in disputes, notably on the waterfront, in freezing works and in coalmines.[11]

Conservative interests were anxious. James Allen (1855-1942), the Minister of Finance in 1919, was convinced that "there is no subject which demands more earnest consideration...than the problem of industrial unrest." He cited a report from 1918 that called for the establishment of a national industrial council – a kind of "trade parliament", comprising employer and employee representatives, modelled on recommendations made to the British government.[12] There was talk of mine nationalization or state oversight of privately owned mines.[13] A year later, when introducing the 1920 budget, Massey spoke in similar but far less specific terms – both employers and workmen had "yet to learn that without mutual confidence and cooperation there can be neither satisfaction nor prosperity."[14]

A parliamentary industries committee, which had reported in 1919, believed:

A 1919 housing act aimed to increase the housing stock by the government or other authorities with public loan money, an expansion of a pre-war regime.[16] But at the census taken in March 1921, 14.9 percent of the population were living in overcrowded conditions. Wellington and Auckland were the worst off of the four main centres.[17]

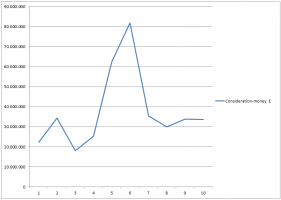

If the towns were turbulent, so also were country districts, but for different reasons. Land prices rose and a great deal of land was traded. In 1920/1921, 55,746 land transfers took place, worth in total £81.8 million, compared with 22,500 in 1918/1919 worth just over £25 million.[18] The financing provided to soldier settlers (see below) contributed: "In effect the government turned loose in the real estate market 22,585 new purchasers armed with £22,627,584 of borrowed money."[19]

The Post-war Bust↑

Trading conditions deteriorated in the 1920/1921 production season (July 1920 to June 1921) and did not recover for eighteen months (i.e. late in 1922). The major falls in commodity prices came when the wartime commandeers ended. Wool fell first, followed by meat and the dairy produce. "The recorded total of exports in 1921 would have been four and three-quarter millions greater had average prices of exports remained as in 1920."[20] The land bubble burst: the number of mortgages registered fell from £60.1 million in 1920/21 to £26 million in 1922/23 (after which the total started to rise again).[21] Banks increased overdraft interest rates to counter the contraction in deposits and rise in advances (lending).[22] Bankruptcies increased from 144 in 1920 to 336 in 1921 and nearly 700 in each of the next three years.[23]

Food prices eased in 1921 but rent did not; nor did fuel and lighting. On the other hand, effective wages, even only taking food prices into account, rose because prices fell faster than wages – the relevant index was well below 900 in 1920 but over 1,100 in 1922 (the highest for any year recorded since 1909).[24]

In advance of that trend setting in, industrial unrest stayed at levels comparable to 1920. Waterfront disputes in Auckland and Wellington in February and March 1921 were the most prominent; both were settled only after intervention from the prime minister. The total cost in lost wages from the two disputes, which between them involved 3,500 men, was estimated at £40,000 ($NZ3.21 million in 2014). Moreover, the Wellington dispute was a lockout, not a strike, something that had not been seen since before the war.[25] Other unionised workers saw cost of living bonuses that had been awarded since 1919 reduced. Early in 1922 the government cut its own spending, including the wages of public servants, to save money.[26] War indebtedness had caught up with the government: out of £28.4 million of spending, £8.5 million was allocated to paying interest on loans in a year when revenue was £6.1 million below that of the year before (£28.1 million compared with £34.3 million).[27]

The much weaker labour market, and possibly the rise in effective wages, limited protests.[28] For the workforce, the burden of the depression was borne particularly by the unemployed. The 1921 census – taken in March of that year, early on in the depression – returned 11,061 male and 2,154 female wage workers unemployed, amounting to 3.56 percent of the wage-earning population compared with 2.34 percent in 1916.[29] The fall in produce prices and cutbacks in spending had "resulted in unemployment of a considerable number of persons" explained the government when Parliament opened in September 1921 and to that end "expenditure on special works employing labour has been undertaken by government and by local authorities."[30] It was at times a very "hands-on" approach. Acting Prime Minister (and Hutt Valley resident) Francis Henry Dillon Bell (1851-1936) met the mayors of Petone and Lower Hutt in September 1921 to discuss what was to be done about fifty unemployed men in the Hutt Valley.[31] Through 1922, the approximately £1,580 spent daily on public works in the Auckland urban area employed more than 1,000 men.[32] The £192,500 charities spent on poverty relief in 1921/1922 was not exceeded until 1926/1927.[33]

