Introduction↑

In early 1914 most observers would have given Russia a solid credit rating. The ruble was fully backed by gold, and the country’s highly accomplished economists and bankers guided its financial management. Gold no longer flowed abroad as it did during the 1905 Revolution. Recovering from recession, industry once again experienced robust growth after 1910. But there were underlying weaknesses. Russia’s trade turnover was no greater than Belgium’s and only one-fifth that of Britain.[1] Russian capital markets were also not as well developed as they were elsewhere in Europe. A telling indicator is that in 1912-1914 the value of Russian securities amounted to only 2 percent of national assets, compared to 11 percent in Germany, 18 percent in the US, 26 percent in France, and 41 percent in the UK.[2] And even though between 1900 and 1914 the Russian stock market nearly doubled in worth, from 11.9 billion rubles to 21.1 billion rubles, without foreign investment those totals would have been cut roughly in half.[3] In retrospect the numbers suggest that the Russian government was seriously handicapped in what turned out to be an astronomically expensive war.

What follows is a survey of Russian public finance during the Great War as crafted in the interplay between the tsarist Ministry of Finance, the Council of Ministers, and the State Duma. The text begins with the measures taken by the Ministry of Finance immediately after the onset of war. The article continues with an assessment of government policies regarding taxation, foreign loans, domestic bond issues, and currency emissions. It concludes with the crisis of inflation, which helped to bring down both the old regime and the Provisional Government. Primary sources for the article include the stenographic reports of the Duma and the notes taken by Arkadii Nikolaevich Iakhontov (1878-1939) during meetings of the Council of Ministers.[4] But this essay is also a synthesis of the literature on the subject, from old but still valuable classics by émigré and Soviet scholars, to essential recent works by historians S. G. Beliaev, Peter Gatrell, and V. V. Strakhov.[5]

The Dilemmas of Russian Finance↑

Upon the declaration of war the government made two decisions that had negative repercussions, channeling the direction of public finance for the duration of the conflict. In August 1914 Nicholas II, Emperor of Russia (1868-1918), who was a convert to the notion that temperance would cure social ills, banned the sale of vodka first during mobilization and then for the duration of the war. With prohibition, the government thought it was correctly applying the lessons of history: if, as the Tsar and his advisors assumed, drunkenness had contributed to defeat in the Russo-Japanese War and the disorders of the 1905 revolution, then this time round every effort would be made to induce sobriety on the part of the masses. Temperance advocates were thrilled when, as one of them put it, “the financial receipts of the [State Monopoly of Spirits] collapsed like a pricked bladder.”[6] That, however, created a fiscal problem: vodka sales contributed 28 percent of the state budget, the largest single source of government revenue.[7] And now the bottle was corked, just when the country was thrust into a costly war. A year later, Duma deputy Andrei Ivanovich Shingarev (1869-1918), the leading expert on the state budget in the left-of-center Constitutional Democratic (Kadet) Party, was scathing in his assessment of the measure: “from time immemorial countries waging war have been in want of funds…. Never since the dawn of humanity has a single country, in time of war, renounced the principal source of its revenue.”[8] But in August 1914 the Russian government was not alone in expecting a quick victory rather than a long war that would destroy centuries-old empires.

The government’s other fateful financial decision was to suspend specie payment and one-to-one gold backing in order to issue paper money beyond the normal legal limits. Among the reasons were the need to provide instant appropriations for mobilization of the army and liquidity to stem a run on the banks.[9] Moreover, the Council of Ministers was taking care once again “not to repeat the mistakes” of the past, as Minister of Finance Petr L’vovich Bark (1869-1937) stated. The currency had collapsed in the wake of the Russo-Turkish War (1877-1878) and would have done so after the Russo-Japanese War if not for large lifeline loans from France and England. With the outbreak of war in 1914, tsarist officials were concerned to maintain the hard-won international reputation of the ruble and the credit-worthiness of the Russian state. To that end they took measures to protect its gold reserves, directing the military to use paper money rather than specie for procurements “in occupied territories.” As it turned out the effort was for naught: the army violated the rules when it saw fit and, as we will see, the treasury had to ship much of its gold abroad as security for British loans.[10] Furthermore, few people, including Duma deputies and the government’s economic advisors, understood that paper emissions could set in motion an inflationary spiral that would be difficult to brake.[11]

