Introduction↑

“We are the centre of all things” remarked the banker Sir Felix Schuster (1854-1936) in 1912.[1] Historians have agreed. While Britain’s industrial supremacy had been eclipsed by the time war came in 1914, dominance of the global financial order remained. Its financial heart, the City of London, ensured that international trade pulsed steadily. Britain was the world’s largest exporter of capital, while its earnings from invisible services such as shipping and insurance were unmatched. The gold standard, to which Britain was committed, was an integral component of British hegemony.[2] This state of affairs, so beneficial to British power, was jeopardized by war in 1914.

This was so because of a paradox: Britain’s financial strength inspired confidence that the funds required to pay for the war would be forthcoming. At home this proved to be true, for while there was debate regarding how to garner the required revenues, and at times the Treasury and the Bank of England worried, the money was found. Abroad, Britain’s principal European allies in the wartime coalition – France and Russia from the outbreak of war, Italy from 1915 – were to a greater or lesser degree unable to pay for their purchases. Britain’s allies expected London to aid them financially. This situation, coupled with two other considerations, pressed British financial capacity to the limit. The first was the unexpected scale and duration of the conflict. Expenditure outpaced even the grimmest pre-war prognostications. The second was that successive ministries deemed preserving British financial hegemony a key war aim. The imperative to retain it inexorably ratcheted up the screws on Britain’s financial means.

What follows begins with the financial crisis of 1914. The crisis, and its resolution, exerted a powerful influence on British war finance. The second section considers wartime domestic finance. There were two means of paying for the war: through taxation and through borrowing. They take pride of place, with a brief canvass of what this meant for money supply and prices. The third section deals with external finance. Loans to the Allies, gold, and the problem of the dollar are the chief themes. Here Britain’s travails became acute as dependence upon the United States grew.

The Financial Crisis of 1914↑

The British financial position was, by any reckoning, strong before the war. Since the Boer War national debt had been whittled steadily. The national debt declined from £798 million in 1903 to £651 million on 31 March 1914. Taxation was low, resting on income tax that was levied progressively, supplemented by a Super Tax, estate taxes, and indirect taxation such as customs duties.[3] Not all was comforting – prior to 1914 there was disquiet regarding the size of the Bank of England’s gold reserves. The joint-stock clearing banks, whose power within the City had grown in step with their balance sheets, agitated forcefully for a larger gold reserve, suggesting that should war come, Britain was vulnerable because of a paucity of bullion.[4]

The financial crisis of 1914 was triggered by the coming of war. The London stock exchange closed on 31 July. Two linked phenomena developed: the first was internal demand for money; the second was the gradual, then rapid, paralysis of trade and the exchanges. At home, the public turned to the joint-stock banks for gold as panic set in. The reluctance of the joint-stock banks to comply owed something to their pre-war fears about the adequacy of the gold reserve. Abandoning the gold standard was suggested by the joint-stock bankers. It was a prescription resisted strongly by Walter Cunliffe (1855-1920), the Governor of the Bank of England, supported by the Treasury. Concurrently the mechanisms of trade and exchange seized. A network of accepting houses, discount houses, bill brokers, and joint-stock banks worked harmoniously to finance the movement of goods. The acceptance houses were the first to feel the strain. As European stock exchanges closed, they began refusing new business. The acceptance houses demanded repayment of the money they were owed by foreigners, but this was not forthcoming as it was impossible for debtors to ship gold as war loomed, while bills on London were unobtainable. Yet the acceptance houses had their own debts. If the acceptance houses collapsed, they might drag down the bill-brokers and discount houses who had lent them funds. Matters were worsened by the joint-stock banks. The latter, who also held some acceptances, had furnished much of the capital that allowed the bill-brokers and the discount houses to operate. The joint-stock banks sought to liquidate their loans to the brokers and discount houses, calling in outstanding debts. Faced with no alternative, the brokers and discount houses rushed to the Bank of England to discount bills. While the credit market froze, the exchanges yawed wildly, particularly the dollar. American borrowing in London was seasonal in nature. As the crisis intensified the City of London drew on New York, resulting in a dramatic depreciation of the dollar versus sterling.