Labour MP Peter Fraser (1884-1950) unsuccessfully introduced an unemployed workers bill into Parliament in October 1921 (the first of eight such bills up to and including 1929). He pointed out that unemployment insurance had been introduced into the United Kingdom in 1911, at which time both Ward and Massey had talked of introducing such a measure in New Zealand. The British scheme had been expanded in 1920,[34] but an unemployment act in New Zealand was only to be passed in 1930.

Compensation↑

It was against this backdrop of boom and bust that returned soldiers and their families had to find a place in post-war New Zealand. A repatriation department was established in 1918 "to help every discharged soldier requiring assistance to secure for himself a position in the community at least as good as that relinquished by him when he joined the colours."[35] The government refused for some time to embark on an immigration policy despite requests from the British government, "until our own soldiers have been provided for."[36]

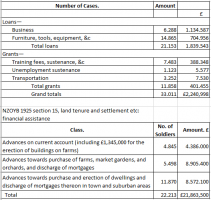

Of the 80,000 returned soldiers, the government had assisted 18,000 into work by mid-1920; 4,000 had been found general labouring jobs and another 2,500 farm work.[37] As of March 1922, the government had lent £3.9 million to just over 4,800 returned soldiers to lease crown land suited for farming and lent £8.77 million to another 5,442 to buy privately owned land. The government also spent nearly £6.5 million buying more land for soldier settlement.[38]

In later times, soldier settlement has often been seen as primarily a matter of putting men on the land. But the government also lent £7.5 million to another 10,789 returned soldiers to buy or build houses in towns.[39]

Some soldier settlers got into trouble because they were not suited for farming, whilst other difficulties were financial. Many faced repayment charges on their loans, often contracted at the height of the boom, which could not be readily serviced when prices fell. In 1924, the Lands Department considered that out of 4,845 soldier farms on Crown land, 201 (4.1 percent) had been surrendered and 324 (6.7 percent) had been forfeited, while 610 (11.1 percent) of the 5,498 section two farms (those established on land that had been privately, not Crown-owned) had been abandoned.[40] The financial difficulties faced by many soldier settler farmers prompted the government to set up inquiry boards, which were incorporated into a nationwide revaluation a year later.[41] It was not only a soldier settler problem.[42] But it was more acute for soldier settlers than other Crown leaseholders – only seven non-soldier leases were revalued in 1921/1922 and sixteen in 1922/1923. Forfeitures and surrenders of ordinary Crown leaseholds were also relatively modest.[43]

Soldier settler failures were more numerous in the Wellington and Auckland land districts than in the South Island, where the land was more developed.[44] Much of the North Island was still in the process of being broken in, not something many returned servicemen were equipped to do. The Auckland district lands board emphasized that in a "great majority of the cases failure has been due in a very considerable degree to impaired physical or mental vitality as the result of war service which has rendered it impossible for the settlers to overcome difficulties" arising from a lack of farming experience.[45]

Pensions were another important part of compensation. The government focused on restoring men to their pre-war circumstances and avoiding "dependence" – war pensions were intended to compensate for lost earning power rather than approximating regular wages. War pensions expanded state welfare. In 1920, war pensions accounted for 65.5 percent of all pension payments – the government spent over £1.87 million on soldiers and their dependents compared with a total pension of £630,000 in 1916 (and a total £2.85 million in 1920, amounting to about 10 percent of total government spending).