The expectation that Russia would conquer German or Austrian territory reflects the excessive optimism of all the belligerent powers at the start of the war. That mood did not last, but in July 1915, Minister of Finance Bark was still presenting a sunny visage to the public, informing the Duma that despite the war Russia was in no worse shape financially than any other combatant nation, except perhaps England, with its efficient tax system. He was pleased to announce that the ordinary (non-military) budget was in balance thanks to treasury surpluses rolled over from previous years.[12] As late as February 1916 he insisted that the economy was stable and healthy, and he predicted that after the war Russia would be “sober, rich, and powerful” thanks to prohibition’s stimulus to productivity.[13]

Bark did not admit to the Duma that he and other members of the Council of Ministers were already worrying in June 1915 about the “collapse of monetary circulation.”[14] But he made no secret of the colossal financial challenges facing the nation: the extraordinary (military) budget was in deficit, due in large part to the ban on vodka sales; besides military operations, the government had to disburse massive aid to draftees’ families, wounded soldiers, and civilians whose property and livelihoods were destroyed in the vicinity of the front, above all in war-ravaged Poland; and expenditures on the war had doubled over the course of 1915 and were climbing higher.[15]

While contending with these effects of the war, Bark also had to navigate some treacherous waters in the Council of Ministers. In October 1914 representatives of the War Ministry complained that the Ministry of Finance was too slow in organizing payments for the purchase of foreign supplies. Bark retorted that his department was working well, while the military understood nothing about the principles of banking, bookkeeping, or international finance.[16] He and other ministers carped at the War Ministry for the amounts of money it was spending without regard for the fact that it was pushing prices up and threatening the stability of the civilian economy.[17] Bark and his supporters seem to have tacitly agreed with the Kadet leader Pavel Nikolaevich Miliukov (1859-1943), who accused the War Ministry of corruption by selling contracts for bribes or handing them out to cronies, all to benefit those whose “profitable profession is robbing the treasury.”[18] Bark also struggled against the War Ministry’s treatment of Jews, who were being summarily expelled from the western parts of the empire. As he told his colleagues, this was making it harder to place loans abroad.[19] But the prevailing sentiment within the government was that the Ministry of Finance’s primary purpose was to fund the army and navy no matter what the cost and without asking too many questions.

Wartime Fiscal Strategies of the Ministry of Finance↑

With state revenues plummeting, the Russian budget deficit stood at 40 percent in 1914, 76 percent in 1915, and 78 percent in 1916.[20] To plug these holes and defray the costs of war, the Ministry of Finance adopted a three-pronged strategy involving loans, tax reform, and expanded currency emissions.

Taxation↑

Of the three, taxation was the method of war financing that was least preferred by the experts and political leadership, and which contributed the least to Russian wartime budgets.[21] Raising tax rates was a sensitive issue, considering that the lower classes were already carrying a disproportionately large share of the tax burden on their shoulders: before the war, indirect taxation on consumer staples (sugar, tobacco, matches, spirits, and mineral oils) contributed four-fifths of the total tax intake (the rest came from levies on real estate, capital, property transfers, and the like). The government nonetheless did increase some of the preexisting direct and indirect taxes, and also raised duties on the railroads for both passengers and freight.[22]

But a consensus developed fairly quickly in the Council of Ministers and State Council that thoroughgoing tax reform was vital. By mid-1915, Bark was preparing several tax initiatives, including an excess war-profits tax and an income tax that he hoped would become the foundation of a new state revenue structure. The purpose was to improve the treasury’s balance sheet on the basis of a more equitable distribution of taxation; one gets the sense that Bark, in contrast to the rest of his ministerial cohort, was starting to understand that the war was going to transform all of society in its wake.[23] There was, to be sure, strong opposition to the proposed income tax: large landowners fought it on the grounds that it would drain potential investment capital from their estates, which they claimed propped up the local peasant economy. Joint-stock companies also lobbied against it, arguing that taxation of both business profits and dividend earnings amounted to double jeopardy.[24] But on the question of an income tax, unlike almost any other issue, the government had the backing of both progressives and reactionaries in the Duma. Among others, Miliukov and Nikolai Evgen’evich Markov (1866-1945), the leader of the Far Right faction in the Duma, demanded that the elite pay its fair share, during times of war as well as peace.[25] Unfortunately, the income tax was not ready for implementation until 1 January 1917, which meant its impact would be miniscule. And as the government became more involved in the war economy it ended up paying transport fees and many indirect taxes to itself, rather than collecting them from civilians, which negated their purpose.[26]

Although it was a heroic endeavor that would have had long-lasting effect on Russian society, reforming the tax system was an enormous task to undertake during wartime. But Bark and the other political leaders had no reason to believe that the imperial regime was on the verge of oblivion. They thought they had time to do it right rather than ruthlessly squeeze revenues out of an already straitened populace.

