Introduction↑

The assassination of Franz Ferdinand, Archduke of Austria-Este (1863-1914) in Sarajevo on 28 June 1914 was the spark that lit the fire smouldering between the European powers for years. In the early days of the war there was a debate in Spain between those who supported entering the war (who, in turn were divided between sympathisers of the Entente and sympathisers of Germany) and those who defended neutrality. Spain finally declared its neutrality on 30 July.[1]

An issue that has aroused enormous interest among economists is the effects of the war on the economy, not only in the countries at war but also in those that remained neutral. Neutral countries saw their exports increase as they provided goods previously supplied by the nations at war. Although there was a reduction in the export of goods considered luxuries by the average consumer and of those that were excessively large or had little added value to make their transport profitable, the balance of payments was, on the whole, positive. Neutral countries accelerated the growth of their agricultural production and raw materials and initiated or consolidated their industrialisation process in the light of the substitution of imports, which proved to be more effective than any of the protectionist policies previously developed by their governments. However, the extent to which the national economy benefited from these circumstances depended on local context. This question is still being studied, although the current consensus is that most countries increased their production but not their capacity or productivity. Corporate profits increased but did not contribute to enhancing the solidity of the industrial fabrics.

This article focuses on the effect of the First World War on one neutral European economy, namely Spain.[2] This period is usually considered an exceptional circumstance which did not have much of an influence on the structure or long-term evolution of Spain’s national economy. However, the First World War had an enormous impact not only on the conflicting countries but also on the economies of the neutral countries, particularly Spain, which had close economic ties with the countries at war. The consequences for the Spanish economy were even greater than in other neutral countries if we take into account its geographical location as a neighbour of France and its privileged situation with respect to the Atlantic and Great Britain, the Mediterranean and Africa.

Evolution of Macroeconomics Data↑

We begin our study by analysing the evolution of the principal macroeconomic factors during the period. The Spanish population grew by 15 percent between 1900 and 1920 and 7 percent between 1910 and 1920.

| Principal demographic indicators | |||||

| Population on 1 July (thousands) | Birth rate (per thousand) | Death rate | Natural population growth | Life expectancy | |

| 1914 | 20,398 | 29.8 | 22.1 | 7.7 | 41.7* |

| 1915 | 20,535 | 29.9 | 22 | 7.9 | |

| 1916 | 20,673 | 29 | 21.4 | 7.6 | |

| 1917 | 20,811 | 28.9 | 22.4 | 6.5 | |

| 1918 | 20,950 | 29.2 | 33.2 | -4 | 41.2** |

Table 1: Demographic Indicators for Spain.[3] *Life expectancy in 1910, **Life expectancy in 1920

As we can see, the Spanish population was fully immersed in a demographic transition during the years considered in the study, with birth rates of between 29 and 30 percent and death rates of around 22 percent, except in the year 1918 in which the influenza epidemic caused the death rate to shoot up to more than 33 percent. However, the country still had a low population density and was much less urban than its neighbours. Life expectancy, which is a synthetic indicator of well-being, fell slightly between 1910 and 1920.

The per capita GDP reveals that there was slight growth at the beginning of the conflict (1 percent in 1915), but this accelerated in the middle years of the war (4 percent in 1916) and declined in 1917 and 1918. The balance between 1914 and 1918 is a growth of 1.56 percent (an annual accumulative growth rate of 0.38 percent). It is very important to highlight that, despite this modest growth, during the war the Spanish economy experienced a phase of significant convergence with respect to Western Europe.