To meet the emergency Cunliffe implemented the traditional remedy, raising the Bank Rate.[5] Conferences among the Chancellor of the Exchequer, David Lloyd George (1863-1945), his officials, Cunliffe, and representatives of the City, took advantage of the fact that the crisis coincided with a Bank Holiday on 3 August. By extending the holiday until Friday 7 August, the government bought time. It was decided to postpone settlement of payment of Bills of Exchange (3 August), followed by a general moratorium on payments of cheques and bills (6 August), and on the same day, the authorisation of special Currency Notes in denominations of £1 and ten shillings by the Treasury. The reopening of the banks on 7 August proceeded smoothly, allowing for the reduction of Bank Rate.[6] The decisions to stay on gold and to provide relief to the City through moratoria were fateful. They signalled clearly a determination to preserve the City’s international role while ensuring that the domestic ramifications of the financial crisis were contained.

Domestic Finance↑

The wartime financial dilemma is captured starkly:

| 1913-14 | 1914-15 | 1915-16 | 1916-17 | 1917-18 | 1918-19 | |

| Revenue | 198.2 | 226.7 | 336.8 | 573.4 | 707.2 | 889.0 |

| Expenditure | 197.5 | 560.5 | 1559.2 | 2198.1 | 2696.2 | 2579.3 |

| +/- | +0.7 | -333.8 | -1222.4 | -1624.7 | -1989.0 | -1609.3

|

Table 1: Imperial Revenue and Expenditure of the UK (£m)[7]

While revenue increased dramatically, it failed to keep pace with the growth of expenditure. The consequence was massive deficits. In the opening weeks of the war, the government paid for its outlays through short-term Treasury Bills and Ways and Means Advances from the Bank of England.[8] Such expedients could not last indefinitely. The story of wartime revenue extraction is the effort to raise taxation without crippling public willingness to support the war effort. As for borrowing, two periods are apparent: the first, a period of reliance upon long-term War Loans, beginning in November 1914 and lasting until the spring of 1917; the second, from the spring of 1917, saw the abandonment of long-term borrowing in favour of shorter term instruments.

Taxation↑

Past practice suggested that the government should seek to pay for the war substantially from taxation. Whatever effects dim remembrances of the Napoleonic and French Revolutionary Wars or more recently the Gladstonian tradition might have had, such expectations were revealed rapidly as illusory. Lloyd George’s reticence to increase taxation in either of his two wartime budgets (November 1914 and May 1915) was attacked by contemporaries, but by the time he was replaced as Chancellor of the Exchequer by Reginald McKenna (1863-1943) in May 1915 (McKenna was Chancellor until December 1916), the die was cast. Expenditure was surging, approaching £5 million per day when McKenna tabled his first budget in September 1915. It was this budget that set the template for subsequent wartime budgets. McKenna raised income tax by 40 percent, lowered the earnings level at which it was levied, increased duties on various indirect taxes, and took two distinctive steps. First, he sacrificed Liberalism’s adherence to free trade, selectively imposing import duties on goods. Second, he introduced the Excess Profits Duty, a tax aimed at reducing profiteering, playing to widespread animosity of the “hard-faced men” who seemed to be thriving. Nonetheless, while McKenna was willing to take unprecedented steps, he recognized the limitations of taxation. As he told the House of Commons in April 1916, new taxation would be levied only to the level required to cover interest charges on new borrowing as well as to allow for the creation of a sinking fund to meet the debt incurred. His successor as Chancellor, Andrew Bonar Law (1858-1923), the Conservative party leader who held the post from December 1916, followed in McKenna’s footsteps. Bonar Law implemented no new taxation initiatives and was content to raise the rates on taxes already established by McKenna, including moving the Excess Profits Duty to 80 percent in his budget of May 1917.[9] Neither Chancellor was willing to undermine public sympathy for the war through swinging taxation. More radical steps to reduce the deficit, such as a capital levy, were rejected by the Treasury. The Treasury worried that a slump in asset prices occasioned by asset-holders seeking to raise capital would depress the capital markets and reduce confidence in the United States in Britain’s soundness.[10] Overall, wartime taxation met approximately 26 percent of expenditure.[11]