Debt↑

The fact is that most prominent economists in Russia considered debt, whether foreign or domestic, to be less onerous for the country than taxes since payment could be deferred until peacetime.[27] Bark, too, maintained that it was only fair to spread payment for the war over several generations, and he hoped that borrowing money would help to limit the volume of notes the treasury would have to print. The fastest way to get a much-needed injection of funds to replace those lost to prohibition was to open lines of credit with the allies and place loans on the London, New York, and Paris bond markets.[28] Bark made this his first priority in 1914 and 1915.[29]

Foreign creditors were concerned that as the war hindered exports and destabilized the economy it would become difficult for the tsarist government to service its debts.[30] The skepticism of the bond markets was justified: enemy blockades on the Baltic and Black Seas forced a 75 percent decline in exports by 1915. At the same time, imports soared as industry and government placed more and more orders for military equipment abroad. All of this was compounded by the German occupation of some of Russia’s most productive agricultural and industrial regions, lopping off 20 percent of its pre-war factory output and disrupting the food supply. The exchange rate of the ruble fell sharply and the trade balance went from positive (+ 146 million rubles in 1913) to deeply negative (-737 million rubles in 1915, and -1.874 million rubles in 1916).[31]

Ultimately, though, the military alliance trumped investors’ anxieties. In short, the negotiations of Bark and other treasury officials yielded 1.5 billion rubles from the French government, 5.4 billion rubles from the British Exchequer, and lesser contributions from the Japanese government and private banks in the US, Italy, and the Netherlands. By October 1917 Russia’s wartime foreign debts totaled more than 8 billion rubles (on top of 3 billion rubles of outstanding pre-war foreign debt) and provided 20 percent of the government’s total war expenditure. The British would only extend loans in return for Russian shipments of about 2 billion rubles’ worth of gold bullion to England and Canada to serve as collateral. To preserve the appearance that the Russian state’s gold stores were still full, these shipments to London and Ottawa were called loans and exchanged for 1.8 billion rubles in British treasury bonds. But that was purposely deceptive: the bonds were additional to the hard currency loaned by the UK to the Russians against their gold. And even though the ingots were held in British depositories the Russian Ministry of Finance continued to count them (illegally) as part of Russia’s gold reserves.[32] This fiscal legerdemain did not fool the government’s Kadet critics in the Duma, although Shingarev acknowledged that Bark may not have had any option if he wanted to come away with British loans.[33]

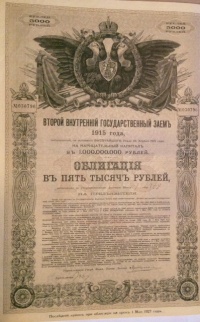

At home, the Ministry of Finance expended a great deal of energy trying to attract interest in the six bonds it released on the internal market in 1914, 1915, and 1916.[34] They initially had a dual function: to raise revenues and to guard against inflation by absorbing the excess paper money circulating in the country, a result of exploding currency emissions. By October 1915 with the issuance of the fourth loan, the overriding purpose was to counter the impact of the printing press.

The first bond issue and the two that followed, in February and April 1915, were sold to syndicates of private banks and other big companies in return for various inducements, among them tax breaks and allowing use of the bonds as collateral for State Bank loans to be invested in war industries. Unlike the previous bond issues, the fourth, fifth, and sixth (of October 1915 and February and October 1916) were officially designated “war bonds.” That name meshed with a vast propaganda drive whose purpose was to “democratize” participation in the loans. This was the Ministry of Finance’s attempt to convince the lower classes, above all the peasantry, to contribute to the war effort by investing in bonds. To make it easier for peasants to deposit money for that purpose, in 1916 the finance ministry opened more than 4,300 savings counters in rural railroad stations and post offices. As in other belligerent nations, the government commissioned posters, films, brochures, postcards, and newspaper advertisements to tout the patriotic virtue of “taking on debt for the Motherland.”[35]