| Pc GDP at factor cost 1914=100 | ||

| pc GDP | Index | |

| 1900 | 1670.37 | 88.71 |

| 1901 | 1777.66 | 94.40 |

| 1902 | 1714.13 | 91.03 |

| 1903 | 1710.17 | 90.82 |

| 1904 | 1692.76 | 89.90 |

| 1905 | 1661.98 | 88.26 |

| 1906 | 1731.2 | 91.94 |

| 1907 | 1773.36 | 94.18 |

| 1908 | 1830.16 | 97.19 |

| 1909 | 1849.18 | 98.20 |

| 1910 | 1772.14 | 94.11 |

| 1911 | 1886.33 | 100.18 |

| 1912 | 1859.65 | 98.76 |

| 1913 | 1922.24 | 102.08 |

| 1914 | 1883.03 | 100.00 |

| 1915 | 1901.03 | 100.96 |

| 1916 | 1976.10 | 104.94 |

| 1917 | 1938.90 | 102.97 |

| 1918 | 1912.38 | 101.56 |

| 1919 | 1911.48 | 101.51 |

| 1920 | 2035.91 | 108.12 |

| 1921 | 2068.85 | 109.87 |

| 1922 | 2135.45 | 113.40 |

| 1923 | 2141.32 | 113.72 |

| 1924 | 2179.76 | 115.76 |

| 1925 | 2291.53 | 121.69 |

| 1926 | 2260.10 | 120.02 |

| 1927 | 2431.22 | 129.11 |

| 1928 | 2416.27 | 128.32 |

| 1929 | 2561.20 | 136.01 |

Table 2: Per capita GDP in 1990 Geary-Khamis dollars.[4]

| Distribution of GDP by Sector | |||

| Primary | Secondary | Tertiary | |

| 1913 | 29.08 | 30.51 | 40.41 |

| 1914 | 27.71 | 30.01 | 42.27 |

| 1915 | 33.02 | 28.63 | 38.35 |

| 1916 | 31.98 | 30.70 | 37.32 |

| 1917 | 29.48 | 30.92 | 39.60 |

| 1918 | 30.31 | 30.39 | 39.30 |

| 1919 | 32.13 | 28.48 | 39.39 |

| 1920 | 31.93 | 30.20 | 37.87 |

| 1921 | 28.87 | 30.01 | 41.12 |

| 1922 | 29.44 | 29.44 | 41.11 |

| 1923 | 25.90 | 31.63 | 42.47 |

| 1924 | 26.48 | 31.79 | 41.73 |

Table 3: Distribution of GDP by sector.[5]

With respect to the participation of the different sectors in the economy (see Table 3), between 1914 and 1918, the tertiary sector lost weight, which was gained by industry, and particularly by the primary sector. The explanation for this evolution resides in the fact that the war stimulated those production activities that were demanded by the European countries at war and by neutral countries, while services became less important. In an analysis of the period 1913-1919, the principal beneficiary was the primary sector, which increased its participation in GDP by three points, while the tertiary sector lost one point and industry two, making the latter the most affected in relative terms during the period.

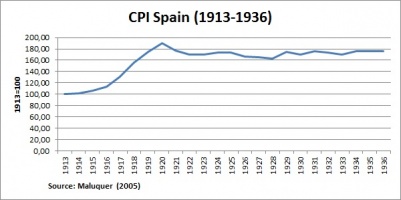

While inflation in the country as a whole was notably lower than that of the European countries at war, it put an end to the enormous stability that prices had enjoyed throughout the most part of the 19th century. In 1913, the level of prices was very similar to that of the beginning of the previous century, during which it had experienced oscillations although the long-term trend remained stable. Prices almost doubled between 1914 and 1920 and then remained stable until the Spanish Civil War. Inflationary pressure was exercised in both directions, from consumption to the prices of factors of production, and affected the evolution of real wages. Therefore, it was one of the determining causes of the increase in social conflict experienced in Spain during the war years.

| CPI Spain 1913=100 | |

| 1913 | 100.00 |

| 1914 | 101.06 |

| 1915 | 106.10 |

| 1916 | 113.39 |

| 1917 | 131.35 |

| 1918 | 156.08 |

| 1919 | 175.30 |

| 1920 | 189.88 |

| 1921 | 177.36 |

| 1922 | 170.45 |

| 1923 | 169.93 |

| 1924 | 173.22 |

Table 4: Consumer Price Index.[6]

Impact on Spain’s Economic Structure↑

Similar to other neutral countries, although probably more acutely due to Spain’s geographical proximity and ties with the nations at war, Spain saw a considerable increase in exports. Foreign sales grew to satisfy the needs of neutral countries, which had been clients of the belligerents and to supply the warring parties with military products which Spain had not been capable of producing previously. This increase in demand went hand-in-hand with what some authors have labelled “automatic spontaneous protection”, that is, circumstances in which mainly the industrial sector (except those subsectors that depended on no-longer available imports from the belligerents) increased its production in order to substitute the goods formerly purchased from the combatants.

Mining was heavily affected by the closure of international markets.[7] Both lead and metallic minerals reduced their exports in terms of volume and value. The production of the sector also decreased, with the exception of iron from Biscay which was still essential for British industry and saw continued demand during the war. In contrast, the demand for Spanish coal increased as a consequence of the protection of natural resources generated by the war. Consequently, national production shot up, as did prices. When the conflict ended, two effects were seen in this subsector. First, its low competitiveness came to light with the return of European producers to the world market and Spanish coal was plunged into a deep recession. Second, the inflation which affected this product is considered by specialists to be the origin of the use of electrical energy in Spain due to the reduction of its relative price.