The government considered its assistance generous – the RSA and many individual soldiers did not always agree. One episode of disruption took place September 1919 when a deputation from the Wellington RSA backed by 2,500 marchers lobbied the government for larger gratuities.[46]

A more sustained campaign sought big increases for soldiers classed as having a more than 50 percent disability, widows with children and dependent widowed mothers. A commission that investigated the matter in 1922 recommended a supplementary "economic" pension, in effect acknowledging the economic as well as the compensatory facet of a war pension.[47] The economic pension was defined as "a supplementary pension granted on economic grounds, and being in addition to any pension payable as a right in respect of the death or disablement of a member of the Force."[48] On 31 March 1924, the average war pension was £52, paid to 23,166 individuals, of whom 14,400 were returned soldiers (the others were dependants); 2,267 economic pensions were in force (of which 1,917 were paid to soldiers), amounting to a total annual value of £132,288.[49]

Compensation was also an international issue. At the Paris Peace Conference in 1919, £26 million had been allocated to New Zealand as its share of German reparations.[50] Modest sums of money were received in subsequent years, for example £186,000 in 1925/1926 to a total of £1.75 million by 1929.[51]

The New Zealand government confiscated German holdings in Samoa. The profits – £156,000 had been remitted to New Zealand as of late 1919 – were treated as war reparations.[52] The formerly German island of Nauru, a joint Australian-New Zealand-British possession, formally under the League of Nations, was a source of cheap phosphate, used to fertilize New Zealand and Australian pastures.[53]

Restoration, Development and Compensation↑

Apart from boom and bust, repatriation and compensation, another part of the economic scene was the drive to restore pre-war conditions. Should tax rates return to pre-war levels? 60 percent of income tax was paid by companies in 1920/1921.[54] Business interests lobbied for reduction and the government responded. Lower income tax rates halved the income tax revenue between 1921/22 (£6 million) and 1922/23 (£3 million). Customs again became the most significant source of taxation, accounting for 53.3 percent in 1925/25 compared with 29.7 percent in 1918/19.[55]

The drive for tax reductions overlapped with an "efficiency" campaign that gathered momentum through the 1920s. It took a different direction from the wartime preoccupation with efficiency, focused on manpower issues.[56] It sought both to place government enterprise on a business-like basis and – sometimes the two impulses were in contradiction with each other – to do away with the special status enjoyed by some government enterprises, for instance government rail as compared to private road transport.[57]

A mortgage moratorium imposed in 1914, intended primarily to protect farm mortgagors, was renewed annually until 1924; even at that date dairy interests wanted to prolong it.[58] But to financial interests it interfered with "freedom of contract" and – an appeal to farmer self-interest – discouraged new investment in farm mortgages.[59] With the end of the moratorium, farmer interests lobbied for new financial institutions – cheaper credit became a farmer slogan, though critics thought the problem was too much credit, not too little.

Another line of endeavour by farmer groups was to gain control over their produce beyond New Zealand, an attempt, that is, to replicate some of the advantages of the wartime commandeer. The government set up a meat producers’ board at the beginning of 1922; its main efforts were directed towards regularizing shipments of frozen meat to the British market to avoid gluts, shortages and commodity speculation.[60] Different forms of ownership in the dairy industry – co-operatives and private companies – meant division; co-operatives were keener on export control than the private companies. The Dairy Produce Export Control Board, set up late in 1923, came into force only once a majority of producers had endorsed the plan.[61]

An enthusiasm for hydro-electricity would have persisted even without the incentive of wartime fuel shortages:

Major hydroelectric projects – Waikaremoana, Mangahao, Waitaki and Arapuni – were a feature of the 1920s. The 1918 Electric Power Boards Act made it easier for rural areas to get electricity: before the 1920s, electricity was mostly reticulated to towns and cities but the boards, which could be set up in any local area, could borrow money to expand electricity supply in their districts.[63]

Economic conditions were more stable through the mid to late 1920s. 1924 and 1925 were good years, though 1926 and 1927 less so, and unemployment returned. 1928 and 1929 were better again, but unemployment persisted through the winter months. In these years, wartime assistance to returned soldiers segued into a return to state-sponsored lending and development for the civilian population, much as had thrived before the war. Whereas from the end of the war to 1923 most state lending for housing and land settlement was to returned soldiers, thereafter it took in all settlers and workers.[64]