As was his wont, Bark gave an upbeat report to the Duma, but the results were not what he had hoped for.[36] For the most part, only the richest peasants subscribed. Among workers, it was the most educated who did. The middle classes showed less and less interest with each new bond issue - in part because industrial stocks and bonds remained attractive until the end of the old regime, in part because with the growing political crisis tsarist government securities no longer seemed a safe haven. The regions farthest from the center sold very few and in some cases none. In general, the propaganda campaign was “sluggish” and sales were “slow” among the lower classes, which despite all the hoopla remained “without adequate understanding” of government debt, according to contemporaries. When Shingarev lectured the workers of the Putilov factory in Petrograd on the importance of buying bonds, they shouted him down.[37] In the end, commercial bank syndicates played the biggest role in the “democratized” bonds as they had the earlier ones.

The war bonds of 1914-1916 did raise the substantial sum of 8 billion rubles, which accounted for about 30 percent of the total wartime budget of the Russian Empire. But the bonds were not as successful as those amounts suggest. Essentially, the State Bank provided most of the financing itself, either by advancing large institutional investors the money necessary to buy them, or by allowing the bonds to be used as collateral for other loans. And the funds the bonds brought into the treasury were not retired to help stabilize the ruble, as was the goal, but spent on military needs. In either case, money was re-circulated back into the economy, and undermined the purpose of the bond drives. They may not have stoked inflation, but they certainly did not neutralize it. Right before the February Revolution, Bark was planning a lottery with the expectation that it would appeal more to the lower classes than the complicated interest-bearing securities he had pushed in the past few years.[38]

Currency Emissions↑

As Bark claimed, without the bonds the government would have had to print even more money, so it did help some.[39] But the war swallowed up all the tax and loan resources the state could muster, and demanded ever more. With the gold standard breached the first time on a temporary basis, the precedent was set, and the government, despite its forebodings, saw no alternative but to print ever-greater quantities of paper money. As Minister of Agriculture Aleksandr Vasil’evich Krivoshein (1857-1921) woefully stated when Bark proposed still another temporary expansion of the currency by 1 billion rubles in March 1915, it was a “sad and painful measure, but, alas, necessary.”[40] In the first year of the war, the number of banknotes in circulation jumped to five times the gold supply, despite efforts of the finance ministry to encourage mining.[41] Before August 1914, the State Bank had printed 4-5 million rubles in notes per day. In 1915 it was 20-30 million, and by early 1917 it had reached 50 million.[42] Added to that were another 7.8 billion rubles of short-term, 5 percent treasury bills issued during the war years. As the government required companies (often against their will) to accept them in payment for its purchases, these bills functioned in the economy like paper money.[43] Bark justified currency emissions to the Duma as “an unavoidable evil in wartime” which every country resorted to.[44] Indeed that was true, but in Russia it was five to six times pre-war levels, whereas in England it did not change, in France it doubled, and in Germany it tripled.[45]

Inflation and the Change of Regimes↑

The ever-increasing volume of banknotes in circulation eroded the purchasing power of the ruble. Declining production for the civilian sector of the economy added to the inflationary pressure. So did the government’s imposition of price caps on grain and other agricultural products for the purpose of ensuring that food for the cities and armed forces remained free from the “capriciousness of the market,” as the Minister of Agriculture put it.[46] In response, peasants withdrew from the money economy altogether, sold at higher prices on the black market, or, gambling on a lifting of price controls, held back stocks of grain. Prices doubled between 1914 and 1916, and by February 1917, the purchasing power of the ruble declined to about 30 kopecks in pre-war money.[47] This also reduced the real value of the war bond issues of 1916.

In proof of Gresham’s Law, which holds that bad money drives out the good, the populace hoarded gold, silver, and soon copper coins.[48] Whereas in early 1914, 69.5 percent of the money in Russia was paper, by the end of the year it was 82 percent, and by late 1916 it was 100 percent. The shortages of small change and small bills compelled the government to print more money to prevent the paralysis of trade.[49] The stamp money and paper coupons it produced as surrogates for coins signaled to everyone in the Russian Empire that the once mighty gold-backed ruble was on unstable ground, and so, it seemed was the regime.[50] Riots over the price of staples became frequent. Fueled by rumor, participants routinely blamed peasants, shopkeepers, resident Germans, Jews, police officers, bureaucrats, or, portentously, the tsar.[51]

Government ministers were hypersensitive to this “nervousness of the population.” Their panic over it paralleled the inflation rate. Already in 1915 Interior Minister Nikolai Alekseevich Maklakov (1871-1918) warned his colleagues that rising prices were “having an effect on the mood of the population, inciting it toward rebellion!”[52] By early 1917, top officials were stating publicly that they “could not hide their alarm” and feared imminent disaster.[53] But Russia had few options left, as evidenced by the fact that when anti-tsarist Duma deputies found themselves running the country after the February Revolution and the fall of the monarchy, they adopted the same policies they had once attacked.