Borrowing and the National Debt↑

Borrowing was the foundation of British wartime finance. Once the tremors associated with the financial crisis subsided, Lloyd George moved to the traditional means: a long-term government loan. The First War Loan was floated in November 1914. The loan was a failure, though its miscarriage was disguised by the Bank of England.[12] Despite this fiasco, a commitment to long-term borrowing remained the centrepiece of government borrowing until the spring of 1917. The Second War Loan (1915) and the colossal Third War Loan (1917) were supplemented by shorter term borrowings, Bonds and Treasury Bills. In lock step interest rates rose.[13] After the Third War Loan, a different tack was taken. Three expedients were employed: first, Treasury Bill offerings with maturities of three and six months and bearing fixed interest rates were issued; second, the introduction of medium term bonds, labelled either Exchequer or National War Bonds with maturities of lengths up to ten years; third, an increased reliance in 1917-18 on borrowing from the Bank of England in the form of Ways and Means Advances. Why was there a shift away from long-term borrowing? The use of Treasury Bills and Bonds allowed for tailoring of duration and rate to the capital market and to the British public. Moreover, American entry into the war in April 1917 afforded the Treasury the opportunity for cheaper borrowing. Interest rates declined from the high level that had been deemed necessary to prop up the sterling-dollar exchange. When neither Treasury Bills nor Bonds sufficed, Ways and Means Advances from the Bank of England proved to be an effective way of filling in the revenue gap. The shift to a policy of more or less continuous borrowing had drawbacks. The unfunded debt climbed dramatically, forcing the authorities to have steady recourse to the markets to service the floating debt. It has been pointed out that doing so not only placed governments in the position of constantly chasing new funds, it also complicated handling as issues and maturities multiplied. The business of managing the national debt became more intensive with the move away from long-term financing.[14]

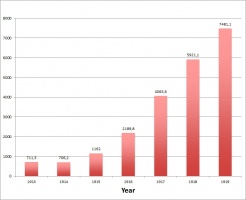

Figure 1: Net National Debt of the UK (£m), financial year end-March[15]

While borrowing was the chief means of meeting the government’s deficit, relief was also sought through expansion of the money supply. From 1914 to 1918 the money supply doubled. Naturally, this had consequences for the level of prices in the UK, which doubled as well.[16] That inflation did not rise further owes something to the depth of the City’s capital markets. Balderston has suggested that the latter effectively acted as a shock absorber, permitting not only the raising of funds needed by the government, but also checking the rise in prices.[17] Some growth in the money supply was helpful from the Treasury perspective, for excess liquidity made borrowing at home easier.

External Finance↑

In War and National Finance (1921), the merchant banker R.H. Brand (1878-1963) described external finance as “by far the greatest and most serious problem”.[18] External finance was trying for various reasons: the determination to maintain London as the dominant global financial centre; the dictates of waging a coalition war in which Britain’s co-belligerents demanded financial assistance; the sensitivities associated with dealing with the chief neutral from 1914-17, the United States, which became rapidly the greatest supplier to the allied cause; and the unexpected scope and duration of the war. These were issues that transcended the financial, encompassing war aims, internal politics, diplomacy, economics, and grand strategy. A series of scholarly works have illuminated the approach of British governments while at the same time drawing attention to the tensions generated by external finance.[19]

The summer and fall of 1914 were, in retrospect, misleading. The chief problem seemed to be that the rest of the world could not pay the City the debts that it was owed. Britain had agreed in the Declaration of London, signed in September 1914 with France and Russia, not to forge a separate peace. Quickly it became apparent that for Paris and Petrograd credit was an essential element in what constituted the alliance. This was not necessarily a stipulation that bothered Lloyd George as Chancellor. He was willing to furnish financial assistance. However even Lloyd George agreed that if Britain was to assist its Allies in financing purchases in the British Empire and the United States, that gold should be shipped in return. Both the Bank of France and the Imperial Russian State Bank had gold reserves dwarfing those of the Bank of England. Cunliffe and the Treasury argued that given that France and Russia had suspended convertibility while Britain remained on the gold standard, that the gold was better deployed by Britain in the name of the coalition. It was a view resisted by the French and the Russians, both of whom suspected darkly that this was a ploy to support continued British financial hegemony. Nonetheless, the Treasury and the Bank of England persisted in tying the extension of credits to the provision of gold. Gold played a central role in Britain’s wartime financial relationship with its Allies: during the war the Russians shipped £68 million in gold to Britain while the French provided considerably more, £112.6 million.[20]