By March 1928, when it had completed its work, the Dominion revaluation board had dealt with more than 5,000 applications, reduced the capital value of soldier settler farm land by £2.678 million (around 20 percent of the value of the land which it investigated) and remitted around £800,000 arrears of interest. It also negotiated reductions in private mortgages, but on a much smaller scale.[65] This compared with the £27.1 million the government had invested in soldier settlement between 1917 and 1926 by way of grant or loan.[66]

The scale of war and economic pensions triggered a more general debate about social services in the late 1920s, but about the fiscal burden rather than the precedent they set for compensating for others in disadvantaged circumstances. In particular officials canvassed contributory schemes – in New Zealand, as in Australia, but not in most of Europe, social services were funded from direct taxation, not on a contributory basis.[67] The new departures – a pension for the blind, introduced in 1925, and a family allowance, introduced in 1927, were modest, whilst from 1928 the problem of providing for the unemployed overshadowed broader issues. The focus on placing soldiers on farms also evolved into debate about "urban drift" and the relative contribution of country and town to the New Zealand economy, but it was sidelined by the great depression.[68]

The Depression of the 1930s↑

The economic depression of the early 1930s was an unprecedentedly severe event that reversed many of the upward trends of the later 1920s. Farmers were again hit by falling prices and in towns and cities unemployment rose to unprecedented levels. The whole story of the depression does not belong in a discussion of the post-war economy but one effect of it was to return the circumstances of returned soldiers and their families to prominence.

Through the late 1920s, the RSA had remained unhappy with the way the economic pension operated, making unfavourable comparisons with economic rehabilitation in France, the United Kingdom and Germany.[69] The Barton commission, which reported in January 1930, was sympathetic; it noted inter alia the disincentive to rehabilitation that any income earned having to be repaid; that police were known to make enquiries to employers that discouraged the employers from keeping veterans on.[70] It recommended a separate administration for economic pensions but implementation was sidelined by the government’s drive for financial stringency.

The government matched one "loss" and one gain on the international compensation front. In 1931 Germany suspended reparation payments; in turn, New Zealand took advantage of the US Hoover moratorium of the same year to suspend its war debt payments to the United Kingdom.[71] Although these arrangements were temporary, neither reparation payments nor war debt payments were resumed by Germany, New Zealand or by most other countries.

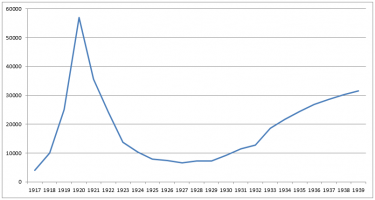

The RSA picked up some of the burden of returned soldier distress. Total RSA financial membership had fallen to a low of 7,000 in 1927 (from 57,000 in 1920) – the organization faced extinction. The return of unemployment and then mass unemployment changed that. RSA membership rose to nearly 13,000 in 1932 and 21,000 in 1934, as returned soldiers turned to the association for help.[72] In the Auckland office of the RSA in the last two months of 1930, 4,000 returned soldiers had called, 900 had personal interviews, 400 letters were written and twenty-eight sittings of the pensions appeal board had been held.[73] Walter S. Leadley, prominent in veteran affairs in Christchurch, cited 800 registered unemployed returned soldiers in that city in early 1932 and by extrapolation 8,000 in the country as a whole (out of a total estimated adult male unemployed at that time of around 50,000).[74] Conditions varied around the country – one Auckland RSA branch estimated 80 percent of its membership was unemployed but for some country RSA branches, the unemployed were not such a focus.[75]

The recovery of the economy in the late 1930s helped returned soldiers as well as other New Zealanders. Nonetheless many soldier settlers, particularly in more difficult parts of the North Island, applied for mortgage relief under the law passed by the new Labour government in 1936.[76]

Conclusion↑

Economic conditions in New Zealand were more unstable in the fifteen years after the First World War than they had been in the generation before. It was in the first post-war years 1919-1924 that the government paid most attention to and spent most money on returned soldiers. In the late 1920s, the economy was more stable and it seemed that most returned soldiers had been assimilated into ordinary life. The economic depression of the early 1930s created difficulties for many returned soldiers and their families but they shared the distress – and the subsequent recovery – with much broader segments of the population than had been the case in the early post-war years.