Under the Provisional Government, the currency crisis worsened and the economy unraveled. By late May, a diarist wrote that “now money has gone crazy. Money has lost all value.”[54] “The ruble,” another contemporary mourned, “is broken.”[55] The new currency notes, nicknamed “Kerenky” after the prime minister, Aleksandr Fedorovich Kerensky (1881-1970), were so worthless that people began hoarding the devalued tsarist paper money.[56]

For the four months from March through June, currency emissions amounted to 3 billion rubles; in July and August it was 2.3 billion.[57] For the new government, as its predecessor, the currency crisis represented a “grave and imminent danger” requiring urgent action. The only tactic available to control inflation was to issue the Liberty Loan: “the shortest route to financial health is for the population of the country to play an active role in buying state bonds, which will absorb excess money from the market and limit the need for printing money.”[58] The Petrograd Soviet, before it was in the hands of the Bolsheviks, ordered all regional soviets to force workers and soldiers to subscribe - without success. The Bolsheviks agitated against purchase of the Liberty Loan, which may have had some effect.[59] But cash-strapped and frustrated with the government, the middle and upper classes did not want them either.[60] Instead, those who could started buying foreign securities and shipping assets abroad.[61]

A forced loan from the population was mooted and shot down.[62] Nothing worked. Between February and October the ruble shriveled in value from 30 pre-war kopecks to 6 or 7 kopecks. And the “dance of the billions,” as one contemporary economist called the emission of paper money, continued, becoming even more frenetic after the Bolshevik takeover.[63]

Conclusion↑

In the end, the cost of the war for Russia through the summer of 1917 has been estimated at between 38 and 50 billion rubles (that number does not include the value of destroyed property, capital goods, or lives). To cover its expenses it relied on a combination of foreign and domestic loans (62 percent), unused funds from the pre-war budget (7 percent), and currency emissions (31 percent). The budget was in deficit during the war to about the same degree as Germany and the UK.[64] But Russia was forced to rely more extensively on the printing press than the other powers (with the exception of the Ottoman Empire) to compensate for the dismantling of the lucrative spirits monopoly and other deficiencies of its tax structure and capital markets.

Tracing Russia’s public finance during the war allows us to pinpoint these weak spots in its economy, most of which stemmed from the long-standing political choices of the autocracy. But it also gives a hint of the changes that were likely to come had the regime survived, including a more equitable tax system and a more thoroughgoing integration of the peasantry into the modern banking and financial sector. As the expansion of internal debt turned the populace into creditors of the state, one can easily imagine that the balance of power in the political system might have shifted a bit more away from the monarchy and toward the public. In the event, none of this came to pass as the inflation hollowed out the economy in 1917 and aided the Bolsheviks’ rise to power.

Steven G. Marks, Clemson University

Section Editors: Boris Kolonit͡skiĭ; Nikolaus Katzer

Notes

- ↑ Ananich [sic], Boris: The Russian Economy and Banking System, in: Lieven, Dominic (ed.): Cambridge History of Russia, volume II, Cambridge 2006, pp. 415, 417f., 421.

- ↑ Michie, Ranald C.: Global Securities Market. A History, Oxford 2006, p. 126.

- ↑ Gatrell, Peter: The Tsarist Economy, 1850-1917, New York 1986, pp. 217, 228.

- ↑ GDSO; Gal’perina, B. D. et al.: Sovet ministrov rossiiskoi imperii v gody pervoi mirovoi voiny. Bumagi A. N. Iakhontova [The Imperial Russian Council of Ministers during the First World War: The Papers of A. N. Iakhontov], St. Petersburg 1999.