Gold was not the only reason why Allied financial relations were a source of friction within the coalition. Repeated French and Russian efforts to borrow directly on the UK capital market were either rebuffed or conceded in ways that limited their possible borrowing. For example, in February 1915 the French were given permission to float short-term obligations in London but only if they were denominated in francs rather than sterling, which curtailed their appeal markedly. Whereas in 1913 new capital issues in London totalled £197.5 million, by 1916 the figure had dropped to £25.9 million, reaching a wartime low of £17.9 million in 1917.[21] The Treasury was determined to control access for its purposes. While stringent, there were limits for the allies could not be starved financially. The outcome was loans to the Allies by Britain. At the end of the financial year 1918-19, British government loans outstanding to its three principal European co-belligerents (France, Russia and Italy) amounted to £1,415 million.[22]

As the war exacted an ever greater financial toll, a rancorous debate blossomed. For McKenna and his officials, Britain could not pay for its external purchasing, fund allied requirements and simultaneously expand and equip the new mass British armies. Trying to do so would not only endanger the war effort, but also bankrupt Britain. McKenna argued in favour of waging a war within Britain’s means. Others, notably Lloyd George, were insistent that what mattered was winning the war. The fall of the Asquith coalition and the advent of Lloyd George as Prime Minister in December 1916 ended the debate but did not alter external financial policy. McKenna’s successor as Chancellor, Bonar Law, admitted to Parliament in May 1917 that the credit of the Empire was dependent entirely upon the gold standard. The Lloyd George government had no way out of this financial cul de sac nor did it try to resolve the contradiction inherent in waging a war to the bitter end with a desire to retain the City’s international dominance.

The Dollar↑

American entry into the war rescued the Lloyd George ministry. The importance of the United States to the war effort rose steadily:

| 1914 | 1915 | 1916 | 1917 | 1918 | |

| Imports | 138.6 | 237.8 | 291.8 | 376.3 | 515.4 |

| Exports | 64.6 | 56.5 | 64.5 | 60.1 | 27.8 |

| Deficit | 74.9 | 181.3 | 227.3 | 316.2 | 487.6 |

Table 2: British Trade with the United States, 1914-1918 (£m)[23]

The problem facing London was much more acute than the table demonstrates, for the trade deficit adumbrated does not capture the allied trade deficits with the United States that Britain was increasingly responsible for financing. How was Britain to pay? Selling sterling to obtain needed dollars, while plausible in 1914 when the exchange favoured the pound, was soon recognized as counterproductive given the growing pressure on sterling generated by the shift in trade. Boosting exports, a prescription articulated by McKenna, was a chimera. Three possibilities existed: shipping gold, selling American dollar denominated securities in the US, and borrowing in the United States. All three courses were employed but each had drawbacks.

Shipping gold was perilous in wartime while extracting gold from France and Russia caused inter-allied friction. Selling securities in the United States was rendered difficult by several considerations. The Treasury did not know how many American dollar securities were held in Britain. Obtaining them raised uncomfortable questions for a liberal state at war. Initially the Treasury borrowed securities from holders on a volunteer basis. It was not until 1917 that American dollar securities were sequestrated. Over the life of the scheme, 1915-19, the American Dollar Securities Committee bought or borrowed bonds and shares worth $1,423 million.[24] It was not enough - neither gold shipments nor sales of securities sufficed. Borrowing was required. Here too there were obstacles. The City fretted that borrowing in the United States might create a rival through the creation of more sophisticated American capital markets. Needs must however overruled these scruples. In 1915, a massive Anglo-French loan for $500 million was floated in the United States with the cooperation of a syndicate headed by J.P. Morgan & Co. The latter, which became in 1915 the British and French purchasing agents in the US, was increasingly influential. The Anglo-French loan was a limited success. The syndicate found buyers scarce. After 1915, more modest expedients were sought. In 1916-17, various devices were employed, including offering guaranteed UK government loans. Late in 1916, a plan championed by Morgans to issue short-term Treasury Bills in the United States was rebuffed by the Federal Reserve Board at the behest of the American President Woodrow Wilson (1856-1924), who hoped refusal would force the allies to heed his mediation proposal to end the war. Wilson’s gambit failed but allied financial precariousness was exposed. The overdraft on Morgans reached the staggering figure of nearly $400 million in the spring of 1917.[25] France had reached the end of its tether. Could Britain continue? On its own account perhaps, but not paying as well for the allied accounts, at least not for long. American belligerency extricated London from the worst spectres, though it raised other fears. Would the United States supplant Britain as the dominant global financial power?[26]