Malcolm McKinnon, Victoria University of Wellington

Section Editor: Kate Hunter

Notes

- ↑ Auckland Star, 30 November 1920, cited in: George, Dennis J.: The Depression of 1921-22 in New Zealand, MA thesis, University of Auckland 1969, p. 9.

- ↑ New Zealand Official Yearbook (NZOYB) 1923, Section XI.–External trade, Subsection E.–Imperial government supplies.

- ↑ Appendix to the Journals of the House Of Representatives (AJHR) 1920, B6, p. xxiii; NZOYB 1923, Section XI.–External trade, Subsection C–Imports; quote from Burdon, R. M.: The New Dominion. A Social and Political History of New Zealand between the Wars, Wellington 1965, p. 40.

- ↑ Auckland Star, 17 June 1921, reporting Harold Beauchamp, chair of the Bank of New Zealand; Auckland Star, 23 August 1921.

- ↑ AJHR 1920, B6, p. xxii.

- ↑ NZOYB 1923, Section XXXII.–Prices; Everton, Alan John: New Zealand Government Intervention in the Economy in the First World War. Its Aims And Effectiveness, MA thesis, Victoria University of Wellington 1995, pp. 342f.

- ↑ Everton, New Zealand 1995, p. 347; see also NZOYB 1923, Section XXXII.–Prices; see also 1926 census for statistics on overcrowding for 1916 and 1921. Overcrowding had increased between 1911 and 1916 (Everton, New Zealand 1995, p. 309, table 11.1).

- ↑ Everton, New Zealand 1995, p. 341 citing census statistics; see also Census of Population and Dwellings 1926, vol. 13, p. 6.

- ↑ NZOYB 1925, Section XXXIV.–Wages notes that the prices which were taken into account in computing the effective wages were food prices only owing to the lack of historical data for rents, fuel and lighting.

- ↑ AJHR 1920, H11, p. 4. The fall in domestic coal output led to the government importing coal from South Africa and Australia. See AJHR 1920, B6, p. xxiii.

- ↑ NZOYB 1923, Section XXXIV.–Industrial disputes; AJHR 1921, H11, p. 57.

- ↑ AJHR 1919, B6, pp. xvii-xviii.

- ↑ Burdon, New Dominion 1965, pp. 29f; AJHR 1919, H44A, passim.

- ↑ AJHR 1920, B6, p. xxi (financial statement from 27 July 1920).

- ↑ AJHR 1919, I-12, p. xxxiv.

- ↑ Ferguson, Gael: Building the New Zealand Dream, Palmerston North 1994, pp. 71-83 on the variety of inquiries related to housing problems in New Zealand in 1919; NZOYB 1923, Section XXIII.–State aid to settlers, workers, etc.

- ↑ Census of population and dwellings 1921.

- ↑ AJHR 1939, sic B4, p. 3; NZOYB 1923, Section XV.–Land tenure, settlement, etc., Subsection A.–General.

- ↑ Condliffe, J.B.: New Zealand in the Making, London 1930, p. 254.

- ↑ NZOYB 1923, Section XI.–External trade, Subsection B.–Exports shows the effect of prices on New Zealand exports.

- ↑ NZOYB 1925, Section XXX.–Mortgages. There is some duplication because the same mortgage could be registered in more than one district, but that would be true in both years.

- ↑ Auckland Star, 21 January 1921; Burdon, New Dominion 1965, p. 44.

- ↑ NZOYB 1926, Section XXXI.-Bankruptcy.

- ↑ NZOYB 1923, Section XXXII.-Prices, Section XXXIII.-Wages.

- ↑ NZOYB 1923, Section XXXIV.–Industrial disputes. Wellington was not specifically identified but the yearbook doesn’t call it a strike, whereas it does so label the Auckland dispute.

- ↑ McKinnon, Malcolm: Treasury. The New Zealand Treasury 1840-2000, Auckland 2003, pp. 86f.

- ↑ AJHR 1922, B6, pp. i-ii.

- ↑ Burdon, New Dominion 1965, pp. 46f.

- ↑ Census of population and dwellings 1916, 1921.