- ↑ Michelson, Alexander et al.: Russian Public Finance during the War, New Haven 1928; Sidorov, A. L.: Finansovoe polozhenie Rossii v gody pervoi mirovoi voiny (1914-1917) [The Russian Financial Situation during the First World War, 1914-1917], Moscow 1960; Beliaev, S. G.: P. L. Bark i finansovaia politika Rossii 1914-1917 [P. L. Bark and Russian Financial Policy, 1914-1917], St. Petersburg 2002; Gatrell, Peter: Poor Russia, Poor Show. Mobilising a Backward Economy for War, 1914-1917, in: Broadberry, Stephen / Harrison, Mark (eds.): Economics of World War I, Cambridge 2005; Gatrell, Peter: Russia’s First World War. A Social and Economic History, Harlow 2005; Gatrell, Tsarist Economy 1986; Strakhov, V. V.: Vnutrennie zaimy v Rossii v pervuiu mirovuiu voinu [Russian Internal Loans in the First World War], in: Voprosy istorii [in Questions of History] 9 (2003), pp. 28-43.

- ↑ Herlihy, Patricia: Alcoholic Empire. Vodka and Politics in Late Imperial Russia, Oxford 2002, pp. 60-67, 137-139. The quote is from an American temperance worker active in Russia.

- ↑ Michelson, Russian Public Finance 1928, p. 70.

- ↑ Ibid., p. 87.

- ↑ Beliaev, Bark 2002, p. 243.

- ↑ Gal’perina, Sovet ministrov [The Imperial Russian Council of Ministers]1999, p. 29 (Bark quotes); GDSO, zasedanie 1 (July 19, 1915), cols. 33-34, 36; Sidorov, Finansovoe polozhenie [The Russian Financial Situation] 1960, pp. 109-110; Anan’ich, Boris: Russian War Financing, in: Steinberg, John W. et al. (eds.): Russo-Japanese War in Global Perspective, volume I, Leiden 1995, pp. 449-464.

- ↑ Russia. Gosudarstvennaia Duma, Stenograficheskii otchet chastnogo soveshchaniia 1917 [State Duma: Stenographic Report of the Private Session of the Members of the State Duma (Fourth Duma)], pp. 4; Sidorov, Finansovoe polozhenie [The Russian Financial Situation] 1960, p. 110.

- ↑ GDSO, zas. 1, cols. 28-30, 41.

- ↑ Ibid., zas. 22 (16 Feb 1916), cols. 1744 (quote), 1751.

- ↑ Gal’perina, Sovet ministrov [The Imperial Russian Council of Ministers] 1999, p. 186.

- ↑ GDSO, zas. 1 (19 July 1915), cols. 27-29, 39, 42-43; zas. 22, col. 1745.

- ↑ Gal’perina, Sovet ministrov [The Imperial Russian Council of Ministers] 1999, p. 88.

- ↑ Ibid., p. 155.

- ↑ GDSO, zas. 1, col. 100.

- ↑ Gal’perina, Sovet ministrov [The Imperial Russian Council of Ministers] 1999, pp. 147, 163, 211.

- ↑ Gatrell, Poor Russia 2005, p. 247.

- ↑ Gal’perina, Sovet ministrov [The Imperial Russian Council of Ministers] 1999, pp. 41, 66-67.

- ↑ Michelson, Russian Public Finance 1928, pp. 15-25, 47, 94-103, 106-110, 131-135; Beliaev, Bark 2002, pp. 550, 560.

- ↑ GDSO, zas. 1, cols. 30-32; zas. 7 (11 Aug 1915), cols. 578-589; Michelson, Russian Public Finance 1928, pp. 146-148.

- ↑ GDSO, zas. 7, cols. 600-602; Michelson, Russian Public Finance 1928, pp. 173.

- ↑ GDSO, zas. 1, cols. 62-63, 107; zas. 7, cols. 619-620, 642-645; zas. 22, cols. 1772-1773, 1775.

- ↑ Sidorov, Finansovoe polozhenie [The Russian Financial Situation] 1960, p. 127; Michelson, Russian Public Finance 1928, pp. 172-177. And see Kotsonis, Yanni: “Face-to-Face”. The State, the Individual, and the Citizen in Russian Taxation, 1863-1917, in: Slavic Review (Summer 2004), pp. 221-246.

- ↑ Sidorov, Finansovoe polozhenie [The Russian Financial Situation] 1960, p. 133.

- ↑ GDSO, zas. 1, cols. 30, 32.