Conclusion↑

When the armistice came in November 1918, the National Debt stood at £7,171 million, of which £1,420 million was floating debt.[27] The government was confronted with a massive ongoing deficit, while much of Britain’s overseas investments had been sold. It was unclear whether the loans made to the Allies, and erstwhile Allies, namely Russia, might be recouped, while it was apparent that the United States wanted repayment. It was a bleak landscape. The way forward was charted by the interim report of the Committee on Currency and Foreign Exchanges after the War, sometimes known as the Cunliffe Committee. Its interim report appeared in August 1918 and was little changed in its final version in December 1919. The report regarded the financial problems occasioned by the war as interconnected. There was a pressing need to make economies in government spending, to bring interest rates down to alleviate the burden of the debt, to head off the danger of an unwise credit expansion, and to stabilize the foreign exchange. The means to do so was re-establishing a functioning gold standard. It was a prescription accepted by the Treasury, the Bank of England, the City and the Lloyd George government. The road to recovery would take time, perhaps a decade, but the Cunliffe Committee was convinced that it was possible. And so, at the end of the war, as at its outset, the gold standard was seen as indivisible from Britain’s prosperity at home and abroad.

Martin Horn, McMaster University

Section Editor: Adrian Gregory

Notes

- ↑ Schuster, who was the Governor (executive chairman) of the Union of London and Smiths Bank, made this comment in testimony to the Desart Committee, 27 February 1912, National Archives UK, Cab 16/18A/28480. The Desart Committee, named after its chair, Lord Desart, was a sub-committee of the Committee of Imperial Defence struck to examine the economic vulnerability of Great Britain to a coming war.

- ↑ Michie, Ronald C.:, The City of London as a Global Financial Centre, 1880-1939. Finance, Foreign Exchange, and the First World War, in: Cottrell, Philip L./Lange, Evan/Olsson, Ulf (eds.): Centres and Peripheries in Banking. The Historical Development of Financial Markets, London 2007.

- ↑ Hirst, F.W./Allen, J.E.: British War Budgets, London 1926, pp. 12-15.

- ↑ Sayers, R.S.: The Bank of England, 1891-1944, vol. 1, Cambridge 1976, pp. 60-65.

- ↑ Bank Rate was increased from 3 to 4 percent on 30 July, doubled on 31 July to 8 percent and then on Saturday 1 August increased again to 10 percent. It was reduced to 6 percent and then to 5 percent on 8 August 1914.

- ↑ The most recent and comprehensive account of the crisis is Roberts, Richard: Saving the City. The Great Financial Crisis of 1914, Oxford 2013.

- ↑ Morgan, E.V.: Studies in British Financial Policy, 1914-1925, London 1952, p. 106.

- ↑ Ibid.

- ↑ Wartime budgets are discussed in Hirst and Allen, British War Budgets 1926.

- ↑ Daunton, Martin: How to Pay for the War. State, Society and Taxation in Britain, 1917-24, in: English Historical Review, 111/443, Oxford 1996, pp. 890-91.

- ↑ Balderston, T.:War Finance and Inflation in Britain and Germany, 1914-1918, in: Economic History Review, 2nd ser. XLII/2, 1989, p. 226. It should be noted that the percentage of Britain’s expenditure covered by taxation was the highest of the principal European belligerents.

- ↑ Wormell, Jeremy: The Management of the National Debt of the United Kingdom, 1900-1932, London 2000, pp. 82-85.

- ↑ Morgan, Studies in British Financial Policy 1982, p. 112.

- ↑ See the remarks by Wormell, The Management of the National Debt 2000, pp. 374-376.

- ↑ Wormell, Jeremy: The Management of the National Debt, Appendix III, p. 733.