Spanish agriculture increased its production and its exports (an annual growth rate of 6.2 percent between 1914 and 1918), but the positive impact was concentrated on the most backward subsectors, while the demand for agriculture exports (fruit and vegetables) fell. This had an overall negative effect on Spanish agriculture in the long term, given that the modernisation of the sector was delayed in favour of more backward agriculture. The balance sheet in the primary sector reflected an increase in demand and prices but a fall in sales in two export sectors: fruit and vegetables and mining.

Industrial Production↑

The industrial production index calculated by Albert Carreras shows an inter-annual growth of 0.25 percent between 1914 and 1919; Spanish industry only increased its output by 1 percent from 1913.[8] Other authors believe that most of the progress in Spanish industry was made in the 1920s, that is, on the foundations established during the war (accumulation of capital, adoption of new technologies and markets).[9] However, the direct effects of the war are difficult to analyse due to the diversification that had already occurred in the sector. It is therefore necessary to determine what happened in different subsectors and even within different branches of subsectors.

| Industrial production index 1913=100 | |

| 1913 | 100.00 |

| 1914 | 99.68 |

| 1915 | 104.11 |

| 1916 | 109.02 |

| 1917 | 106.96 |

| 1918 | 108.86 |

| 1919 | 100.95 |

| 1920 | 105.70 |

| 1921 | 106.80 |

| 1922 | 108.70 |

| 1923 | 121.99 |

| 1924 | 128.16 |

Table 5: Industrial Production Index.[10]

Carreras and Xavier Tafunell differentiate between two large groups of industrial subsectors. The first group was made up of those industries which, in the light of the protection of natural resources generated by the war and the increase in external demand, increased their capacity. In other words, they resorted to existing resources, particularly labour and the subcontracting of smaller companies, many of which were newly established. This group increased production; it took advantage of the increase in prices and recorded large profits during these years. However, when the war ended, it suffered a significant crisis and many of the companies created during the war period disappeared. Those that survived were faced with a fall in demand as a consequence of the stagnation of their productivity in the previous years. The second group was made up of industries that were committed to growing production capacity and included modern industries such as emerging chemical companies, metallic manufactured goods companies, and capital goods companies.

From a long-term point of view, Spanish industry as a whole grew relatively little during the war years and only some subsectors contributed to the modernisation of the sector. Furthermore, industry’s share of GDP in 1919 was only slightly higher than in 1914 (20.5 percent as opposed to 19.6 percent), according to estimates made by Prados.[11] However, many industrial subsectors experienced increases in demand, production, prices, and profits. Two phenomena arose which contributed to the remarkable industrial growth of the 1920s: an increase in profits and the accumulation of capital and diversification and the emergence of new companies in advanced subsectors such as the chemical and capital goods industries. Furthermore, market knowledge increased to include those subsectors, which, until then, had not been the focus of Spanish industry. Consequently, the know-how of international trade improved.

In the tertiary sector, we find differences between transport companies (mainly shipping companies) and the banking sector.[12] The former increased their production through a greater use of the resources already available without committing to an extension of the fleet. The latter increased its production capacity through the opening of new branches throughout the country in order to capture the increase in savings that had occurred during these years and to provide services to a business community that had a greater volume of transactions on a national and international level. Spanish banking recorded large profits in this period which enabled the consolidation and growth of the sector. This consolidation took place mainly from the end of 1916 and throughout the whole of 1917, when large capital increases were made in the Bank of Spain, Banco Urquijo, Banco Guipuzcoano, Banco de Vizcaya, Banco Hispano Americano, etc. In 1918, the Basque banking industry led the sector, and in 1919, in the same way as in 1917, a new capital increase process was implemented. As a result, during the 1920s the banking sector became one of the main pillars of the Spanish economy.

International Trade↑

As already mentioned, the consensus among specialists is that the biggest impact of the First World War on the Spanish economy was in foreign trade. According to the most accepted calculations, based on the studies of Carles Sudrià, the balance of payments recorded a surplus of around five billion pesetas between 1914 and 1919.[13] Approximately 1.4 billion pesetas corresponded to the services balance, mainly with respect to the sale of transport services to the warring countries, while half of the total balance corresponded to the trade balance, as a result of the reduction in imports. This fall in foreign purchases was due to the reduction of the production of goods demanded by the Spanish economy from the warring countries (the traditional origin of Spanish imports, particularly France or Great Britain), which had transformed their production facilities so as to prioritise winning the war. Other causes were the transport problems during this period and the controls and obstacles that the European government applied to certain products.