- ↑ New Zealand Parliamentary Debate 191, p. [2] (21 September 1921); p. 65 (28 September 1921).

- ↑ Evening Post, 6 September 1921.

- ↑ George, Depression 1969, p. 140, citing Auckland Star, 11 November 1922.

- ↑ George, Depression 1969, p. 186.

- ↑ See for example New Zealand Parliamentary Debate 209, p. 921 (21 July 1926).

- ↑ NZOYB 1920, Section XXX.-Repatriation of discharged soldiers.

- ↑ AJHR 1919, B6, p. xx.

- ↑ NZOYB 1920, Section XXX.–Repatriation of discharged soldiers.

- ↑ AJHR 1924, C9, p. 6.

- ↑ AJHR 1922, C9, p. 2.

- ↑ Roche, Michael: Failure Deconstructed. Histories and Geographies of Soldier Settlement in New Zealand circa 1917–39, in: New Zealand Geographer 64 (2008), pp. 46-56, p. 49 citing Under Secretary to Minister of Lands, n.d., LS 36/24.

- ↑ AJHR 1923, C9, p. 6; AJHR 1924, C9, pp. 13ff.

- ↑ AJHR 1922, C1, p. 2: "In many cases where private lands had been disposed of during the preceding two or three years at high prices, including heavy mortgages to the vendors, the purchasers were unable to make ends meet and had to relinquish the holdings, which came back into the hands of the mortgagees or previous owners."

- ↑ AJHR 1922, C1, p. 4; AJHR 1923, C1, p. 5.

- ↑ Roche, Failure 2008, p. 47; Parsons, Gwen: 'The Many Derelicts of The War'? Great War Veterans and Repatriation in Dunedin and Ashburton, 1918 to 1928, PhD thesis, University of Otago 2008, pp. 160ff.

- ↑ Roche, Failure 2008, p. 50, citing AJHR 1923, C9A, p. 45.

- ↑ Quick March, 10 Oct 1919, pp. 21ff.

- ↑ AJHR 1923, H28, p. 5.

- ↑ NZOYB 1925, Section XXIII.-Pensions, superannuation etc; AJHR 1923, H28, pp. 7ff.

- ↑ AJHR 1924, H18, p. 3.

- ↑ AJHR 1921, B6, p. x; AJHR 1922, B6, p. xxxvi. None had been received.

- ↑ AJHR 1926, B6, p. 4.

- ↑ AJHR 1919, B6, p. xxviii.

- ↑ Eldred-Grigg, Stevan: The Great Wrong War. New Zealand Society in WW1, Auckland 2010, pp. 424f.

- ↑ NZOYB 1923, Section XXII.–Public finance, Subsection B.–Taxation.

- ↑ AJHR 1925, B6, pp. 24f; NZOYB 1927, Section XXIII.–Public finance, Subsection B.–Taxation.

- ↑ Martin, John E.: Blueprint for the future? ‘National efficiency’ and the First World War, in: McGibbon, Ian / Crawford, John (eds.): New Zealand’s Great War. New Zealand, the Allies and the First World War, Auckland 2007, pp. 520-33.

- ↑ McKinnon, Malcolm: Treasury. The New Zealand Treasury 1840-2000, Auckland 2003, pp. 90-93; Evening Post, 23 March 1926, 31 October 1926, 1 November 1927.

- ↑ Auckland Star, 2 July 1924.

- ↑ Hunt, W.D., in: Evening Post, 1 August 1923.

- ↑ Condliffe, New Zealand 1930, pp. 266f.

- ↑ Burdon, New Dominion 1965, p. 56 reports 22,000 voted for and 9,000 against; see also AJHR 1923, I-10A.

- ↑ AJHR 1919, I-12, p. iii; see also Martin, John E. (ed.): People, Politics and Power Stations. Electric Power Generation in New Zealand 1880-1998, Wellington 1998, pp. 68-72.

- ↑ Martin, People 1998, pp. 70ff.

- ↑ AJHR 1922, B6, pp. xv, xxxiii; AJHR 1925, B6, pp. 11f, 14f.

- ↑ AJHR 1928, C9, p. 3; see also Condliffe, New Zealand 1930, p. 255.