- ↑ This is evident from discussions in the Council of Ministers: see Gal’perina, Sovet ministrov 1999, passim.

- ↑ Gatrell, Russia’s First World War 2005, p. 141.

- ↑ Gatrell, Poor Russia 2005, pp. 239, 247; Gatrell, Russia’s First World War 2005, pp. 142-143; Sidorov, Finansovoe polozhenie [The Russian Financial Situation] 1960, p. 567.

- ↑ Gatrell, Russia’s First World War 2005, pp. 142-144; Beliaev, Bark 2002, p. 588; Michelson, Russian Public Finance 1928, pp. 288-329.

- ↑ GDSO, zas. 22, cols. 1763-1765.

- ↑ Unless otherwise noted, all material in this section comes from Strakhov, Vnutrennie zaimy [Russian Internal Loans] 2003; Gatrell, Russia’s First World War 2005, pp. 139-140; and Michelson, Russian Public Finance 1928, pp. 249-280.

- ↑ Quotes from Strakhov, Vnutrennie zaimy [Russian Internal Loans] 2003, pp. 33f.

- ↑ GDSO, zas. 22, col. 1750; Beliaev, Bark 2002, pp. 228, 230; Gal’perin, Sovet ministrov [The Imperial Russian Council of Ministers] 1999, p. 211.

- ↑ Strakhov, Vnutrennie zaimy [Russian Internal Loans] 2003, p. 39; Sidorov, Finansovoe polozhenie [The Russian Financial Situation] 1960, pp. 160, 162. See also Beliaev, Bark 2002, p. 228.

- ↑ Beliaev, Bark 2002, pp. 230f.

- ↑ GDSO, zas. 1, col. 33-34.

- ↑ Gal’perina, Sovet ministrov [The Imperial Russian Council of Ministers] 1999, p. 145.

- ↑ Mikhailov, I. A.: Voina i nashe denezhnoe obrashchenie [The War and Our Currency]. Petrograd 1916, p. 33; GDSO, zas. 1, cols. 36-37.

- ↑ Russian State Archive of the Economy (RGAE), f. 7733, op. 1, d. 166, l. 11; Beliaev, Bark 2002, pp. 249, 592.

- ↑ Gatrell, Russia’s First World War 2005, pp. 139-140; GDSO, zas. 22, col. 1762; Arnold, Arthur Z.: Banks, Credit, and Money in Soviet Russia. New York Press 1937, pp. 38-39.

- ↑ GDSO, zas. 22, col. 1749.

- ↑ Sidorov, Finansovoe polozhenie [The Russian Financial Situation] 1960, p. 146.

- ↑ GDSO, zas. 23 (18 February 1916), cols. 1849-1851 (quote); Gal’perina, Sovet ministrov [The Imperial Russian Council of Ministers] 1999, pp. 41, 44.

- ↑ Arnold, Banks, Credit, and Money 1937, pp. 48-50.

- ↑ Vaisberg, R. E.: Den’gi i tseny [Money and Prices], Moscow 1925, pp. 16-17.

- ↑ RGAE, f. 7733, op. 1, d. 166, ll. 12-13.

- ↑ Aliamkin, A. V. / Baranov, A. G.: Istoriia denezhnogo obrashcheniia v 1914-1924 Gg. (Po materialam Zaural’ia) [The History of Currency in 1914-1924 (Based on Materials from the Trans-Urals)], Ekaterinburg 2005, pp. 73-76.

- ↑ Engel, Barbara: Not by Bread Alone. Subsistence Riots in Russia during World War I, in: Journal of Modern History (December 1997), pp. 696-721; Gal’perina, Sovet ministrov [The Imperial Russian Council of Ministers] 1999, p. 321; Pascal, Pierre: Mon Journal de Russie. Á la Mission militaire française, 1916-1918, Lausanne 1975, p. 72; Lohr, Eric: The Russian Army and the Jews, in: Russian Review (July 2001), p. 417.

- ↑ Gal’perina, Sovet ministrov [The Imperial Russian Council of Ministers] 1999, pp. 66, 155, 210, 267, 278, 337.

- ↑ Sidorov, Finansovoe polozhenie [The Russian Financial Situation] 1960, pp. 162-163 (quote); Gal’perina, Sovet ministrov [The Imperial Russian Council of Ministers] 1999, p. 124.