Particularly noteworthy were the reductions in Spanish imports of capital goods, machinery, chemical products, paper pulp, mineral coal, food products, etc. When analysing the evolution of exports, we observe that after 1914 there was an extraordinary increase in Spanish foreign sales of products that were traditionally produced for the domestic market and others which, although they were exported, did not have significant levels of production and sales. The principal products exported in this period were textiles, metals, and goods manufactured from these products such as leathers and footwear, chemical products, and food products. Other products exported before the war, such as fruit or metallic minerals, were affected by the conflict as their traditional destinations were the French and British markets which no longer demanded them. Sectors such as mining particularly experienced the impact of the reduction in investments from foreign capital companies, which experienced problems in placing their financial resources in Spain, together with the increased cost of maritime transport due to the blockage of the warring countries.[14] In the case of Mediterranean fruit, the warring countries deemed these products as dispensable in a time of economic hardship, so the fall in consumption in traditional markets together with the lack and scarcity of maritime transport, led to a reduction in exports. The expansion in exports had significant consequences for the Spanish economy including the increase in the prices of exported products, increased activity and profits of the existing companies, the creation of new companies, and a capital accumulation process.

War Profits↑

Another debate which has aroused the interest of historians is the distribution of the profits generated by the war. According to Carreras and Tafunell, first, capital gains increased their share of GDP at least until 1917, while income tax fell due to the increase in prices, which exceeded the growth of nominal wages.[15] After 1918, the increase in wages obtained by workers after the general strike of 1917 and the mobilisation of the working class which continued thereafter successfully stopped the fall in real wages which began to rise after 1921.

According to Sudrià, the surpluses in the balance of payments had three main destinations: to increase the gold reserves of the Bank of Spain (from 711 million gold pesetas in 1914 to 2.5 billion gold pesetas in 1918), to purchase Spanish financial assets, both outstanding external debt and shares and debt securities which were foreign-owned in 1914 (around 1.4 billion pesetas), and to obtain deposits in pesetas or foreign currency. In the latter case, the currencies were used for speculation or remained inactive. When the war was over, these currencies depreciated and lost their value, plunging their holders into debt. Profits earned from the war were not used for reinvestment, so gross fixed capital formation’s share of GDP fell. One explanation for this was the problems that the industrialists encountered in acquiring foreign machinery during these years. This meant that the banks were the main beneficiaries, as this capital remained in the form of deposits, enabling them to finance large business projects in the 1920s.

Post-War Crisis and Conclusion↑

To conclude our analysis, we will study the behaviour of the Spanish economy during the years of the post-war crisis. According to Juan Velarde, the factors that had boosted Spanish exports and had caused imports to fall now had the opposite effect.[16] Exports fell by around 40 percent in the period 1919-1922 due to the recovery of European industry after peace was restored and the depreciation of the currencies of the European powers, which regained the markets that had been supplied during the conflict by neutral countries like Spain. For the same reason, imports increased, given that the lower value of the European currencies made their products cheaper and the Spanish market, with enormous liquidity, was hungry for all types of goods, particularly investment. Another consequence was the bankruptcy of those banks whose balance sheets depended considerably on the depreciated currencies, as was the case of Banco de Terrassa and, particularly, Banco de Barcelona.

The recovery of the European economic fabric meant a huge drop in domestic prices which, together with higher wages after the strike in 1917, considerably reduced the operating margin of many companies. As a result of this process, the inefficient firms that had been created during the war closed down, unemployment increased, and industrial production was reduced. However, this occurred in highly inefficient traditional sectors which had done little to optimise their production systems. In contrast, the more modern sectors which had begun to consolidate during the war (sectors of the second industrialisation process), in light of the exceptional protection provided by the conflict, substantially increased their investments. They took advantage of the inactive liquidity that existed to offer interesting investment projects. This required the acquisition of capital goods, which had been difficult to find in previous years.