- ↑ AJHR 1926, C9, p. 8.

- ↑ McClure, Margaret: A Civilized Community. A History Of Social Security in New Zealand, 1898-1998, Auckland 1998, pp. 45f.

- ↑ Auckland Star, 29 November 1928.

- ↑ Uttley, Stephen: The Development of New Zealand War Pensions Policy, in: British Journal of New Zealand Studies 7 (1994), pp. 33-48, p. 35.

- ↑ See also RSA Review, November 1929, February 1930

- ↑ AJHR 1931, B6, pp. 22f.

- ↑ Webber, N. P.: The First Fifty Years of the New Zealand Returned Services Association, 1916-1966, Wellington 1966, p. 6.

- ↑ Hanan, P. S. (ed.): Lest We Forget. The History of Morrinsville’s RSA from 1916 to 2004. The Journey From A Soldier’s Club to the Morrinsville District Memorial Returned Services Association Inc., Morrinsville 2005, p. 9.

- ↑ NZRSA Review, February 1932, p. 3. The NZRSA Review is the official organ of the New Zealand Returned Soldiers’ Association.

- ↑ NZRSA Review, May 1933, pp. 17-31.

- ↑ AJHR 1936, C9, pp. 5f. The published reports after this date are uninformative.

Selected Bibliography

- Burdon, R. M.: The new dominion. A social and political history of New Zealand, 1918-39, Wellington 1965: Reed.

- Condliffe, John Bell: New Zealand in the making. A survey of economic and social development, London 1930: Allen & Unwin.

- Eldred-Grigg, Stevan: The great wrong war, Auckland 2010: Random House.

- Everton, Alan John: New Zealand government intervention in the economy in the First World War. Its aims and effectiveness, thesis, Victoria 1995: Victoria University of Wellington.

- Ferguson, Gael: Building the New Zealand dream, Palmerston North 1994: Dunmore Press; Historical Branch, Dept. of Internal Affairs.

- George, Dennis J.: The depression of 1921-22 in New Zealand, thesis, Auckland 1969: University of Auckland.

- Hanan, P. S. / Harper, Felicity: Lest we forget. The history of Morrinsville's RSA from 1916 to 2004. The journey from a soldiers' club to the Morrinsville District Memorial Returned Services Association Inc., Morrinsville 2005: Morrinsville District Memorial Returned Services Association.

- Martin, John E.: Blueprint for the future? 'National efficiency' and the First World War, in: Crawford, John / McGibbon, Ian C. (eds.): New Zealand's Great War. New Zealand, the Allies, and the First World War, Auckland 2007: Exisle Publishing, pp. 516-533.

- Martin, John E. (ed.): People, politics, and power stations. Electric power generation in New Zealand, 1880-1998, Wellington 1998: Electricity Corp. of New Zealand; Historical Branch, Dept. of Internal Affairs.

- McClure, Margaret: A civilised community. A history of social security in New Zealand, 1898-1998, Auckland 1998: Auckland University Press; Historical Branch, Dept. of Internal Affairs.

- McKinnon, Malcolm: Treasury. The New Zealand treasury, 1840-2000, Auckland 2003: Auckland University Press.

- Nolan, Melanie: 'Keeping New Zealand home fires burning'. Gender, welfare and the First World War, in: Crawford, John / McGibbon, Ian C. (eds.): New Zealand's Great War. New Zealand, the Allies, and the First World War, Auckland 2007: Exisle Publishing, pp. 493-515.

- Parsons, Gwen A.: 'The many derelicts of the War'? Great War veterans and repatriation in Dunedin and Ashburton, 1918 to 1928, thesis, Dunedin 2008: University of Otago.

- Roche, Michael: Failure deconstructed. Histories and geographies of soldier settlement in New Zealand circa 1917–39, in: New Zealand Geographer 64/1, 2008, pp. 46-56.

- Uttley, Stephen: The development of New Zealand war pensions policy, in: British Journal of New Zealand Studies 7, 1994, pp. 33-48.

- Webber, N. P.: The first fifty years of the New Zealand Returned Services association, 1916 to 1966, Wellington 1967: Hutcheson Bowman & Stewart.