- ↑ Kniazev, G. A.: Iz zapisnoi knizhki russkogo intelligenta za vremia voiny i revoliutsii 1915-1922 g. [From the Diary of a Member of the Russian Intelligentsia during War and Revolution, 1915-1922; in The Russian Past], in: Russkoe proshloe 2 (1991), p. 157.

- ↑ Sidorov, Ekonomicheskoe polozhenie [The Russian Economic Situation] 1957, pp. 378f.

- ↑ Arnold, Banks 1937, p. 43.

- ↑ Beliaev, Bark 2002, p. 592.

- ↑ Sidorov, Ekonomicheskoe polozhenie [The Russian Economic Situation] 1957, pp. 375, 413.

- ↑ Silin, N. D.: Obeztsenenie deneg [The Depreciation of Money], Petrograd 1917, p. 12; Browder, Robert Paul / Kerensky, Alexander F.: Russian Provisional Government 1917. Documents, volume II, Stanford 1961, pp. 187, 488-492.

- ↑ Gatrell, Poor Russia 2005, p. 246-247.

- ↑ Silin, Obeztsenenie [Depreciation of Money] 1917, pp. 12f.; Browder / Kerensky, Russian Provisional Government, II 1917, p. 510.

- ↑ Ibid., pp. 94-95.

- ↑ Sidorov, Finansovoe polozhenie [The Russian Financial Situation] 1960, p. 146.

- ↑ Beliaev, Bark 2002, pp. 271, 600; Gatrell, Poor Russia 2005, pp. 247-248, 259-261.

Selected Bibliography

- Alpern Engel, Barbara: Not by bread alone. Subsistence riots in Russia during World War I, in: The Journal of Modern History 69/4, 1997, pp. 696-721, doi:10.1086/245591.

- Beliaev, S. G.: Bark i finansovaia politika Rossii 1914-1917 gg. (P. L. Bark and Russian financial policy, 1914-1917), St. Petersburg 2002: Izdatelstvo S. Peterburgskogo Universiteta.

- Galʹperina, B. D.: Sovet Ministrov Rossiiskoi imperii v gody Pervoi mirovoi voiny. Bumagi A. N. Iakhontova (The Imperial Russian Council of Ministers during the First World War. The papers of A. N. Iakhontov), St. Petersburg 1999: Dmitrii Bulanin.

- Gatrell, Peter: Poor Russia, poor show. Mobilising a backward economy for war, 1914-1917, in: Broadberry, S. N. / Harrison, Mark (eds.): The economics of World War I, Cambridge; New York 2005: Cambridge University Press.

- Gatrell, Peter: The tsarist economy, 1850-1917, New York 1986: St. Martin's Press.

- Gatrell, Peter: Russia's First World War. A social and economic history, Harlow 2005: Pearson/Longman.

- Gosudarstvennaia Duma: Stenograficheskii otchet chastnogo soveshchaniia chlenov gosudarstvennoi dumy (chetvertogo sozyva) (State Duma. Stenographic report of the private session of the members of the State Duma (Fourth Duma)), Petrograd 1917.

- Gosudarstvennaia Duma: Chetvertyi Sozyv. Stenograficheskie Otchety. 1915 g. Sessiia Chetvertaia (State Duma. Fourth congress. Stenographic minutes. 1915. Fourth session), Petrograd 1915-1916.

- Michelson, Aleksandr Mikhailovich / Apostol, Pavel Natanovich / Bernatskii, Mikhail Vladimirovich: Russian public finance during the war. Revenue and expenditure, New Haven; London 1928: Yale University Press; H. Milford.

- Sidorov, Arkadii Lavrovich: Finansovoe polozhenie Rossii v gody Pervoi Mirovoi voiny, 1914-1917 (The Russian financial situation during the First World War, 1914-1917), Moscow 1960.

- Sidorov, Arkadii Lavrovich (ed.): Ėkonomicheskoe polozhenie Rossii nakanune Velikoi Oktiabr'skoi sotsialisticheskoi revoliutsii (The Russian economic situation during the Great October Socialist Revolution), volume 2, Leningrad 1957: Izdatelstvo Akademii Nauk.

- Strakhov, V. V.: Vnutrennie zaimy v Rossii v pervuiu mirovuiu voinu (Russian Internal Loans in the First World War; in Questions of History), in: Voprosy istorii 9, 2003, pp. 28-47.