In view of this crisis situation, the response of entrepreneurs was to demand a tariff to protect national products and to stabilise the balance of payments. Accordingly, Antonio Maura’s (1853-1925) government implemented the tariff introduced in 1922 by Francesc Cambó (1876-1947). On a social level, the demands of the trade unions and working class associations increased during the years of recession, during which the number of strikes and disputes increased considerably. Violence was used both in the actions of the unions and in the responses of employers with the well-known phenomenon of pistolerismo which caused the death of both unionists and employers in the main industrial cities. This difficult situation, together with the problems in Morocco, the discontent of the army, the weakness and lack of leadership of the liberal parties, and the proximity of the Russian Revolution caused Capitán General Miguel Primo de Rivera (1870-1930) to lead a military coup d’état in 1923, which was not disapproved of by the crown, the bourgeoisie, or the army. Even the socialists believed that their social reforms could be carried out with a strong government after restoring public order.

Andrés Sánchez Picón and José Joaquín García Gómez, Universidad de Almería

Section Editor: Carolina García Sanz

Notes

- ↑ Romero Salvadó, Francisco: Spain 1914-1918. Between War and Revolution, London 1999.

- ↑ Ruiz Sánchez, J-L. / Cordero Olivero, I. / García Sanz, C. (eds.): Shaping Neutrality throughout the First World War. Sevilla 2016.

- ↑ Carreras, A. and Tafunell, X (eds.): Estadísticas Históricas de España. Siglos XIX y XX, Bilbao 2005, p. 86, p. 125.

- ↑ Ibid., p. 1363.

- ↑ Ibid., p. 1346.

- ↑ Ibid., p. 1291.

- ↑ Pérez de Perceval, M.A. / López-Morell, M.A. / Rodríguez, A.: Minería y desarrollo económico en España. Madrid 2007.

- ↑ Carreras, A.: La producción industrial española, 1842–1981: construcción de un índice anual, in: Revista de Historia Económica, 2/1 (1984), pp. 127-157.

- ↑ Parejo, A. / Sánchez Picón, A.: La modernización de España (1914-1936). Madrid 2007.

- ↑ Carreras, Albert / Tafunell, Xavier (eds.): Estadísticas Históricas de España. Siglos XIX y XX, Bilbao 2005, p. 397.

- ↑ Prados de la Escosura, L.: El progreso económico de España (1850-2000). Madrid 2003.

- ↑ See Valdaliso, J.M.: The Rise of Specialist Firms in Spanish Shipping and Their Strategies of Growth 1860 to 1930, in: Business History Review 74/2, (2000), pp. 267-300.

- ↑ Sudrià, C.: Los beneficios de España durante la Gran Guerra. Una aproximación a la balanza de pagos española, 1914-1920, in: Revista de Historia Económica 8/2 (1990), pp. 363-396.

- ↑ Pérez de Perceval / López-Morell / Rodríguez, Minería y desarrollo económico en España 2007.

- ↑ Carreras, A. / Tafunell, X.: Historia económica de la España contemporánea 1789-2009, Barcelona 2004.

- ↑ Velarde, J.: Cien años de economía española. Madrid 2009.

Selected Bibliography

- Carreras, Albert / Tafunell, Xavier: Historia económica de la España contemporánea, Barcelona 2004: Crítica.

- Carreras, Albert / Tafunell, Xavier: Estadísticas históricas de España, siglos XIX-XX, Bilbao 2005: Fundación BBVA.

- Parejo Barranco, Antonio / Sánchez Picón, Andrés: La modernización de España (1914-1939). Economía, Madrid 2007: Síntesis.

- Pérez de Perceval Verde, Miguel A. / López Morell, Miguel A. / Sánchez Rodríguez, Alejandro: Minería y desarrollo economico en España, Madrid 2007: Síntesis.

- Prados de la Escosura, Leandro: El progreso económico de España (1850-2000), Bilbao 2003: Fundación BBVA.

- Romero Salvadó, Francisco J.: Spain 1914-1918. Between war and revolution, London 1999: Routledge.

- Ruiz Sánchez, José-Leonardo / Cordero Olivero, Inmaculada / García Sanz, Carolina (eds.): Shaping neutrality throughout the First World War, Seville 2016: Editorial Universidad de Sevilla.

- Sudrià, Carles: Los beneficios de España durante la gran guerra. Una aproximacion a la balanza de pagos española, 1914-1920, in: Revista de Historia Económica - Journal of Iberian and Latin American Economic History 8/2, 1990, pp. 363-396.

- Valdaliso, Jesús Ma: The rise of specialist firms in Spanish shipping and their strategies of growth, 1860 to 1930, in: Business History Review 74/2, 2000, pp. 267-300.

- Velarde Fuertes, Juan: Cien años de economía española. El siglo que lo cambió todo en nuestra economía. De Silvela-Fernández Villaverde a Aznar-Rato, Madrid 2009: Ediciones Encuentro.