- ↑ Broadberry, Stephen/Howlett, Peter: The United Kingdom during World War I: business as usual?, in: Broadberry, Stephen/Harrison, Mark (eds.): The Economics of World War I, Cambridge 2005, p. 219.

- ↑ Balderston, “War Finance and Inflation in Britain and Germany”.

- ↑ Brand, R.H.: War and National Finance, London 1921, p. vii. Brand was a merchant banker with Lazard as well as serving the Treasury during the war.

- ↑ Among these works are: French, David: British Economic and Strategic Planning, 1905-1915, London 1982; Neilson, Keith: Strategy and Supply. the Anglo-Russian Alliance, 1914-1917, London 1984; Burk, Kathleen: Britain, America and the Sinews of War, London 1985; Soutou, Georges-Henri: L’Or et le sang, Paris 1989; Horn, Martin: Britain, France and the Financing of the First World War, Montreal 2002; Siegel, Jennifer: For Peace and Money, New York 2014.

- ↑ Britain was obliged to return much of this gold, which was deemed borrowed. This stipulation occasioned considerable animosity post-war, as Britain baulked at doing so, particularly given the Russian Revolutions.

- ↑ Morgan, Studies in British Financial Policy 1982, Table 37, p. 264.

- ↑ Morgan, Studies in British Financial Policy 1982, Table 48, p. 317.

- ↑ Horn, Britain, France and the Financing of the First World War 2002, p. 87.

- ↑ Wormell, The Management of the National Debt 2000, p. 180.

- ↑ The precise figure is $398.5 million, see Morgan, Studies in British Financial Policy 1982, p. 325.

- ↑ This is a major theme in Burk, Britain, America and the Sinews of War 1985.

- ↑ Wormell, The Management of the National Debt 2000, p. 383.

Selected Bibliography

- Balderston, Theo: War finance and inflation in Britain and Germany, 1914-1918, in: The Economic History Review 42/2, 1989, pp. 222–244.

- Brand, R. H.: War and national finance, London 1921: E. Arnold.

- Broadberry, Stephen N. / Howlett, Peter: The United Kingdom during World War I. Business as usual?, in: Broadberry, Stephen N. / Harrison, Mark (eds.): The economics of World War I, Cambridge; New York 2005: Cambridge University Press, pp. 206-234.

- Burk, Kathleen: Britain, America and the sinews of war, 1914-1918, Boston; London 1985: G. Allen & Unwin.

- Daunton, Martin J.: How to pay for the war. State, society and taxation in Britain, 1917-24, in: The English Historical Review 111/443, 1996, pp. 882-919.

- French, David: British economic and strategic planning, 1905-1915, London; Boston 1982: Allen & Unwin.

- Hirst, Francis W. / Allen, John Ernest: British war budgets, London; New Haven 1926: H. Milford; Oxford University Press; Yale University Press.

- Horn, Martin: Britain, France, and the financing of the First World War, Montreal; Ithaca 2002: McGill-Queen's University Press.

- Kirkaldy, Adam W.: British finance during and after the war 1914-21, London 1921: Pitman & Sons.

- Michie, Ranald C.: The city of London as a global financial centre, 1880-1939. Finance, foreign exchange and the First World War, in: Cottrell, Philip L. / Olsson, Ulf / Lange, Even (eds.): Centres and peripheries in banking. The historical development of financial markets, Aldershot; Burlington 2007: Ashgate, pp. 41-79.

- Morgan, E. Victor: Studies in British financial policy, 1914-25, London 1952: Macmillan.

- Neilson, Keith: Strategy and supply. The Anglo-Russian alliance, 1914-17, London; Boston 1984: Allen & Unwin.

- Roberts, Richard: Saving the city. The great financial crisis of 1914, Oxford 2013: Oxford University Press.

- Sayers, R. S.: The Bank of England, 1891-1944, Cambridge; New York 1976: Cambridge University Press.

- Siegel, Jennifer: For peace and money. French and British finance in the service of tsars and commissars, Oxford; New York 2014: Oxford University Press.

- Soutou, Georges-Henri: L'or et le sang. Les buts de guerre économiques de la première guerre mondiale, Nouvelles études historiques, Paris 1989: Fayard.

- Wormell, Jeremy: The management of the national debt of the United Kingdom, 1900-1932, London; New York 2000: Routledge.